Elegran Brooklyn Market Update: September 2024

Elegran | Forbes Global Properties September 10, 2024

Elegran | Forbes Global Properties September 10, 2024

The Brooklyn residential real estate market experienced a cooling down this summer, with demand steadily declining over the past four months and falling below the five-year seasonal average. August 2024 recorded the fewest signed contracts in the last five years, signaling at least a temporarily softer market favoring buyers.

Rising prices and relatively high interest rates contributed to buyers hitting the pause button. However, the outlook is brightening as mortgage rates have recently dropped to their lowest levels in over a year, with further declines expected through the fall.

This opens up a window of opportunity for buyers to negotiate more favorable deals in the coming months. Although supply dipped slightly last month, it remains higher than last year and is expected to increase as new inventory traditionally enters the market post-Labor Day.

While prices have risen on an annual basis, they stabilized last month, providing another potential entry point for buyers. As interest rates continue to drop and market uncertainties (hopefully) fade, Brooklyn prices are expected to resume their upward trajectory heading into next spring.

The Elegran | Forbes Global Properties Brooklyn Leverage Index remained stable in August, with a slight shift favoring buyers.

– “Neutral” markets don’t exist because buyers and sellers are constantly playing tug-of-war for leverage.

– In August, there’s no clear winner as buyers & sellers reach equilibrium, although there was a slight shift favoring buyers.²

- Demand (measured by contracts signed) decreased in the buyer’s favor.

- The median PPSF (Price Per Square Foot) decreased in the buyer's favor last month but increased in the seller’s favor over the last year.

- Median days on market increased in the buyer's favor.

- The median sales price remained unchanged from the previous month but increased year over year, favoring sellers in the long term.

- Supply decreased month-over-month, favoring sellers, but increased year-over-year, favoring buyers.

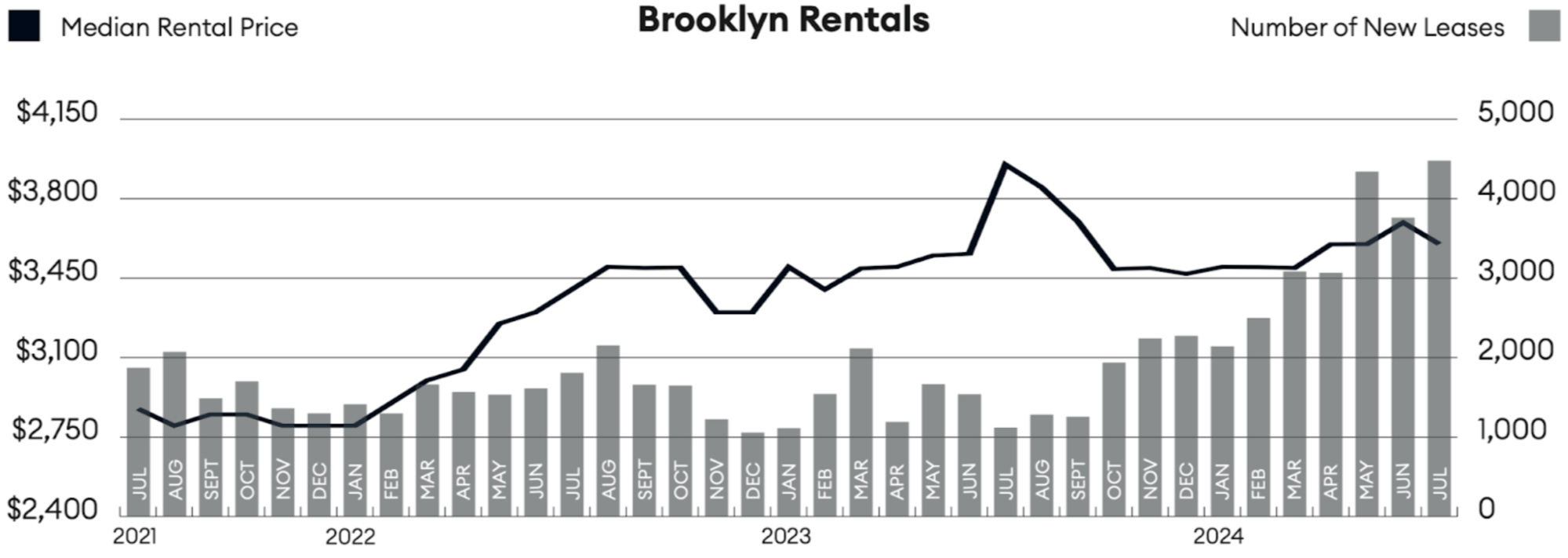

- In July³, the median rental price decreased month-over-month by 2.6% to $3,600. The median rent also declined year-over-year as the average size of rental units shrank for the tenth consecutive time.

