Elegran Manhattan Market Update: June 2025

Elegran June 9, 2025

Elegran June 9, 2025

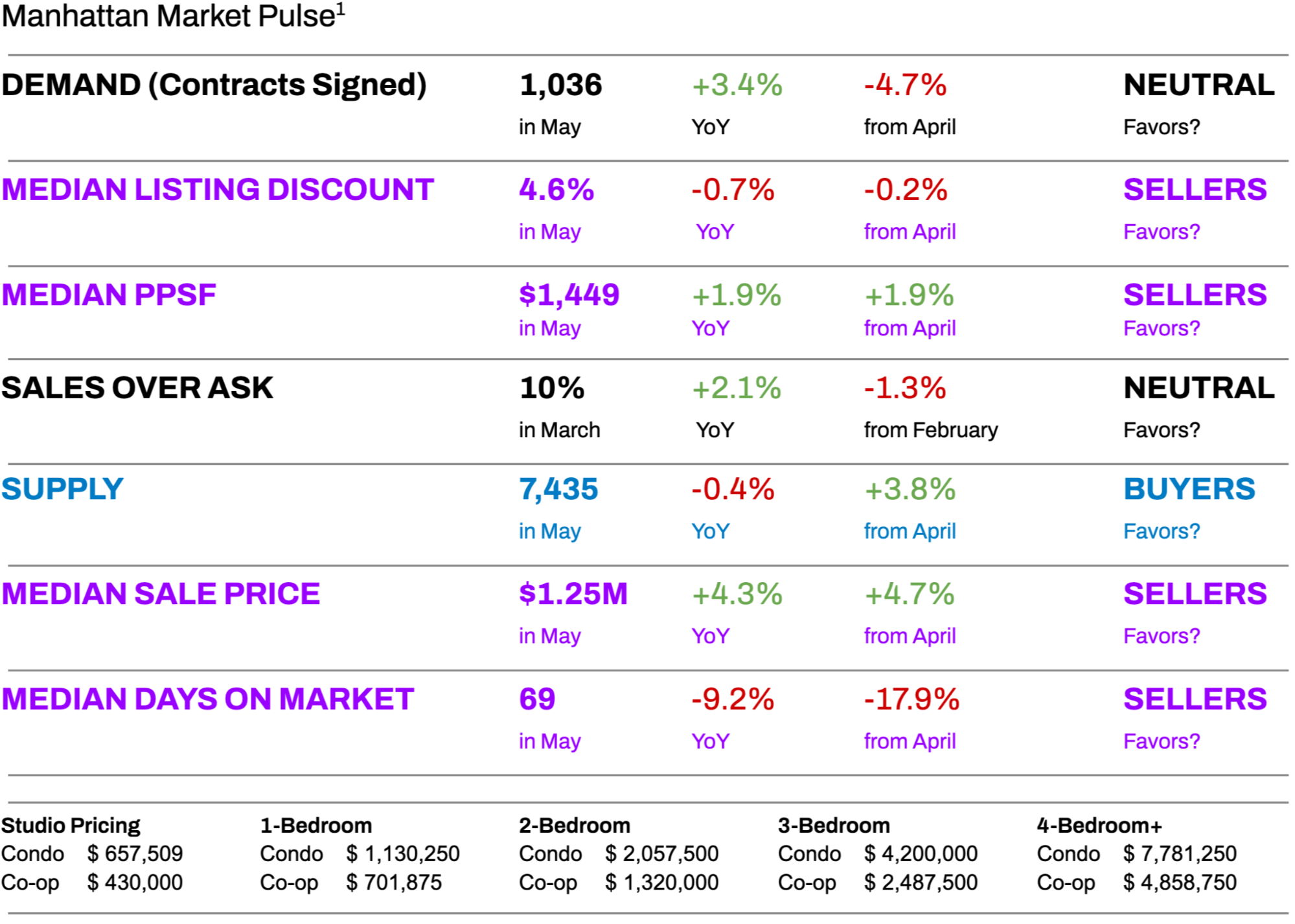

After years of uncertainty, speculation, and volatility, Manhattan’s real estate market has entered a new phase—one that favors confidence, clarity, and well-informed decisions. Whether you’re looking to buy, sell, rent, or invest, the latest data from May paints a picture of a marketplace that’s not only functioning—it’s thriving on fundamentals.

