Elegran Brooklyn Market Update: December 2024

Elegran | Forbes Global Properties December 1, 2024

Elegran | Forbes Global Properties December 1, 2024

Entering the holiday season, Brooklyn’s residential real estate market reflects expected seasonal patterns, moving toward a balanced state. In November 2024, supply decreased by 7.1% from October, falling to 3,157 units—a 0.8% decrease compared to last year. This decline results from fewer new listings late in the fall, more sellers withdrawing unsold homes for the holidays, and steady buyer demand. Importantly, supply remains significantly lower than in 2021 and 2022, although contract activity has similarly declined, keeping the market relatively consistently competitive over the past four years.

Contract activity in November decreased by 19% compared to the previous month, with 536 residential contracts signed, highlighting the typical seasonal slowdown. However, the year-over-year perspective tells a different story: November 2024 saw a 13.8% increase in contracts signed compared to November 2023 and was also 6% higher than in 2022. This indicates sustained buyer interest despite the seasonal dip.

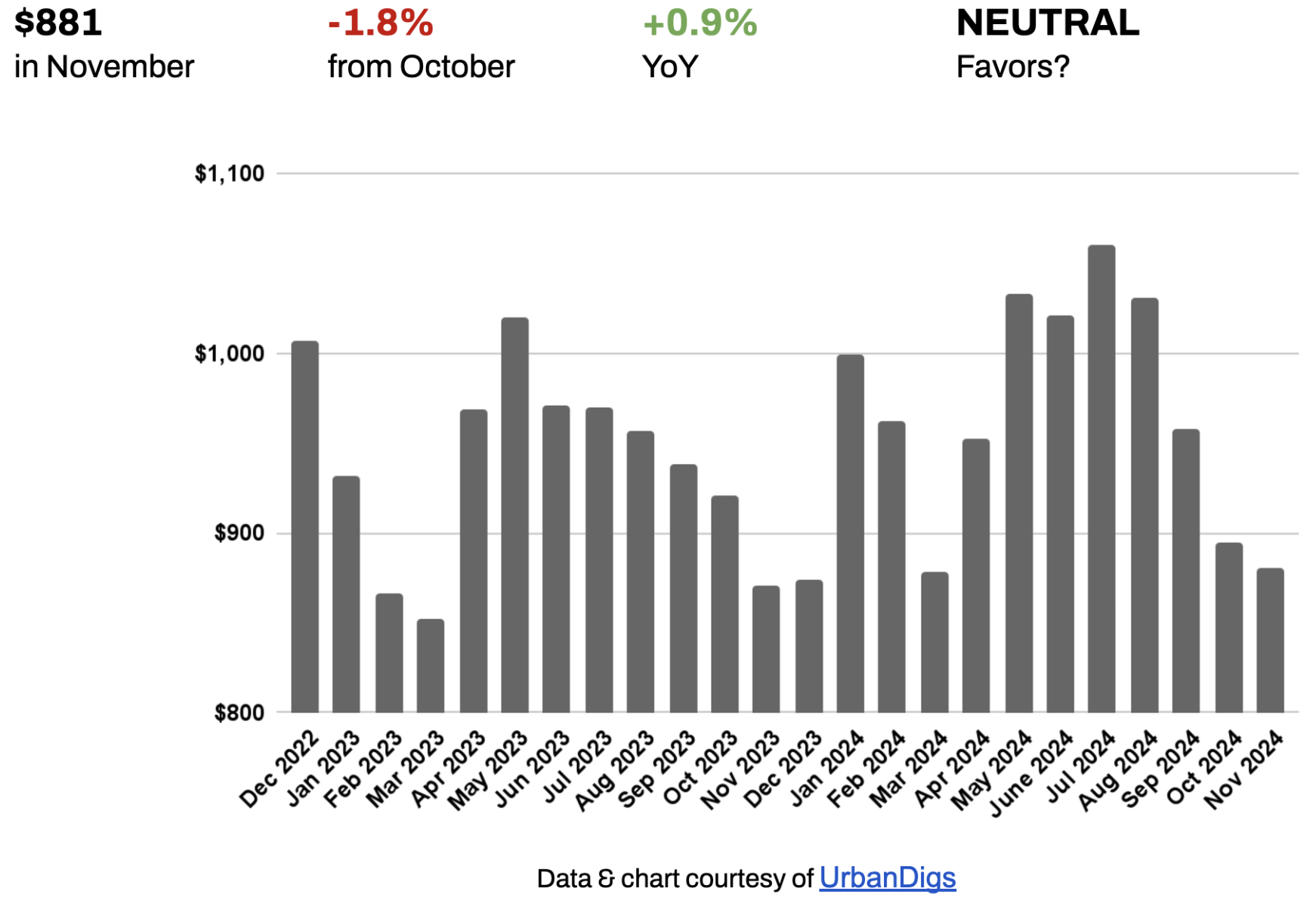

The median price per square foot (PPSF) was $881 in November 2024, marking a 1.8% decrease from October but a 0.9% increase compared to the same month last year. This slight monthly decline is largely attributed to contracts signed over the summer closing in the fall—a period characterized by higher interest rates and buyer fatigue. As the market [re]gains momentum, look for the month-over-month trends to reverse, with annual appreciation likely continuing.

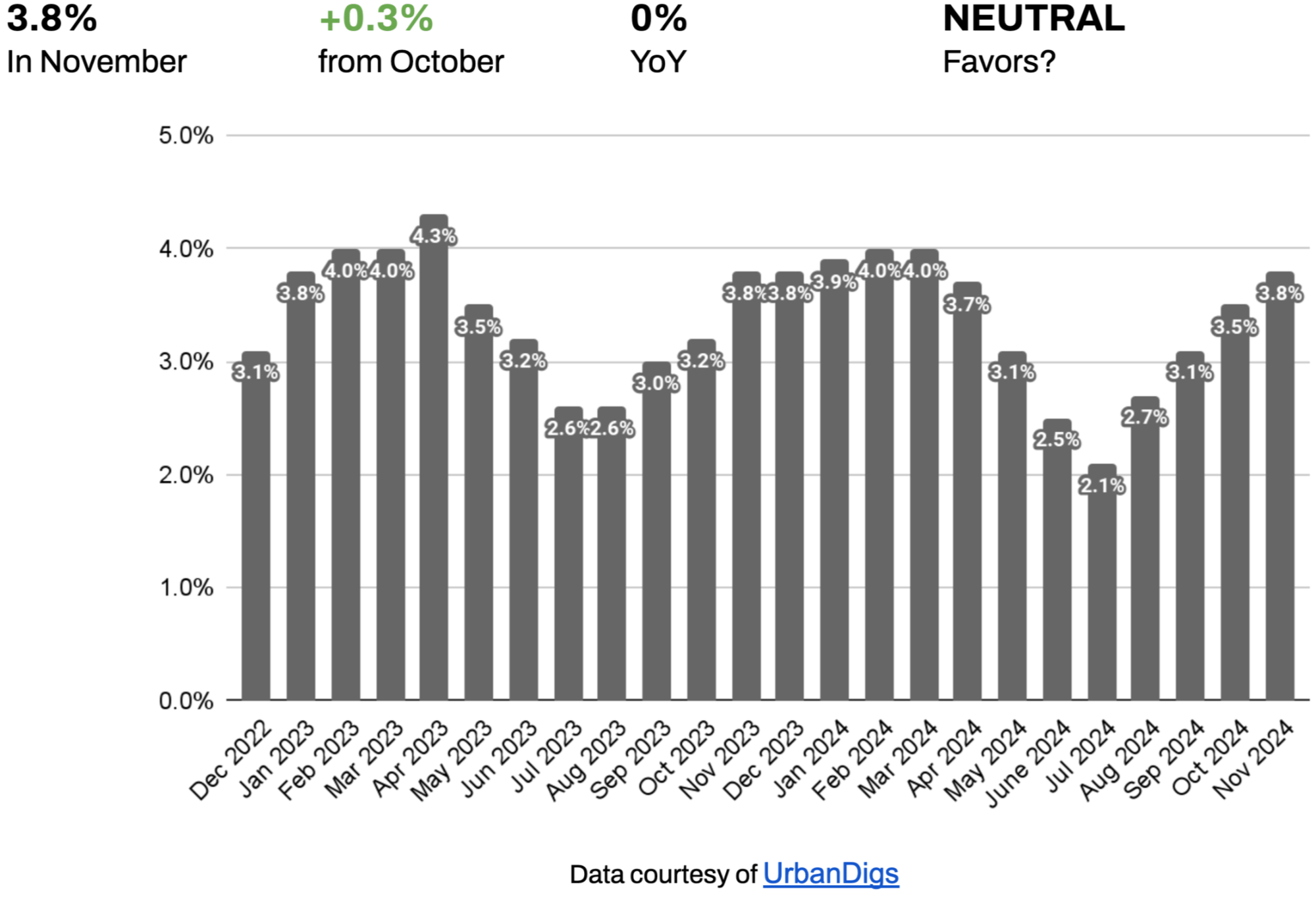

The median listing discount rose to 3.8% in November, up from 3.5% in October, mainly due to seasonal factors and increased negotiability of properties that have been on the market longer. As market activity accelerates, these discounts are expected to narrow. The Elegran | Forbes Global Properties Brooklyn Leverage Index also indicates a shift toward market equilibrium, with no clear advantage for either buyers or sellers.

