Overall Manhattan Market Update: July 2024

Contract Activity Decreased More than Supply, Creating a Window of Opportunity for Buyers this Summer

In June, sellers gained a slight advantage according to the Elegran | Forbes Global Properties Manhattan Leverage Index, driven by a rising median price per square foot and a declining median listing discount. This advantage, however, stems from properties contracted between February and April and closed in June.

Looking ahead, June’s larger decrease in demand (measured by contracts signed) compared to supply has shifted leverage toward buyers, giving them a window of opportunity to negotiate more favorable deals with less competition through Labor Day.

As potential interest rate cuts by the Fed loom, some buyers are holding back, anticipating more affordable rates. However, these buyers risk missing out. Once interest rates start to drop, the market is expected to see a surge in demand that outpaces the supply increase, likely leading to bidding wars and a swift shift in leverage back to sellers.

Supply has peaked for the season and entered its summer slump before an anticipated rebound after Labor Day. negotiate better terms, and lock in appreciation, with the potential to refinance when rates eventually decrease.

The market can remain fairly active this summer, as savvy buyers aim to capitalize on the first-mover advantage.

SALES

- “Neutral” markets don’t exist because buyers and sellers are constantly playing tug-of-war for leverage.

- At times (e.g., more than 1 year already), there’s no clear winner as buyers & sellers reach equilibrium.

- According to the data, June was a neutral month, where neither buyers nor sellers had a significant edge, although sellers gained a very slight edge.

- Demand (measured by contracts signed) decreased by 5.2% in the buyer's favor.

- Supply decreased by 3% in the seller’s favor.

- Median days on the market decreased by 13% to 67 days in the seller’s favor.

- Median PPSF (Price Per Square Foot) increased by 1.2% in the seller’s favor.

