Elegran Manhattan & Brooklyn Weekly Market Update - 7/21

Elegran July 19, 2025

Elegran July 19, 2025

While Manhattan cools down in line with typical summer trends, Brooklyn bucks the seasonal slowdown with an uptick in listings, raising the question: is Brooklyn poised to lead late-summer momentum?

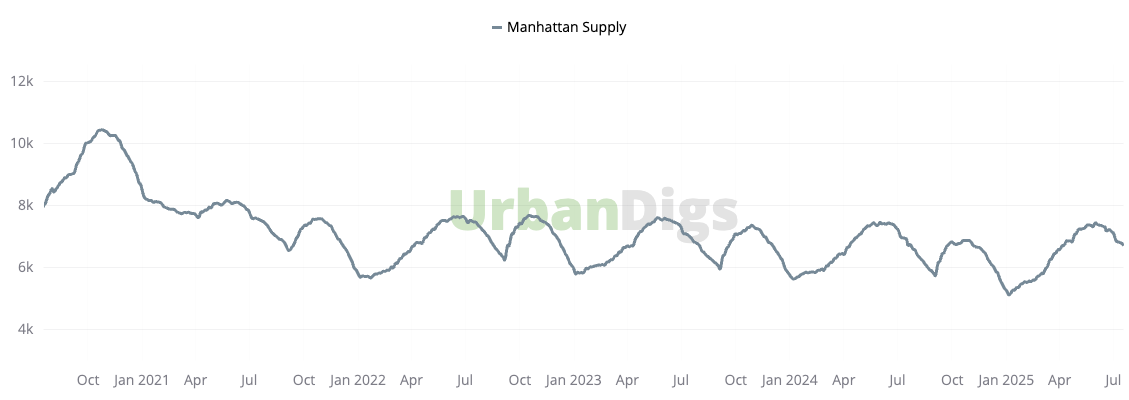

As we move deeper into July, Manhattan’s market continues its familiar seasonal deceleration: supply dropped for the seventh consecutive week, now sitting at 6,716 homes. While 283 new listings did come online (up 2% from the previous week), overall inventory still remains 2% lower than the same period last year. Pending sales dipped modestly by 0.6%, marking the third week in a row of decline, suggesting the peak buying season may be behind us.