Overall, the Brooklyn real estate market is stabilizing, offering opportunities for both buyers and sellers. Sellers can benefit from tighter inventory and potential appreciation, especially when pricing competitively. Buyers may find short-term opportunities due to the seasonal slowdown and slightly higher listing discounts, particularly for properties that have been on the market longer or require renovation.

The Elegran | Forbes Global Properties Brooklyn Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

It’s not just the exact numbers that matter—it’s the direction and slope of the trend. After a brief seller’s market this spring, Brooklyn's real estate landscape shifted in favor of buyers over the summer. This fall, momentum swung back toward sellers, fueled by a surge in contract activity. However, in November, the balance slightly tipped again toward buyers, suggesting the market is approaching equilibrium.

As is typical for this time of year, supply decreased in November compared to October. This decline results from fewer new listings coming on the market late in the fall season, more sellers withdrawing unsold homes for the holidays, and steady buyer demand. In November, supply fell to 3,157 units—a 7.1% drop from October and a 0.8% decrease compared to last year. Notably, supply remains significantly lower than in 2021 and 2022, although contract activity is also correspondingly lower than during those years. Because supply and contract activity have declined proportionally since then, the Brooklyn market has remained relatively consistently competitive over the past four years, keeping negotiability low.

What does this mean for:

Overall, the Brooklyn market is fairly balanced. Sellers can benefit from tighter inventory, while buyers can find better deals on properties that have been on the market for over 90 days or require renovation.

Transitioning into the holiday season, Brooklyn’s residential real estate market reflects the expected seasonal slowdown. In November, contract activity decreased by 19% compared to the previous month, with 536 residential contracts signed. However, a year-over-year perspective tells a different story: November 2024 saw a 13.8% increase in contracts signed compared to November 2023 and was also 6% higher than in 2022.

What does this mean for:

Overall, the Brooklyn real estate market is currently neutral, offering opportunities for both buyers and sellers. Sellers should be strategic with pricing, and buyers can take advantage of the temporary slowdown to negotiate better deals—all while keeping an eye on the longer-term upward trend in contract activity.

In November 2024, the median price per square foot (PPSF) in Brooklyn was $881—a 1.8% decrease from October but a 0.9% increase compared to the same month last year. This monthly decline is largely attributed to contracts signed over the summer that closed in September and October. These deals occurred during a quieter period for Brooklyn real estate, marked by higher interest rates, evident buyer fatigue, and a larger portion of transactions involving properties that had been on the market longer, often selling with more significant discounts. Expect the month-over-month trend to reverse as the market gains momentum and a continued annual price appreciation.

What does this mean for:

Overall, the Brooklyn real estate market appears to be stabilizing. The short-term dip in prices presents potential opportunities for buyers, while sellers may anticipate stronger conditions as the market regains momentum.

In November 2024, the median listing discount for residential homes in Brooklyn increased to 3.8%, up from 3.5% in October, while remaining unchanged compared to November 2023. This modest rise is largely attributed to seasonal factors. Contracts signed during the summer—which typically close in the fall—often involve properties that have been on the market longer and are, therefore, more negotiable, leading to higher listing discounts. As the market accelerates, anticipate listing discounts narrowing in the coming months.

What does this mean for:

The uptick in listing discounts signals that sellers may need to adjust their pricing strategies during the winter months, while buyers have a unique window to negotiate better deals—particularly on homes that have lingered on the market. As market conditions are poised to tighten, both buyers and sellers should act decisively to capitalize on current opportunities.