- Meanwhile, the number of new leases signed rose to a record high.

The Elegran | Forbes Global Properties Brooklyn Leverage Index is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

-An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

It’s not the exact numbers that matter most—it’s the direction and slope of the trend. After a brief seller’s market this spring, the Brooklyn market returned to Equilibrium with an ever-so-slight favor to buyers in August.

As expected for this time of year, Brooklyn’s total housing supply declined month-over-month but saw an annual increase. The number of available listings dropped to 3,061 in August 2024, a 5.3% decrease from July. However, overall supply remains significantly lower than in 2021 and 2022, keeping the market relatively competitive and favoring sellers.

What does this mean for:

- BUYERS: An increase in inventory is expected in September, as a wave of new listings typically hits the market post-Labor Day. Buyers should stay alert for new opportunities but be prepared to act quickly if they find a property that fits their needs.

- SELLERS: The reduction in inventory has been advantageous for sellers, but the landscape is about to shift with new competition arriving as post-Labor Day inventory enters the market. Sellers should closely monitor comparable properties and adjust their pricing strategically, avoiding overly ambitious pricing if they aim to sell quickly and close to their asking price.

With new inventory hitting the market in early September and buyers returning to the city, the fall season presents a short but active window of opportunity, usually peaking before Thanksgiving. The ideal pricing strategy is to make the most of the first 30 days on the market. If no offers are received within that time, prices should be adjusted promptly to maintain buyer interest.

Brooklyn’s residential market cooled in August, with only 518 contracts signed—a 6.3% decline from July and a 3% drop year-over-year. This represents the lowest number of signed contracts for any August in the past five years. Contract volume, which peaked at 800 in August 2020, has steadily declined each year since. High interest rates and ongoing economic uncertainty continue to dampen demand.

What does this mean for:

- BUYERS: The recent decline in signed contracts suggests that demand is temporarily subdued, which could present an opportunity for buyers to negotiate better deals in the near term.

- SELLERS: If you are considering listing a property, monitor interest rate trends closely. Listing sooner could mean less competition while waiting for the market to rebound might allow for a higher sale price.

As the market transitions from summer into fall, market activity is likely to pick up, making it crucial for buyers to be prepared for a more competitive environment. With interest rates expected to drop further and some uncertainties expected to ease, the market could strengthen as we head into winter.

In August 2024, the median price per square foot (PPSF) for residential homes in Brooklyn was $1,031, reflecting a modest 2.7% decrease from July but an impressive 8.2% increase compared to the previous year. The year-over-year rise in PPSF highlights the steady growth in Brooklyn property values, reinforcing the borough’s long-term market strength. However, the month-over-month decline signals a potential temporary market plateau, as demand has recently softened.

What does this mean for:

- BUYERS: Despite the recent dip, the substantial year-over-year increase in PPSF indicates that Brooklyn properties remain a solid long-term investment with the potential for future appreciation. The recent decline in demand can create a buying opportunity.

- SELLERS: Be cautious about overpricing their properties, as the recent dip in PPSF suggests buyers may be more price-sensitive. Setting a competitive price could help attract serious offers in a cooling market.

Although buyer demand has been tempered by economic uncertainty and elevated mortgage rates, the outlook is improving. With interest rates expected to decline further into the fall, and some uncertainties likely being resolved, the market could strengthen into the spring, potentially driving further price appreciation in Brooklyn’s residential sector.