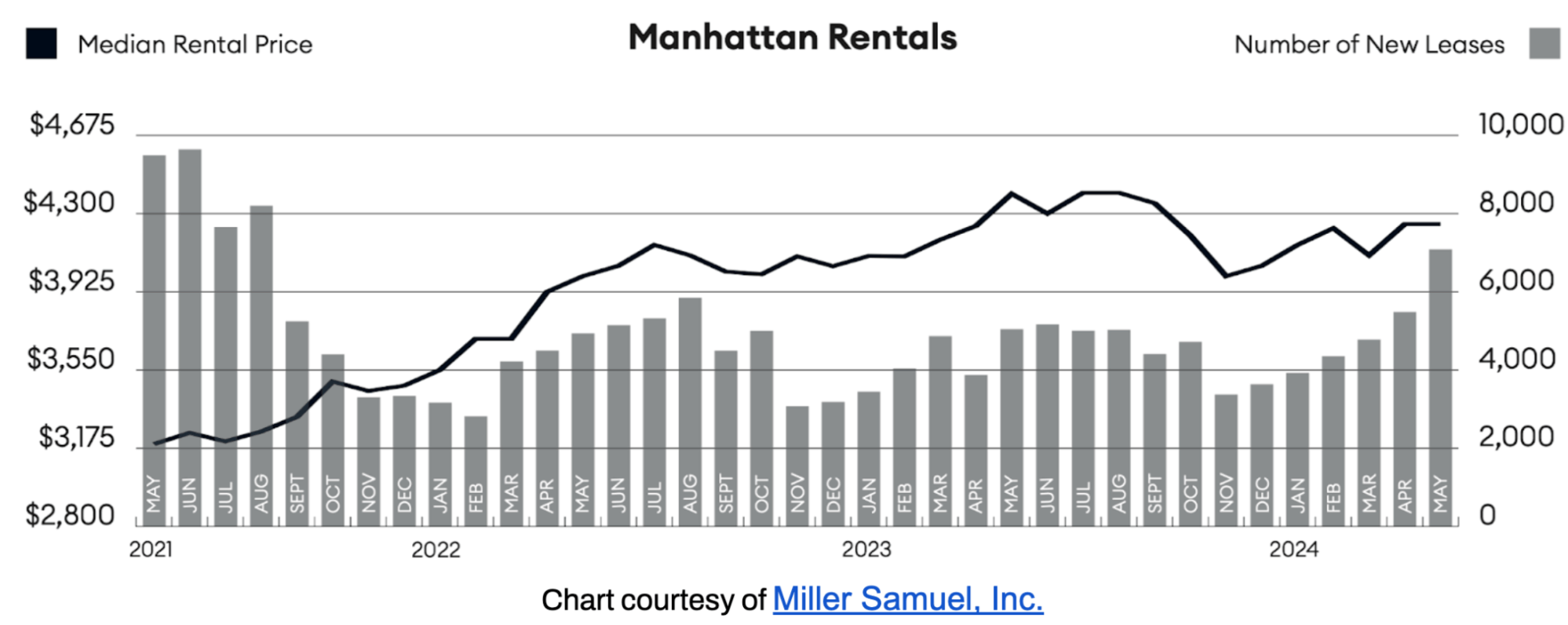

RENTALS

- In May, all price trend indicators slipped year over year, yet median rent reached its second-highest May result in history. The median rental price reached $4,250 in June.

- Listing inventory and new lease signings rose to the record's second-highest level for May.

Elegran | Forbes Global Properties Manhattan Leverage Index

The Elegran | Forbes Global Properties Manhattan Leverage Index is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market.

- A decreasing trend from left to right indicates a buyer’s market.

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other.

- A sharp slope indicates a strong advantage.

The precise numbers aren’t what matters most—it’s the direction and slope of the trend. For over a year, buyers and sellers have been in a stalemate within a relatively balanced market, but over the past two months, there’s been a slight shift towards a seller’s market, reflected in the lagging sales price and negotiability data. With demand decreasing more than supply, buyers have a brief window of opportunity to secure deals with less competition through Labor Day.

Manhattan Supply

At the end of June 2024, there were 7,212 residential listings for sale, marking a slight decrease of 3% from May 2024 and a 1.2% dip compared to June 2023. Supply has peaked for the season and entered its summer slump before an anticipated rebound after Labor Day. Notably, supply has decreased less than demand, creating a window of opportunity for buyers.

What this means for:

- BUYERS: Expect supply to decrease this summer, with new inventory hitting the market in the fall. Sellers who remain on the market—especially those who have reduced their asking prices—signal that they are motivated. This creates an opportune moment for buyers to secure favorable deals with less competition.

- SELLERS: Anticipate less demand over the summer months. Evaluate your target buyer and decide whether to keep your home on the market or temporarily withdraw and relist in the fall. If you choose to stay on the market, consider adjusting your asking price based on recent sales, withdrawals, or price reductions to ensure competitive positioning.

Supply will continue to decline through the summer as properties are sold or withdrawn, with few new listings during this slower season. Monitor the Federal Reserve’s signals regarding interest rates; if an interest rate shift is imminent, it could be advantageous to list sub-$2.5M properties, as buyers in this range are typically more sensitive to interest rate changes.