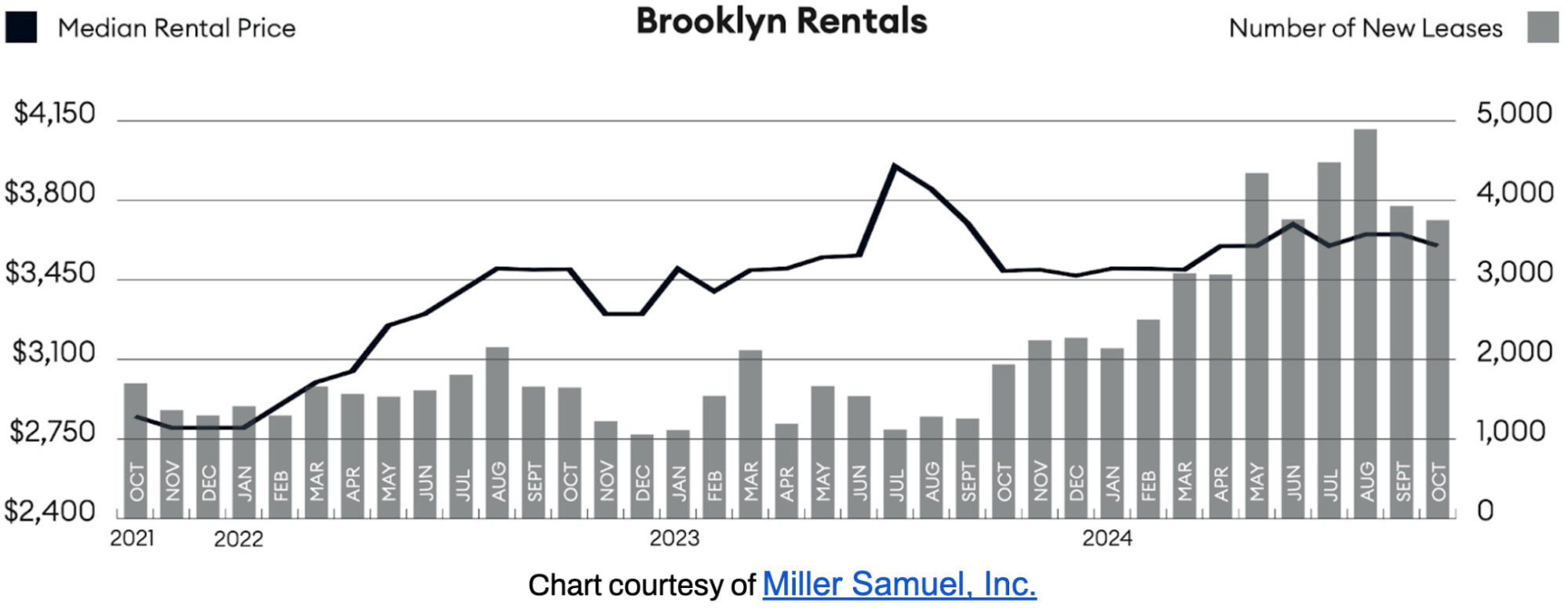

In October, the median rental price decreased from $3,650 in September to $3,600, reflecting a 1.4% decline on a monthly basis. However, on a yearly basis, it increased by 3.2%, marking the first time in four months that the median rent has risen annually. Listing inventory is up year over year for the ninth time.³

The 30-Year Fixed Rate JUMBO Mortgage Index is currently trending at 6.9%⁴, with the average JUMBO Annual Percentage Rate (APR) at 6.7%⁵. Although these rates had decreased in late August and into mid-September, they have since risen by 80 basis points after hitting a low in mid-September.

As economic uncertainty diminishes, interest rates are expected to stabilize. This stabilization should provide much-needed certainty for both buyers and sellers, encouraging transactions and easing market gridlock. A more predictable interest rate environment can boost confidence in the real estate market, leading to increased activity and smoother transactions.

Total returns in Brooklyn are driven by a combination of net rental income and capital appreciation. For all-cash investors, current cap rates range from approximately 3.0% to 3.4%. However, with the average JUMBO mortgage APR at 6.7%, net income potential remains elusive for those heavily relying on leverage.

The chart below illustrates Brooklyn’s gradual upward price trend. While the borough’s appreciation has outpaced Manhattan, it has lagged behind the national average. This gap presents a strategic opportunity: as other markets risk overheating and some have entered bubble territory, Brooklyn’s solid fundamentals indicate room for additional growth. With interest rates stabilizing and potentially declining further, future capital appreciation is set to be the key driver of returns, offering upside potential.

For foreign investors, the timing couldn’t be better. A strong U.S. dollar relative to native currencies enhances the opportunity to realize meaningful capital gains when selling assets in Brooklyn. As interest rates continue to soften, the borough’s real estate market remains primed for long-term value growth.

1. Data courtesy of UrbanDigs

2. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.