Elegran Manhattan Market Update: December 2024

Elegran | Forbes Global Properties December 1, 2024

Elegran | Forbes Global Properties December 1, 2024

November 2024 marked a significant turning point for Manhattan’s real estate market, showcasing a substantial increase in demand and contract activity year-over-year. With 882 contracts signed, this November marks the third-highest contract volume in the past decade. This represents a significant uptick compared to last November, indicating that the market is emerging from the low-volume trap of the past two and a half years.

For the second consecutive month, monthly contract activity has exceeded the rolling seasonal average after lagging for the previous sixteen months. This upward trend is fueled by changing expectations on interest rates, the presidential election now behind us, and growing optimism about economic growth. The Elegran | Forbes Global Properties Manhattan Leverage Index indicates a relatively balanced market in November 2024, with a slight edge for sellers.

Tightening inventory levels further underscore the market’s strength, with overall supply down 8.5% from October to 6,276 units. Inventory is now 7.2% lower than the same period last year and approximately 10% below the ten-year average for November. This decline in supply is attributed to fewer late-fall listings, sellers pulling homes from the market for the holidays, and steady buyer demand. Limited supply and rising demand are expected to sustain inventory constraints through early 2025.

Price trends are beginning to shift as well. The median price per square foot dipped slightly to $1,381—a 0.9% month-over-month decrease—but posted a notable 2% increase year-over-year. While Manhattan prices have remained relatively flat since 2017, unlike other metro areas with substantial appreciation, these dynamics suggest the market is on the verge of breaking through its price ceiling and entering a period of appreciation.

Looking ahead, stabilizing interest rates and Manhattan’s unique position—countercyclical to national trends and not at bubble risk—create a compelling opportunity for growth. Demand is expected to remain robust through the winter and accelerate into the spring season, paving the way for continued market activity. Manhattan appears ready to leave its period of stagnation behind, with rising demand and stabilizing conditions setting the stage for price appreciation and renewed confidence.

The Elegran | Forbes Global Properties Manhattan Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

It’s not the exact numbers that matter most - it’s the direction and slope of the trend. Buyers and sellers have been in a stalemate within a balanced market for over eighteen months. This summer saw a minor shift favoring sellers before buyers regained a slight advantage by September. In October and November, though, the pendulum swung back again, leaning subtly toward sellers.

As is typical for this time of year, supply decreased in November compared to October. This decline is due to fewer new listings coming on the market late in the fall season, more sellers taking their unsold homes off the market for the holidays, and steady buyer demand. Overall supply declined 8.5% in November from October, reaching 6,276 units.

Notably, supply is 7.2% lower than the same period last year. Compared to the last ten November’s, the current supply level is about 10% below the ten-year average for this period. No significant influx of supply is expected in December due to the holiday season, and inventory is anticipated to remain tight through the first month or two of 2025.

What this means for:

Overall, current market conditions in Manhattan favor sellers that are in tune with their local market conditions. However, buyers who are well-prepared and act quickly may still find opportunities to purchase desirable properties. Both buyers and sellers should work with experienced real estate advisors who can provide up-to-date market insights and help navigate the competitive landscape.

Although, as is seasonally normal, contracts signed in November decreased by 11.2% compared to October 2024; November was a very strong month for contract activity in Manhattan by historical standards.

With 882 contracts signed, it ranked as the third-best November in terms of contract activity over the past decade. Additionally, contract activity surpassed the rolling seasonal average for the second consecutive month after lagging for the previous sixteen months, indicating renewed demand after an extended period of low volume. Over the past three months, this upward trend has gained momentum, driven by changing expectations on interest rates, the presidential election behind us, and increasing optimism about economic growth.

What this means for:

Demand is expected to remain above average through the typically quieter winter months and accelerate further during the traditionally busy spring season, with more people expected to transition from renting to owning.

In November 2024, the median price per square foot (PPSF) for residential apartments in Manhattan continued its downward trend, reaching $1,381—a 0.9% decrease from the previous month. This decline largely reflects deals signed over the summer, before the market’s resurgence following the Federal Reserve’s first interest rate cut. More importantly, there was a 2% increase year-over-year in PPSF. While most national markets have experienced significant price appreciation since the start of COVID-19—the national average being 51%—Manhattan has seen only 3% appreciation. The Manhattan market now appears poised to break through its price ceiling and enter a period of appreciation. Meanwhile, many national markets that saw the greatest price increases over the past few years (e.g., Miami, Tampa, Austin) are now experiencing some of the most significant price declines.

What this means for:

While major metropolitan markets face bubble risks, Manhattan’s countercyclical nature and undervalued prices offer a unique opportunity for growth. Rising demand, limited supply, declining interest rates, and the city’s inherent strengths align to set the stage for Manhattan to break through its eight-year price ceiling. As many national markets show signs of cooling, Manhattan is primed for growth and is finally poised for price appreciation.