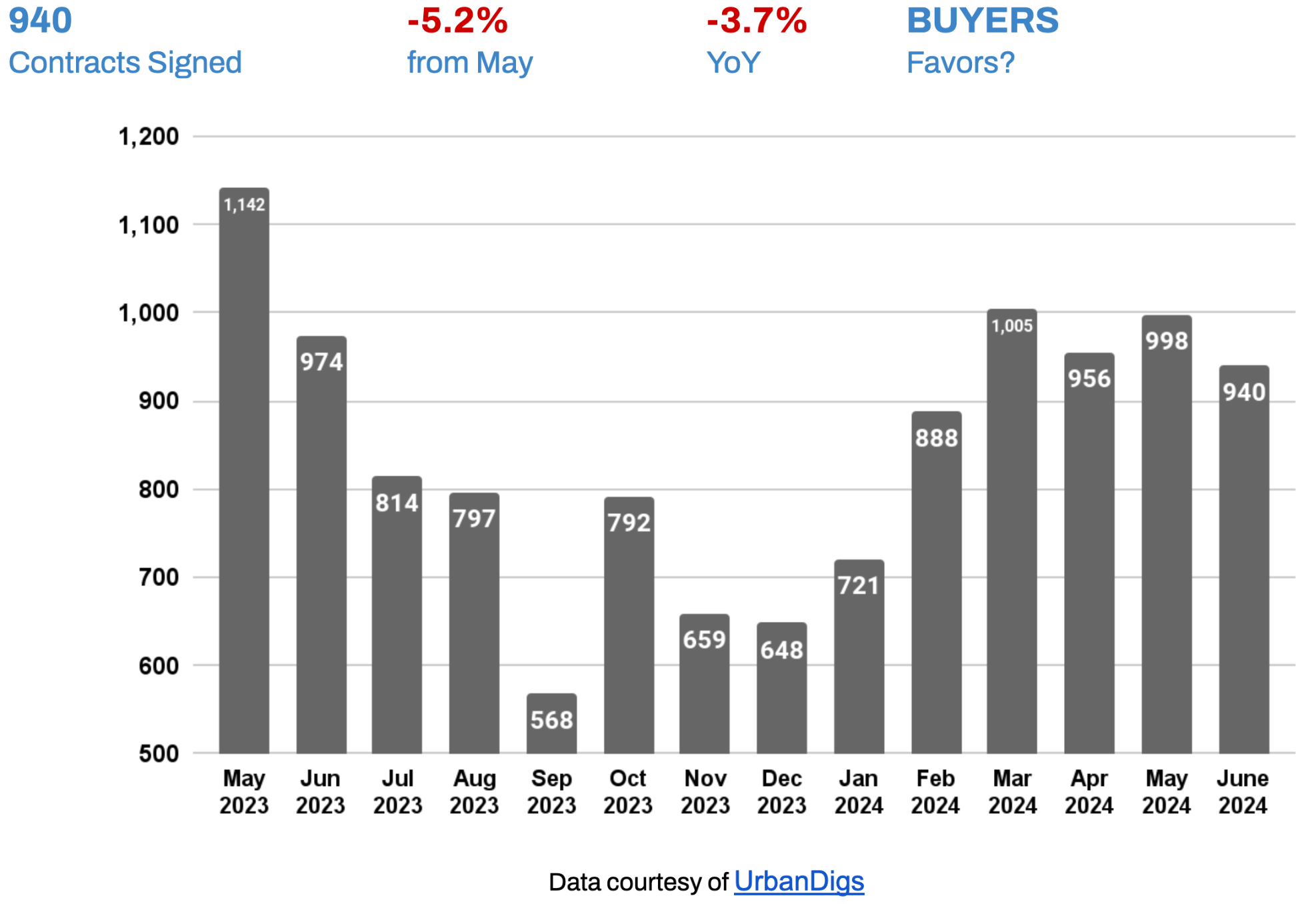

Manhattan Demand

In June 2024, Manhattan saw 940 contracts signed, reflecting a 5.2% decrease from May 2024 and a 3.7% drop compared to June 2023. High interest rates continue to dampen demand, with contract volume for 2024 slightly trailing behind 2023. After a competitive Q1 2024, buyers have faced less competition in Q2, a trend expected to persist through the first half of Q3. However, once interest rates decrease, buyers should be prepared for a surge in demand and a swift shift of leverage back to sellers.

What this means for:

- BUYERS: Those who can tolerate temporarily higher interest rates have the opportunity to secure properties with better terms and less competition, potentially locking in upside appreciation as the market rebounds when interest rates eventually decrease.

- SELLERS: If a quick sale is necessary, be prepared to adjust pricing strategies and enhance listings to attract potential buyers.

In the first few weeks of summer, contract volumes, which were below average this spring, have not dropped further as they typically do in the summer months. Whether contract activity will maintain this level or decline remains to be seen.