And notably, this is all happening against a backdrop of broader economic uncertainty, which may no longer be a temporary condition, but a new constant in modern life. In that context, Manhattan real estate stands out as a tangible, resilient asset, anchored by local demand and long-term value.

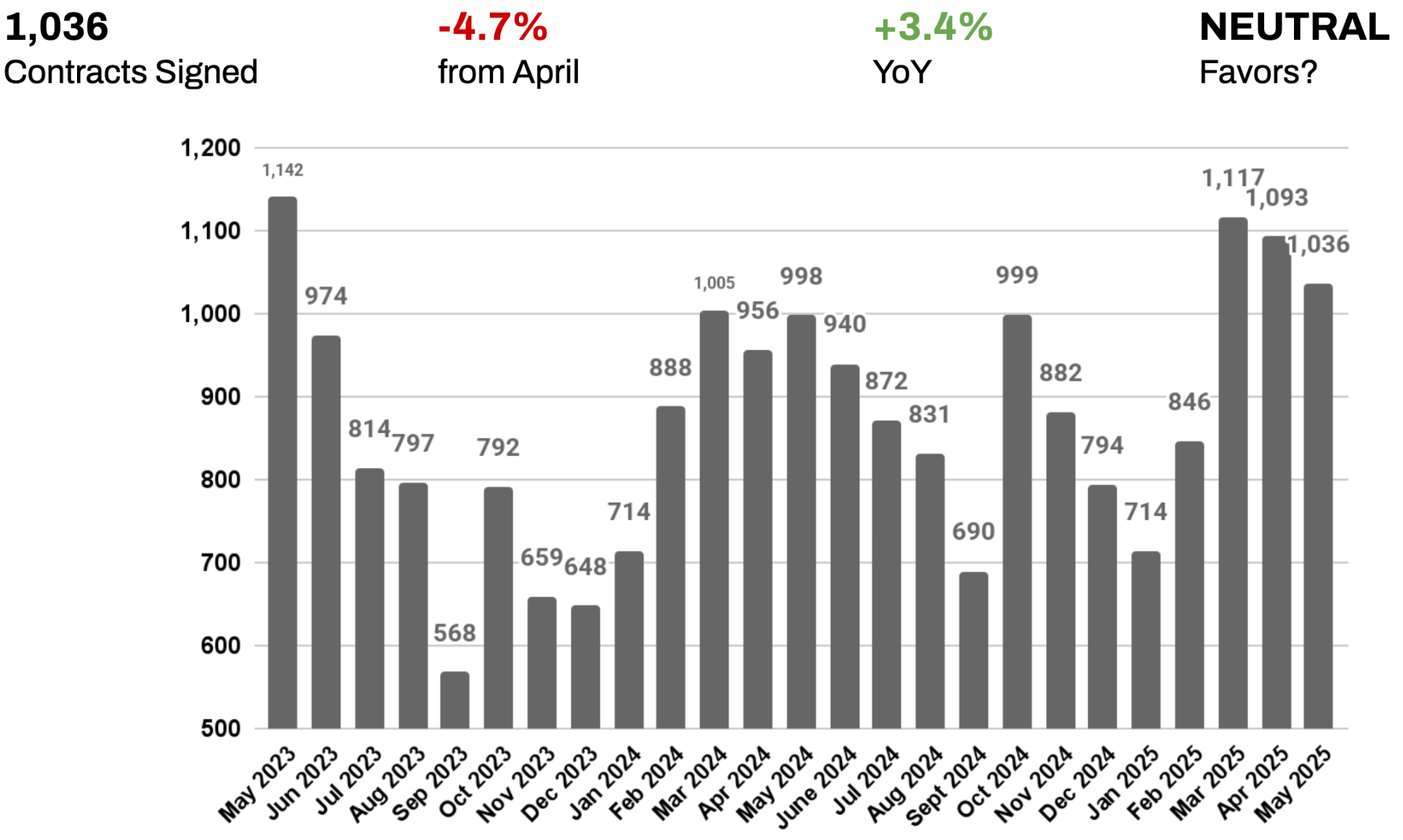

Let’s start with the for-sale market, where stability is replacing volatility. In May, 1,036 contracts were signed—a 3.4% increase compared to the same time last year. That tells us buyers are active and confident, but also measured. Today’s buyers move based on life changes, long-term planning, and a clear understanding of value, not just interest rates or headlines.

