Elegran Manhattan Market Update: August 2024

Elegran | Forbes Global Properties August 5, 2024

Elegran | Forbes Global Properties August 5, 2024

July 2024 saw the third-highest number of signed contracts in any July over the past ten years. Although it was a distant third—with the highest July surpassing 1,200 contracts and the second highest surpassing 1,000—it was a relatively strong month, highlighting the resilience of the Manhattan market.

Market Resilience: Despite facing headwinds and uncertainty, the Manhattan market performed at the 10-year average and slightly above the 10-year median in terms of contract volume. The $2-4M segment outperformed both the lower and higher ends of the market. The sub-$2M segment remains more sensitive to interest rates, while the luxury segment, often discretionary, remains cautious due to the looming election, economic uncertainties, and geopolitical tensions.

Interest Rates: On a positive note, interest rates began August at their lowest level in a year, with the Fed poised to start cutting rates next month. As mortgage rates continue to decline, demand is expected to increase as sidelined buyers re-enter the market.

Supply Trends: Supply has continued to trend lower, in line with seasonal norms, decreasing over 12% compared to June and standing 5% lower than the same time last year. With declining supply and growing demand annually, the market feels more competitive. However, this competitiveness is not uniform; well-positioned properties tend to sell more quickly and with limited negotiability, while mis-positioned properties can linger on the market and require price reductions to attract buyers.

Market Dynamics: The Elegran | Forbes Global Properties Manhattan Leverage Index remains balanced, with a slight advantage for sellers overall. Buyers looking for deals can likely find opportunities by targeting properties on the market for more than three months and those that have had at least one price reduction.

– “Neutral” markets don’t exist because buyers and sellers are constantly playing tug-of-war for leverage

– At times (e.g., more than 1 year already), there’s no clear winner as buyers & sellers reach equilibrium.¹

– According to the data, July was a neutral month, where neither buyers nor sellers had a significant edge.

- Demand (measured by contracts signed) decreased by 7.3% MoM in the buyer's favor and increased 7.1% YoY in the seller’s favor.

- Supply decreased by 12.3% MoM in the seller’s favor.

- Median days on market increased by 1.5% MoM to 68 days in the buyer's favor.