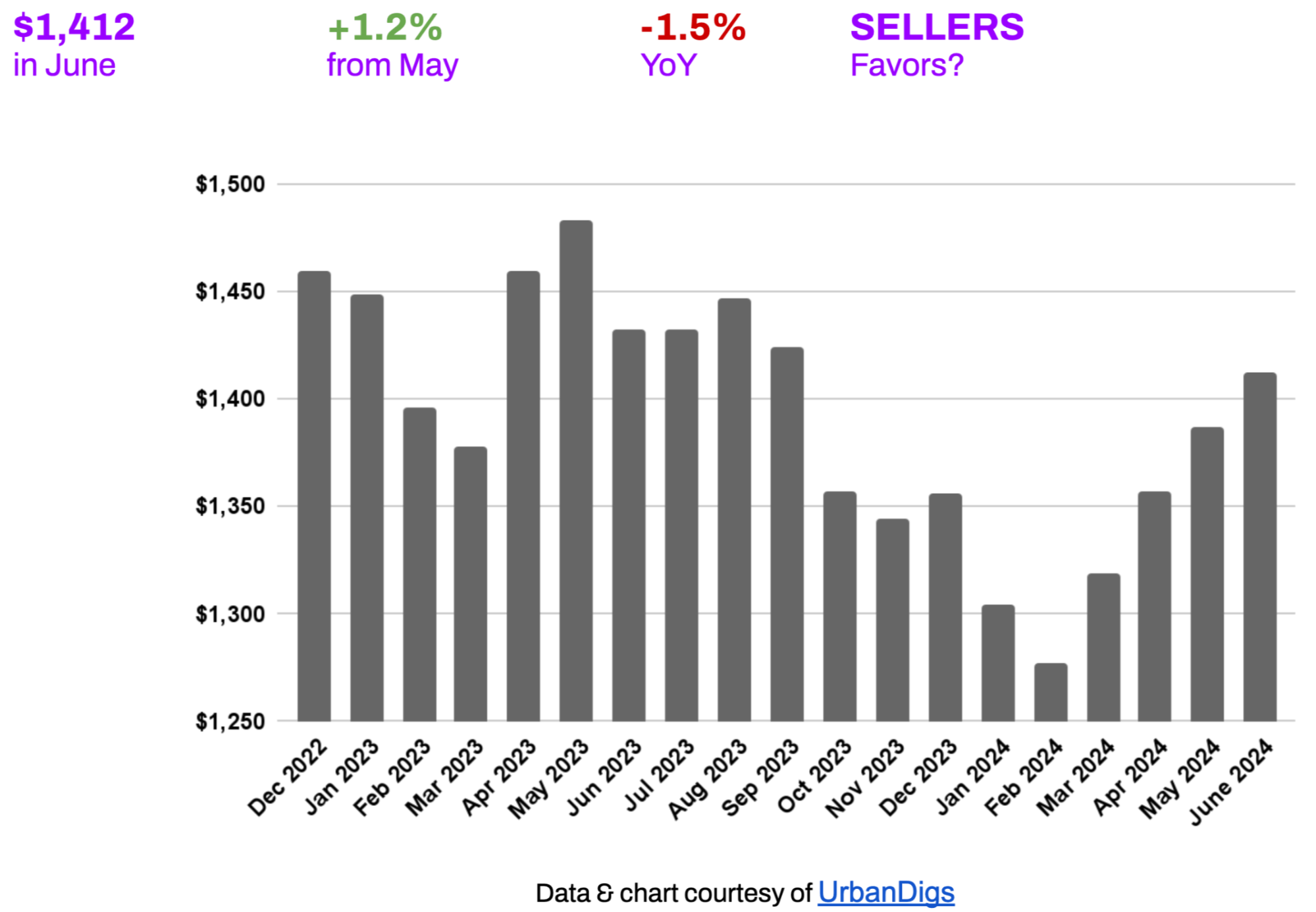

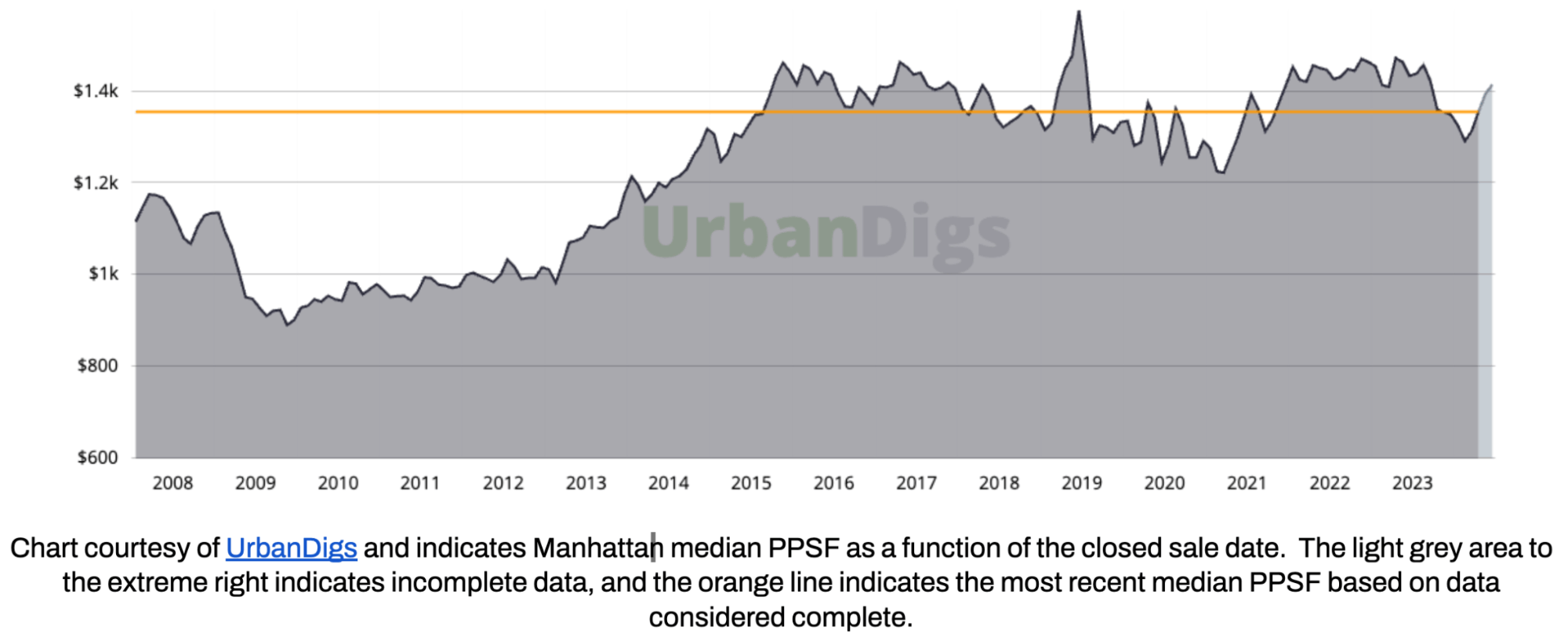

Manhattan Median PPSF

In June 2024, the median price per square foot (PPSF) for residential apartments in Manhattan reached $1,412, marking a 1.2% increase from May despite a 1.5% year-over-year decline. This recent uptick is likely due to the earlier surge in contract volume now closing.

What this means for:

- BUYERS: Despite the slight month-over-month increase, the year-over-year decline presents an opportunity to invest in Manhattan real estate at more favorable prices than last year.

- SELLERS: To attract today’s buyers, it’s important to remain realistic with pricing strategies and avoid overconfidence despite the recent PPSF increase.

While the short-term rise in PPSF is encouraging for sellers, the longer-term decline suggests a cautious approach. It remains to be seen if this trend will reverse over the summer as spring contracts continue to close.