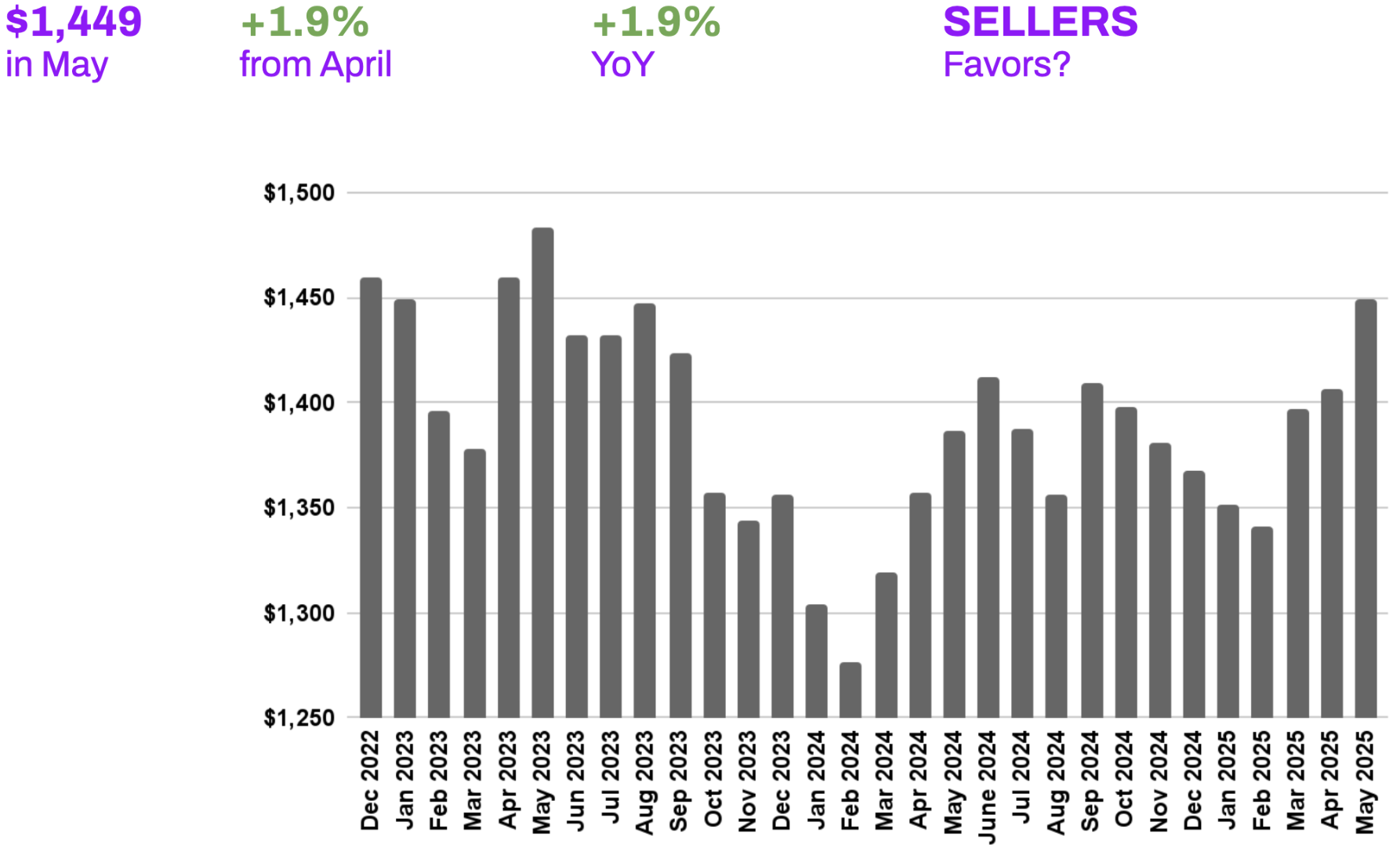

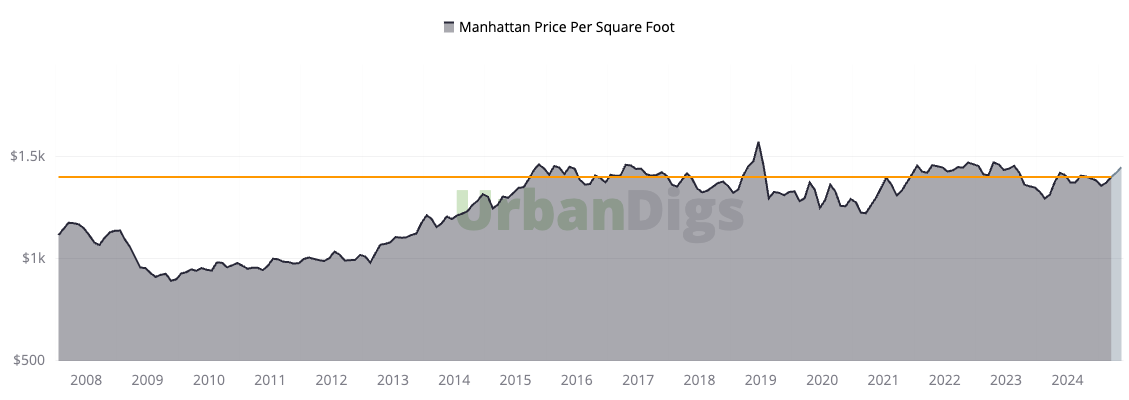

And while buyer activity dipped 4.7% month-over-month, that’s relatively in line with seasonal trends. What matters more is the price trajectory, and here the story is compelling: the median price per square foot rose to $1,449, up 1.9% monthly and annually. This slow, steady growth reflects a market that’s [finally] appreciating in value, not because of speculation, but because well-positioned homes are earning their price tags.