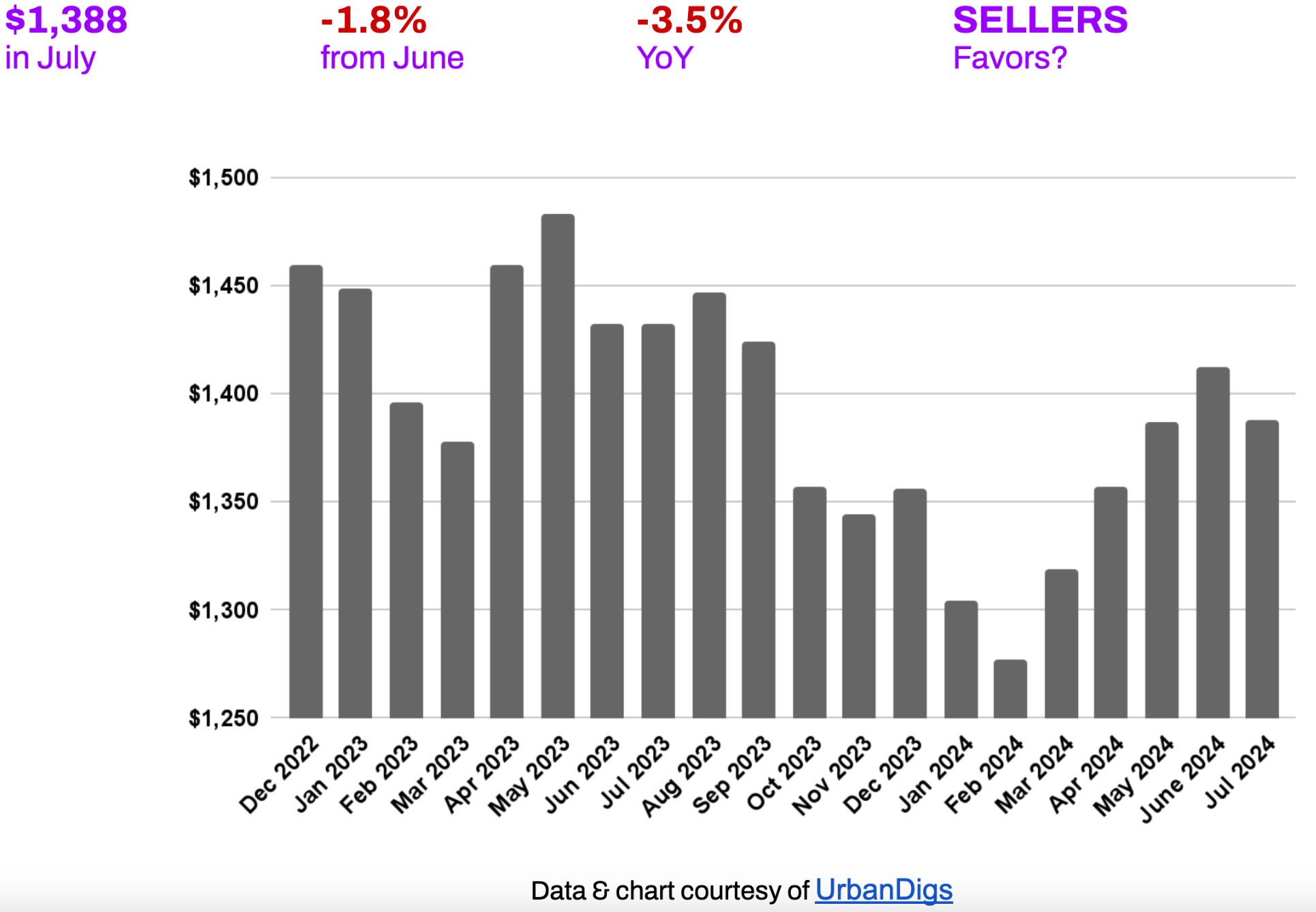

- Median PPSF (Price Per Square Foot) decreased by 1.8% MoM in the buyer's favor.

– In June 2024, median rent reached its second-highest June in history, reaching $4,300.³

– New lease signings reached their second-highest level for June as listing inventory rose to its third-highest for June.

The Elegran | Forbes Global Properties Manhattan Leverage Index is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

The precise numbers aren’t what matters most—it’s the direction and slope of the trend. For over a year, buyers and sellers have been in a stalemate within a relatively balanced market. In July, the market remained in equilibrium with a slight favor towards sellers as supply dropped and demand rose YoY.

At the end of July 2024, there were 6,344 residential listings for sale in Manhattan, marking a significant decrease of 12.3% from June 2024 and a 5.4% decline compared to July 2023. This drop in supply has outpaced the decline in demand on a month-over-month basis, while on a year-over-year basis, demand has increased. Consequently, the market feels more competitive now than it did last summer.

What this means for:

- BUYERS: With the number of listings decreasing, buyers may encounter more competition for available properties, especially in desirable areas. This heightened competition could lead to quicker sales and fewer opportunities to negotiate lower prices. The narrower selection may require buyers to make faster decisions or compromise on certain preferences.

- SELLERS: The reduced supply coupled with relatively stable demand gives sellers more control over pricing and terms. Sellers might experience quicker sales due to the lower inventory and sustained buyer interest, particularly if their properties are well-priced and in good condition.

The current market dynamics slightly favor well-positioned sellers. However, buyers can still find favorable deals by targeting properties that have been on the market for several months and have undergone one or more price reductions. Supply is expected to continue trending downwards through August, with an increase anticipated post-Labor Day as a new wave of listings enters the market.