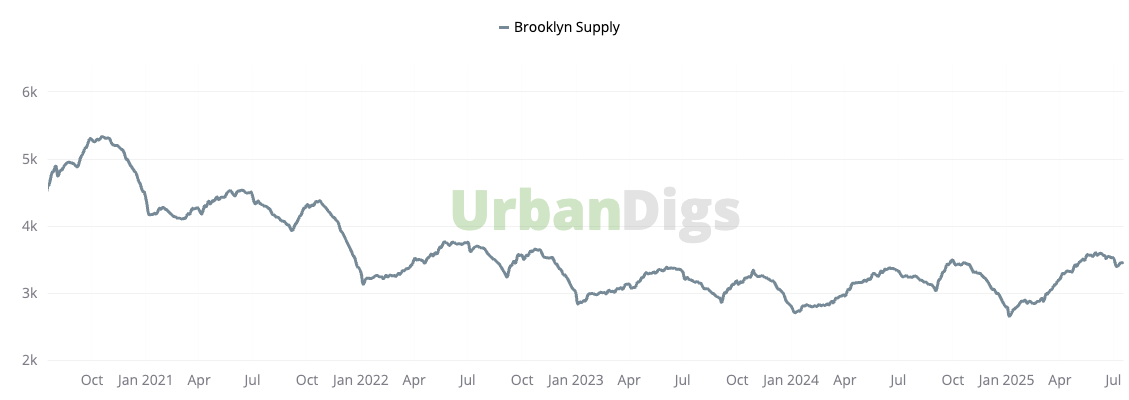

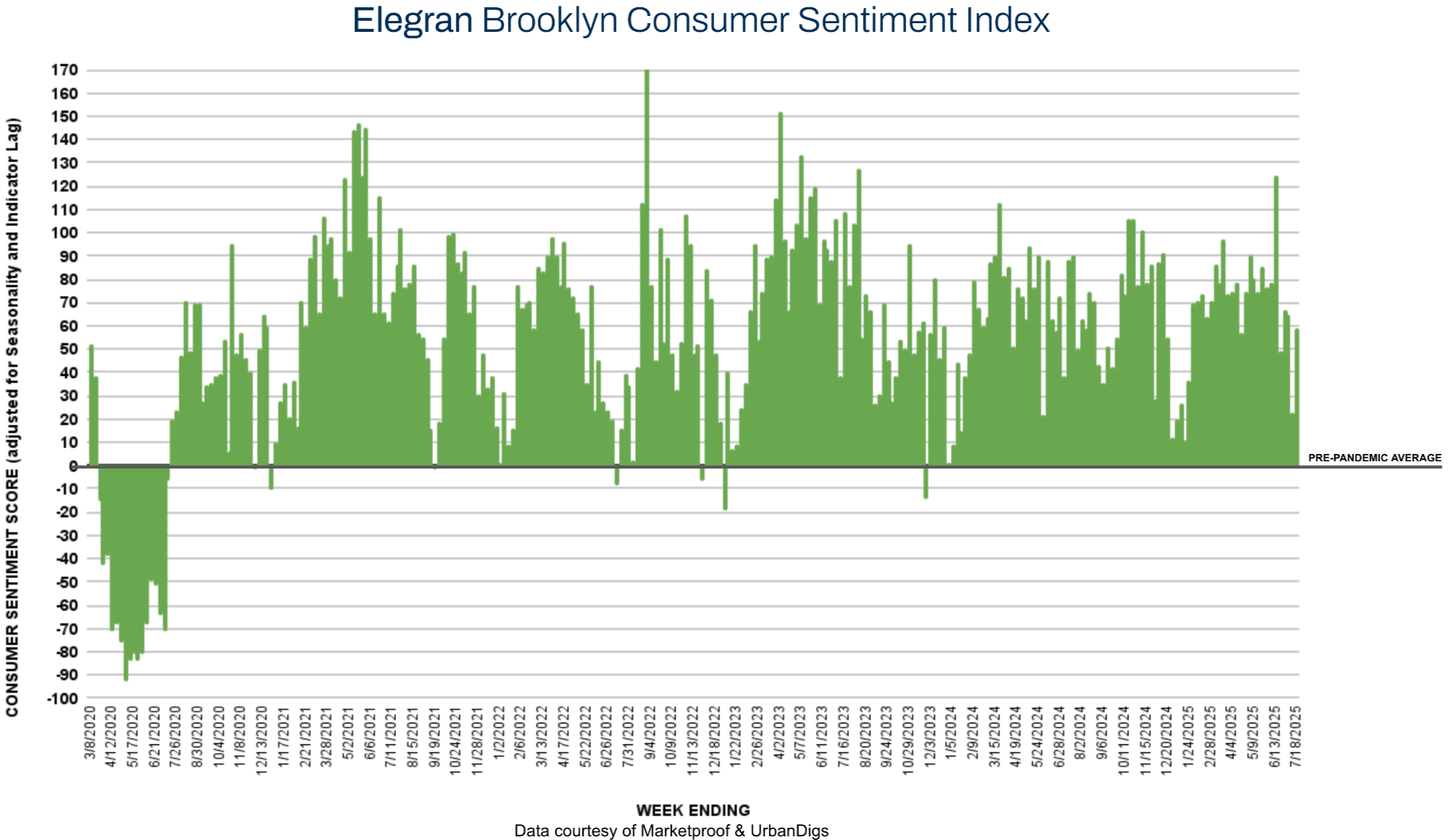

In contrast, Brooklyn is gaining steam. Inventory rose to 3,472 homes, with a notable 16% jump in new listings week-over-week, and an 8% increase compared to this time last year. Although pending sales slipped for the fourth consecutive week (down 2.3%), buyer engagement shows strong signs: 115 contracts were signed, a 32% increase from last week. That pushed the Elegran Brooklyn Consumer Sentiment Index from +22 to +59, highlighting resilience in key submarkets like Park Slope, Williamsburg, and Bed-Stuy.