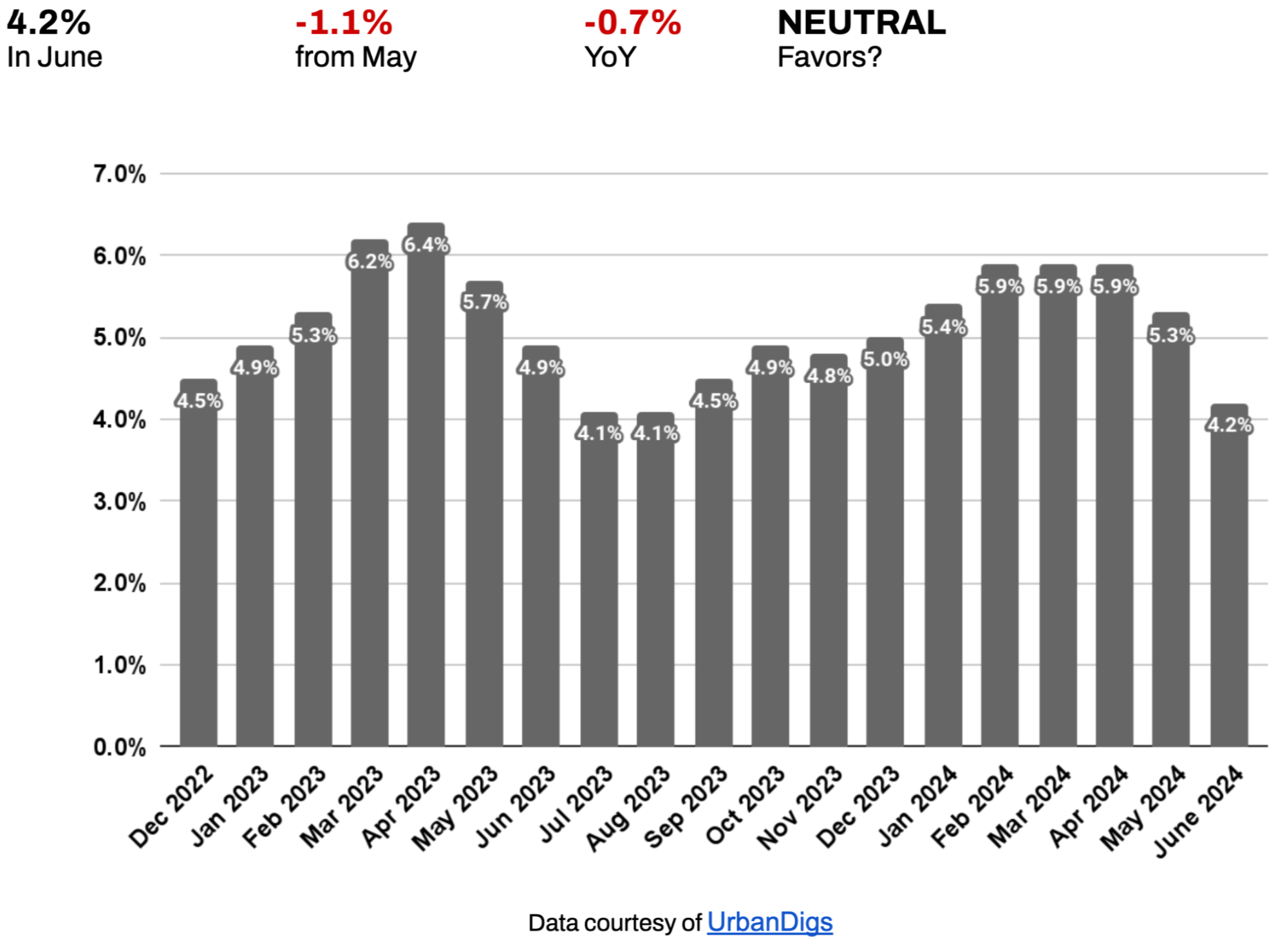

Manhattan Median Listing Discount

In June 2024, the median listing discount for Manhattan apartments was 4.2%, reflecting a 1.1% decrease from May and a 0.7% drop year-over-year.

What this means for:

- BUYERS: The declining discount trend indicates a shift in negotiating power away from buyers, warranting close attention throughout the summer.

- SELLERS: This trend is a positive reminder to set realistic asking prices to attract buyers in the current market.

As interest rates drop, expect negotiability to decrease, which often precedes price appreciation.

RENTAL REMARKS

In May, all price trend indicators slipped year over year, yet median rent reached its second-highest May result in history. The median rental price reached $4,250 in June. Listing inventory and new lease signings rose to the record's second-highest level for May. The 30-Year Fixed Rate JUMBO Mortgage Index is trending at 7.2%⁴, and the average JUMBO APR is 6.85%⁵. So, it’s a “catch-22” for renters, as the rent versus buy scale may feel equally punitive on both sides. Rents are expected to continue their upward trend through the busy summer months.

INVESTOR INSIGHTS

The total return is driven by net rental income and capital appreciation. For all-cash investors, Manhattan cap rates are currently 2.7 - 3.2%. Unfortunately, there is no net income potential for those investors using a large percentage of leverage, with the average JUMBO mortgage APR at 6.85%. Timing and a strong USD may afford foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

References

1. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index.