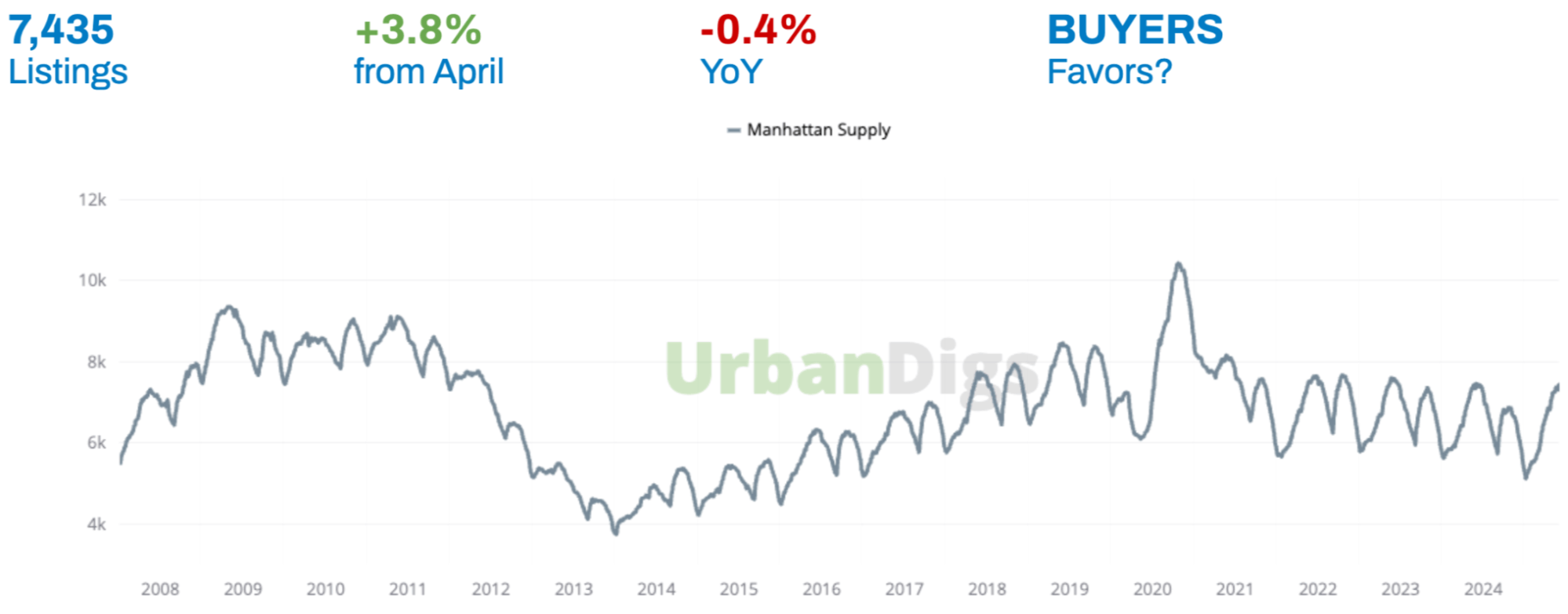

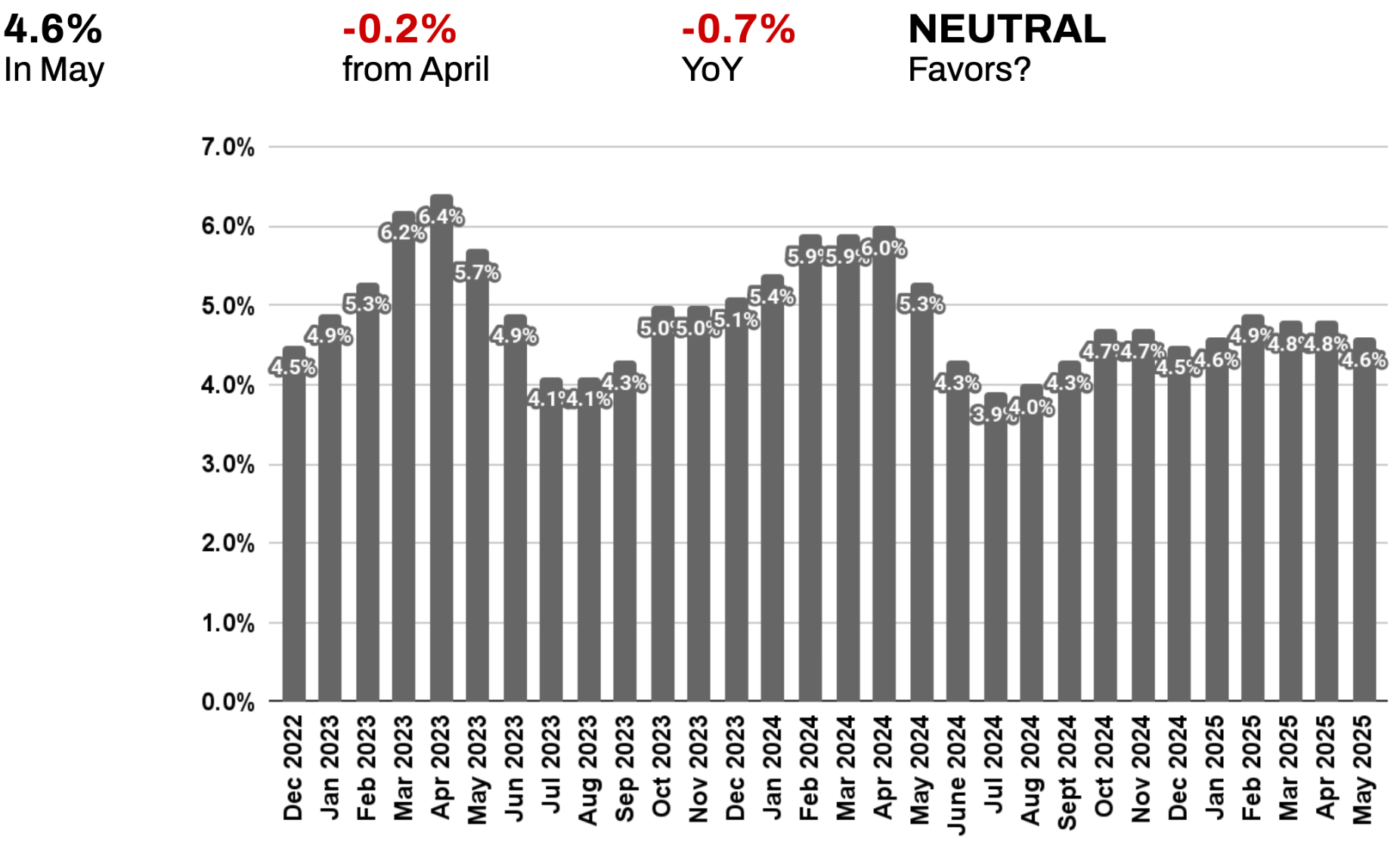

At the same time, inventory levels remain healthy, with 7,435 active listings—up 3.8% from last year and down just slightly from April. That means buyers still have meaningful options, while sellers benefit from a competitive, yet not overcrowded, landscape. And with a median listing discount of 4.6%, negotiations are tighter—sellers are holding firmer on pricing, particularly when homes are priced and positioned properly from day one.