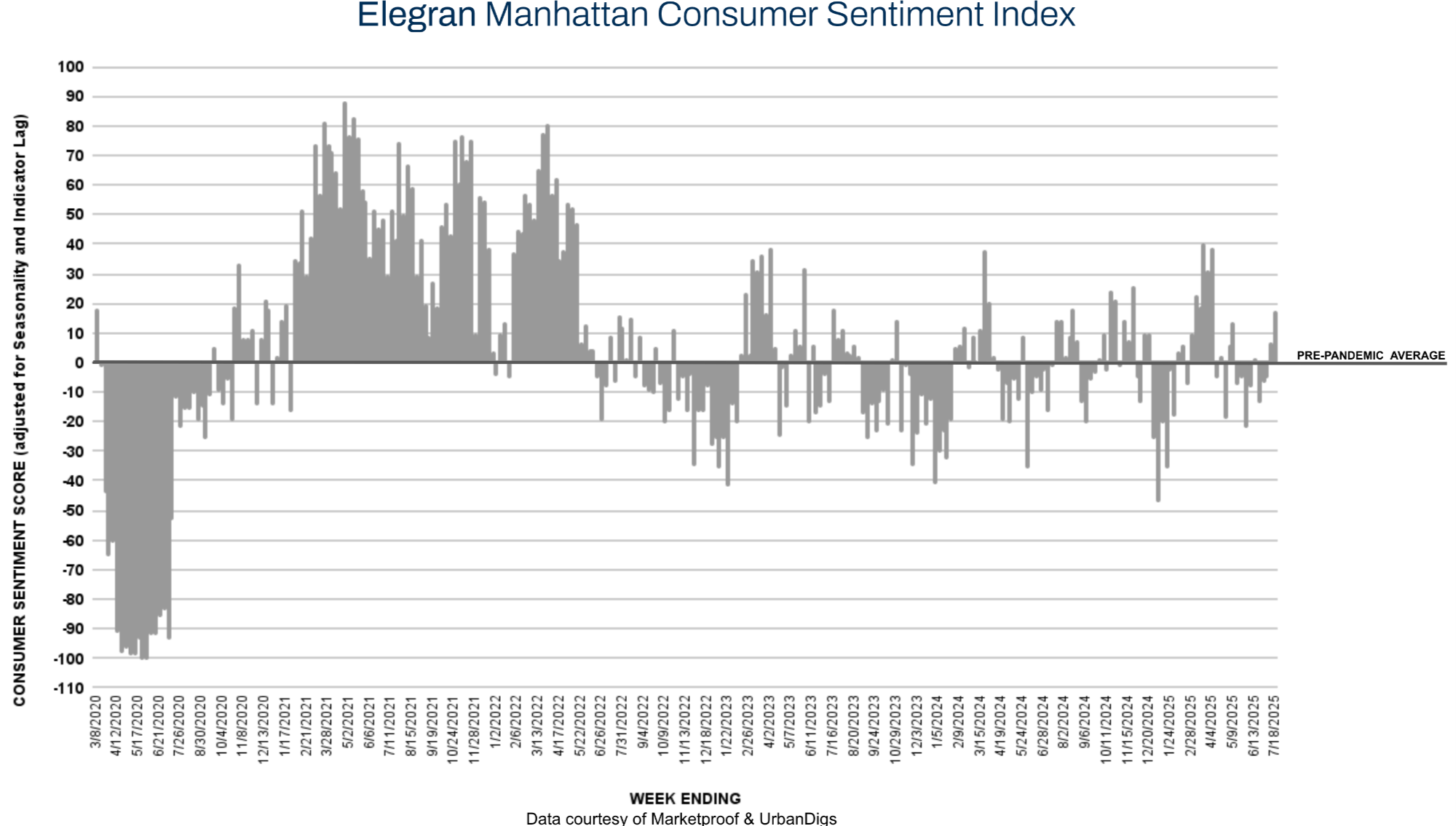

Meanwhile, Manhattan contract activity rose 12%, helping lift the Elegran Manhattan Consumer Sentiment Index from +6 to +17. This upward tick—amid falling supply—suggests that well-priced, move-in-ready properties continue to attract buyers even in a quieter season.