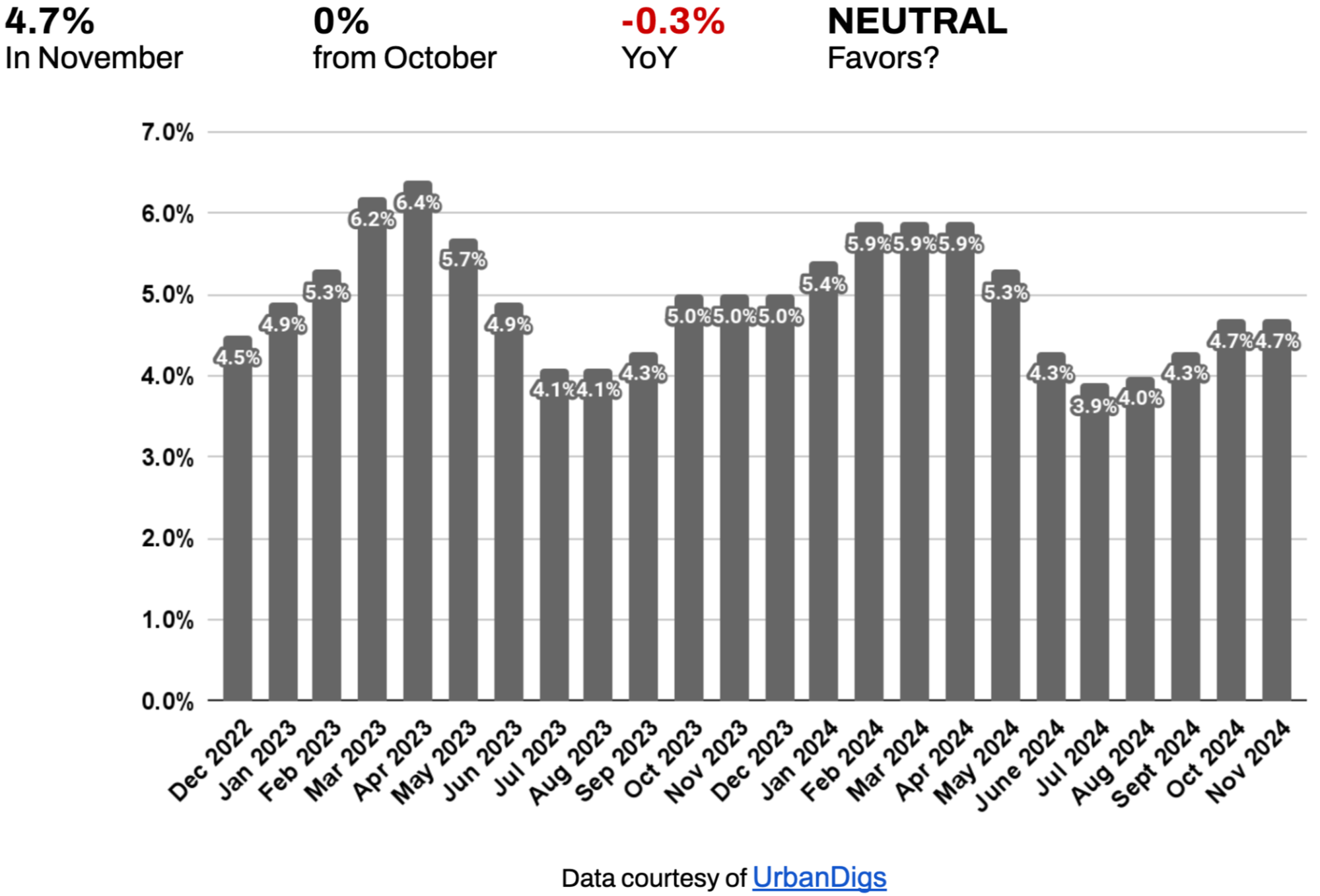

In November 2024, the median listing discount for Manhattan homes remained steady at 4.7%, the same as in October. On a year-over-year basis, the discount saw a minimal decline of 0.3%, indicating a slight firming of the price floor and setting the stage for potential price increases in the mid-term.

What this means for:

Expect listing discounts to continue declining as the imbalance between supply and demand intensifies during the winter months. Declining listing discounts are often a precursor to price appreciation, suggesting a strengthening market ahead.

In October 2024, the median rent in Manhattan increased by 2.3% from the previous month, reaching $4,295. This marks a 2.4% rise year-over-year and the first annual increase in median rent since April.³

The 30-Year Fixed Rate JUMBO Mortgage Index is currently trending at 6.9%⁴, with the average JUMBO Annual Percentage Rate (APR) at 6.7%⁵. Although these rates had decreased in late August and into mid-September, they have since risen by 80 basis points after hitting a low in mid-September.

As economic uncertainty diminishes, interest rates are expected to stabilize. This stabilization should provide much-needed certainty for both buyers and sellers, encouraging transactions and easing market gridlock. A more predictable interest rate environment can boost confidence in the real estate market, leading to increased activity and smoother transactions.

The total return on real estate investments is driven by net rental income and capital appreciation. Manhattan cap rates are currently between 3% and 3.4% for all-cash investors. Unfortunately, investors using a large percentage of leverage face challenges in generating net income, given the average JUMBO mortgage APR of 6.7%.

Current demand and recent bullish signals for Manhattan real estate suggest that prices are starting to see upward pressure. Importantly, Manhattan presents a rare opportunity to purchase assets that have remained virtually unchanged in value since 2017, as indicated in the chart below. No other metro area in the country has seen such minimal appreciation during this period.

Additionally, Manhattan tends to move countercyclically compared to national trends and is not at bubble risk, creating a compelling entry point for buyers. Timing and a strong U.S. dollar may afford foreign investors—depending on their native currency—the opportunity to realize significant capital gains upon selling their assets.

1. Data courtesy of UrbanDigs

2. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.