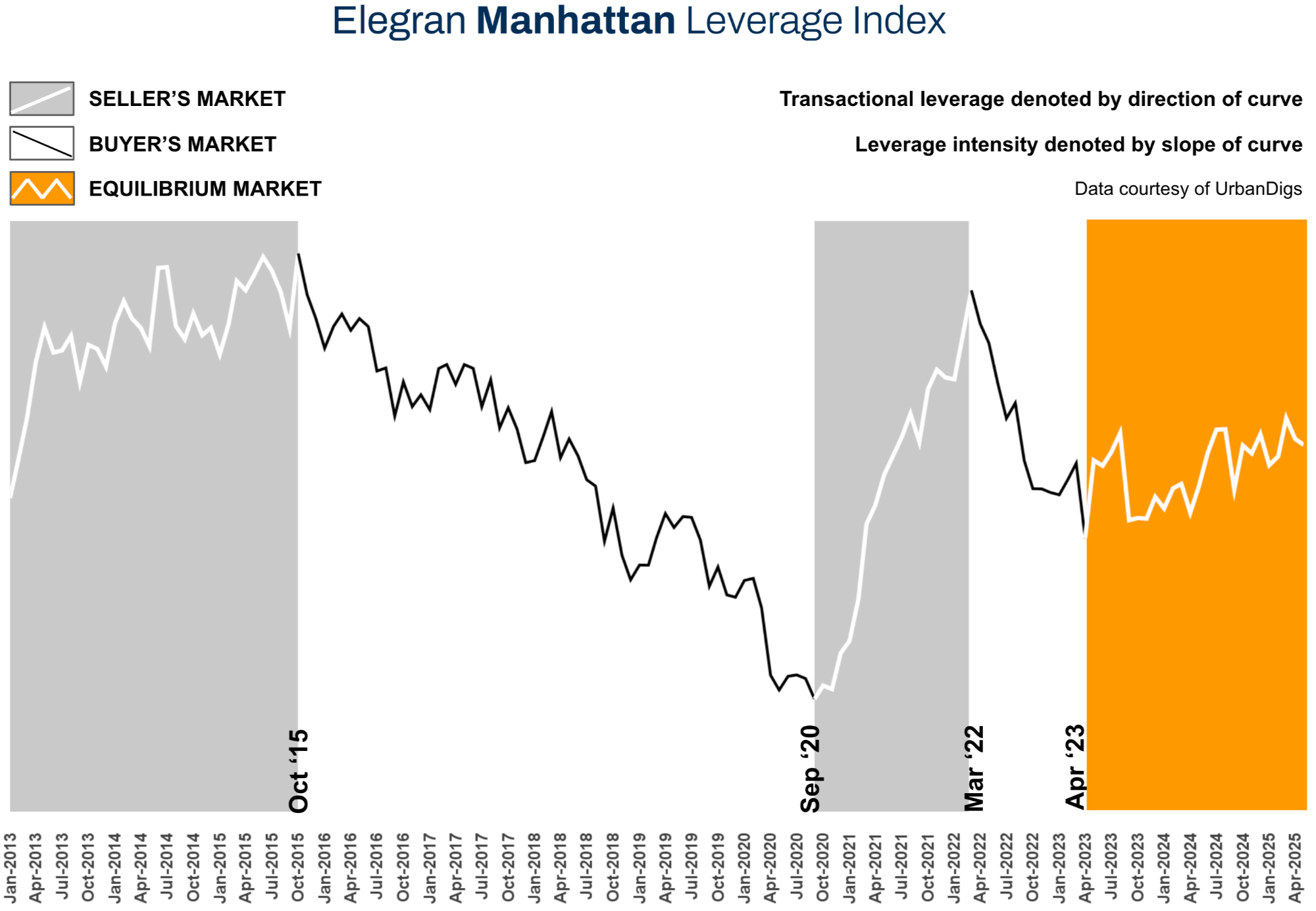

All of this is captured in the Elegran Manhattan Leverage Index², which currently reflects a neutral market, an equilibrium where neither side holds outsized power. We call this a strategy market: one where success comes from thoughtful execution, not perfect timing.