In July 2024, Manhattan saw 872 contracts signed, reflecting a 7.3% decrease from June 2024 but a 7.1% increase compared to July 2023. High interest rates and overall economic, electoral, and geopolitical uncertainty have dampened some discretionary demand. Despite these challenges, this July marked the third-highest number of contracts signed in the past decade. Although it was a distant third—behind the highest July with over 1,200 contracts and the second highest with over 1,000—it was a relatively strong month, underscoring the adaptability of the Manhattan market.

What this means for:

- BUYERS: The 7.3% decrease in contracts signed from June to July 2024 aligns with seasonal norms, as July typically lags behind June in contract volume. However, contract volumes remained strong for July, and combined with the decline in supply, this creates a more competitive market than usual.

- SELLERS: Manhattan remains a relatively liquid market with consistent demand. However, buyers are educated and selective, meaning well-priced and well-positioned properties sell quickly, while mis-positioned properties languish on the market.

Pricing appropriately is paramount in today’s market. Sellers should be realistic about pricing and open to negotiations. Buyers can find opportunities in properties that have been on the market for longer than three months. When uncertainties resolve and interest rates continue to decrease, buyers should be prepared for a surge in demand and a swift shift of leverage toward sellers.

In July 2024, the median price per square foot (PPSF) for residential apartments in Manhattan was $1,388, marking a 1.8% decrease from June and a 0.2% year-over-year decrease. This month-over-month decrease in median PPSF suggests a slight cooling of the market, possibly due to high interest rates or seasonal factors. Both buyers and sellers should remain cognizant of broader economic influences, such as interest rates, which continue to significantly impact market dynamics.

What this means for:

- BUYERS: Buyers may have more negotiating power, especially if the downward trend in PPSF continues. This could allow for better prices or terms, particularly in situations where sellers are motivated to close swiftly.

- SELLERS: In a cooling market, properties priced too high struggle to attract buyers. Sellers should consider competitive pricing to ensure their listings remain attractive. Adjusting expectations and being open to negotiations can help secure a sale.

The data indicates a mixed market with both challenges and opportunities for buyers and sellers. Sellers can still benefit from holding their assets longer while the market works through the current challenges, while buyers might find current conditions favorable for negotiating better deals.

In July 2024, the median listing discount for Manhattan apartments was 3.9%, a decrease from June’s 4.3% and a 0.2% drop year-over-year. This decreasing discount suggests growing market confidence, with sellers feeling more assured in holding closer to their asking prices.

What this means for:

- BUYERS: The decrease in the median listing discount indicates that sellers are becoming less inclined to reduce their asking prices. Buyers may find it harder to negotiate significant discounts unless the property has been on the market for several months.

- SELLERS: The reduced listing discount implies that sellers are achieving closer to their desired asking prices. This positive trend suggests sellers have slightly more control over final sale prices, with less need to make significant price reductions to close deals.

The reduction in the median listing discount reflects a more balanced market, with a slight tilt towards sellers. Both buyers and sellers should remain vigilant of market trends and be prepared to adapt to changing conditions. Sellers can capitalize on the current confidence in the market, while buyers should leverage their knowledge and readiness to find the best opportunities.

In June, median rent reached its second-highest June in history, having reached $4,300. New lease signings reached their second-highest level for June as listing inventory rose to its third-highest for June. The 30-Year Fixed Rate JUMBO Mortgage Index is trending lower at 6.9%⁴, and the average JUMBO APR is 6.4%⁵. So, it’s a “catch-22” for renters, as the rent versus buy scale may feel equally punitive on both sides. Rents though may be hitting their upper limits for this busy season.

The total return is driven by net rental income and capital appreciation. For all-cash investors, Manhattan cap rates are currently 2.7 - 3.2%. Unfortunately, there is no net income potential for those investors using a large percentage of leverage, with the average JUMBO mortgage APR at 6.4%. Timing and a strong USD may afford foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

1. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

2. Data courtesy of UrbanDigs

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.