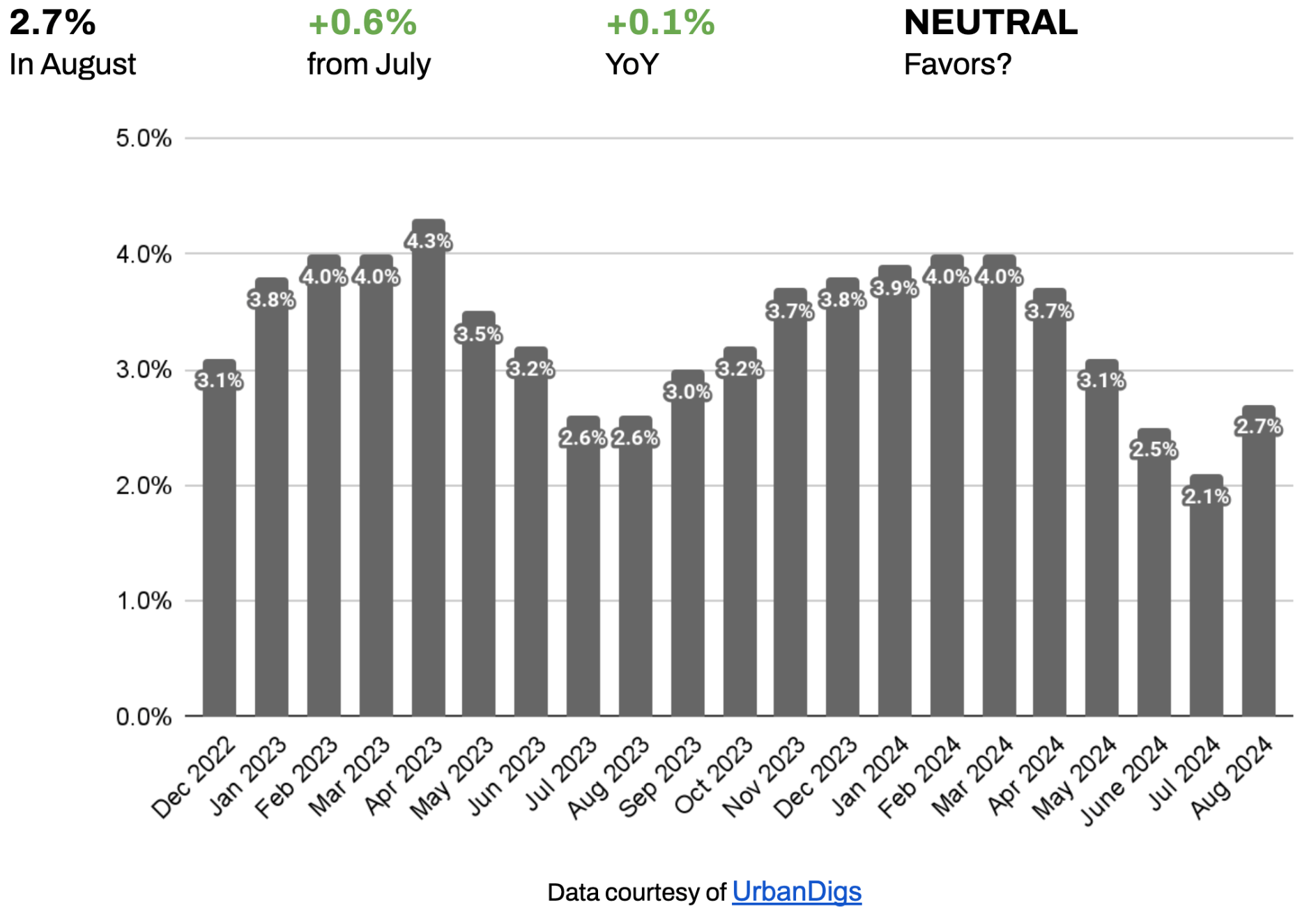

In August 2024, the median listing discount for residential homes in Brooklyn increased to 2.7%, up 0.6% from July and 0.1% year-over-year. This rise suggests that sellers are becoming more open to negotiating and reducing their asking prices, reflecting a recent softening in demand.

What does this mean for:

- BUYERS: The rising median listing discount suggests that buyers may have more room to negotiate on price in the short term.

- SELLERS: The slight rise in the listing discount indicates that sellers might need to be more competitive with their pricing to attract buyers. Overpricing could lead to longer time on the market or the need for price reductions.

As sellers show greater flexibility, buyers may find it easier to secure price reductions or favorable contract terms, making it a prime time to explore concessions in negotiations.

Chart courtesy of Miller Samuel, Inc.

In July, the median rental price decreased month-over-month by 2.6% to $3,600. The median rent also declined year-over-year as the average size of rental units shrank for the tenth consecutive time. Meanwhile, the number of new lease signings surged to a record high. Mortgage Rates: The 30-Year Fixed Rate JUMBO Mortgage Index is trending at 6.7%⁴, and the average JUMBO APR is 6.2%⁵. So, it’s a “catch-22” for renters, as the rent versus buy scale may feel equally punitive on both sides.

The total return is driven by net rental income and capital appreciation. Brooklyn's cap rate is approximately 3.0 - 3.4% for all-cash investors. Unfortunately, there is no net income potential for those investors using a large percentage of leverage, with the average JUMBO mortgage APR at 6.2%. As the chart below illustrates, there was neither a discernable drop in median PPSF nor a rebound due to COVID. So, future price inflation will generate any potential for future capital appreciation. Timing and a strong USD may afford foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

1. Data courtesy of UrbanDigs

2. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.