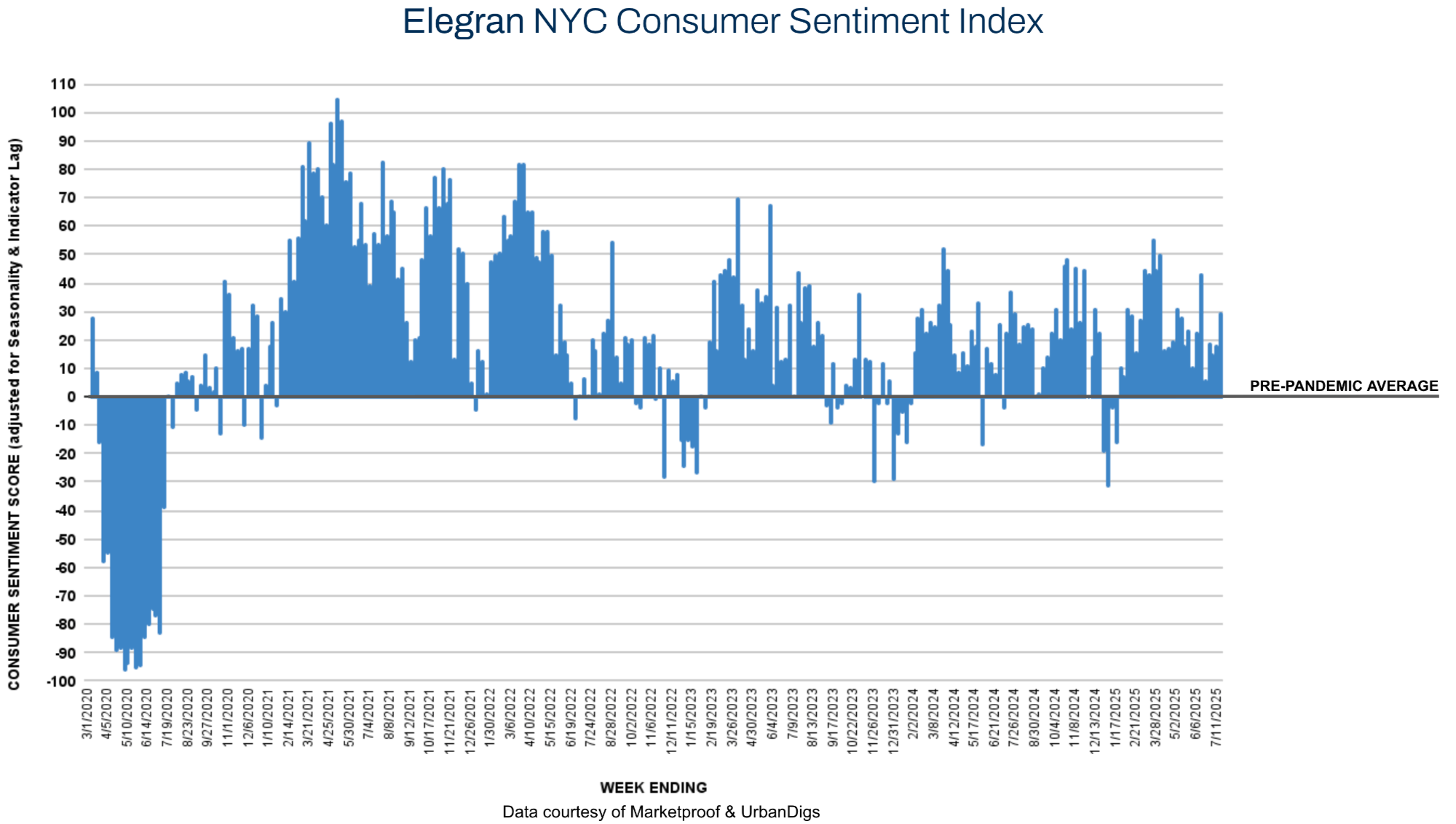

Lastly, based on a relatively active week across both boroughs, the combined Elegran Consumer Sentiment Index rose from +18 to +29.

With August on the horizon, we’ll be watching closely to see if Brooklyn’s strength translates into higher closing volume, or if Manhattan’s constrained supply will keep the market competitive for serious buyers.

Active inventory in Manhattan declined for the seventh straight week, now totaling 6,716 homes—a 1.5% decrease from the prior week. This continued downtrend is consistent with historical summer patterns, where sellers often hold listings until post-Labor Day. While 283 new listings hit the market—a modest 2% week-over-week increase—supply remains 2% lower than the same week in 2024. The bump in new listings is likely a delayed effect from the July 4th holiday period, though overall volume remains muted by seasonality.

In contrast to Manhattan, Brooklyn supply showed notable growth, rising to 3,472 homes—marking its second consecutive weekly gain. A total of 195 new listings came online, representing a 16% increase week-over-week and 8% year-over-year. This momentum suggests that sellers in Brooklyn are taking advantage of renewed buyer interest and less inventory competition. With rising listing activity concentrated in areas like Prospect Heights, South Slope, and Williamsburg, the borough may be setting up for a stronger-than-expected August.

Data courtesy of UrbanDigs

Despite softening pending sales, Manhattan contract activity rose to 212 signed contracts this week—a 12% gain from last week and 3% above the same time last year. As a result, the Elegran Manhattan Consumer Sentiment Index increased from +6 to +17. This rebound signals that while the broader market is in its summer lull, serious buyers are still transacting—particularly for well-located, competitively priced inventory.

Brooklyn experienced a sharp uptick in contract activity, with 115 deals signed—a 32% increase from the prior week. Although this figure remains 17% below last year’s level, the jump in weekly activity pushed the Elegran Brooklyn Consumer Sentiment Index from +22 to +59. The surge reflects a strong buyer response to fresh inventory, especially in family-sized units and newer developments in prime neighborhoods. This trend may indicate early signs of a late-summer demand wave building in Brooklyn.

Marketproof reported that 48 new development contracts were signed in 38 buildings this week. The following buildings were the top-selling new developments of the week:

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.