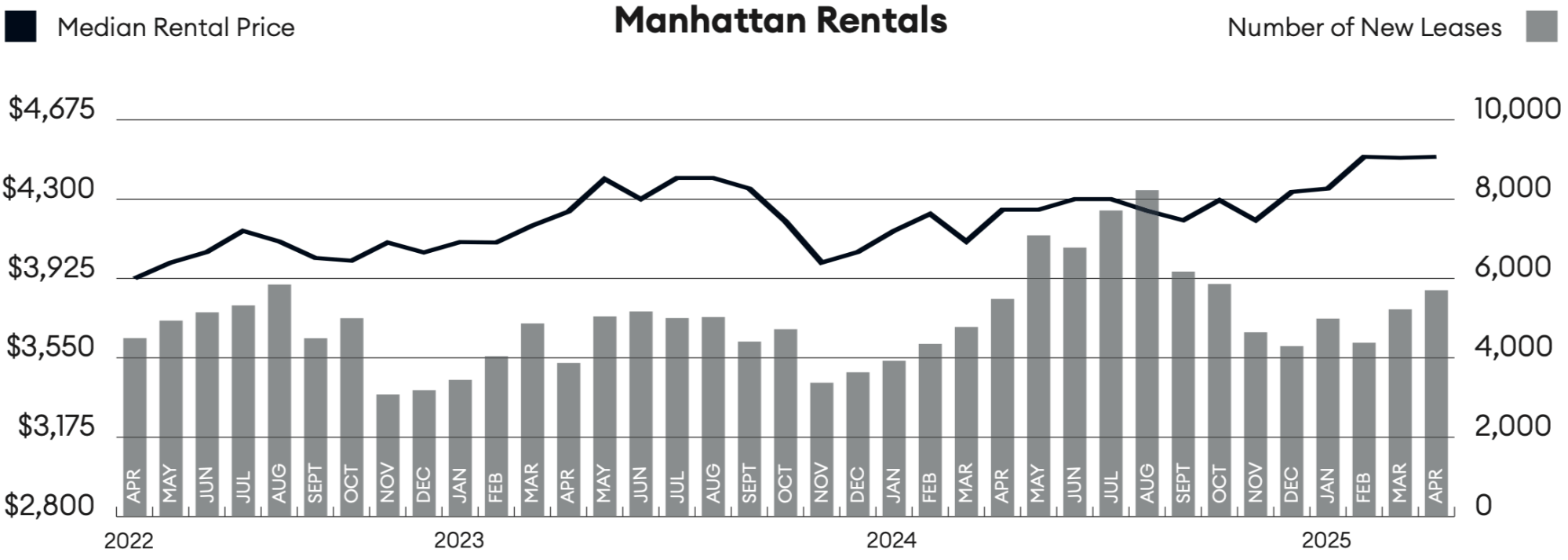

Now, let’s shift to the rental market, which continues to operate at full strength. In April, the median rent hit $4,500—the second record high in just three months. Rents are now up nearly 6% year-over-year, and competition remains fierce across the city. In many neighborhoods, listings are snapped up within days, often with multiple applications, giving landlords real pricing power in a high-demand, low-supply environment. With limited new construction and steady job growth, this dynamic shows no signs of slowing as we head deeper into summer.

So, what does all of this mean for you?

- If you’re a buyer, you’re entering a market that rewards preparation. Well-priced homes in desirable locations are moving quickly, and long-term value is there for those who act decisively.

- If you’re a seller, the market is working in your favor—but only if your pricing and presentation are aligned with buyer expectations. Overpriced or under-prepared listings aren’t moving like they used to.

- If you’re a renter, speed and readiness matter. Prepare your documents, know what you’re looking for, and be prepared to act fast.

- If you’re a landlord, this is your moment. Demand is high, turnover is fast, and pricing power is on your side.

Bottom line:

Manhattan is no longer a wait-and-see market—it’s a participate-with-purpose market. With pricing power returning, buyer and seller behavior normalizing, and fundamentals guiding decision-making, this is a moment defined not by speculation but by strategy.

The Manhattan market has regained its footing. It’s strategic. It’s stable. And it’s moving forward.

The Elegran Manhattan Leverage Index is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current market is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

It’s not just the numbers that matter—it’s the direction of the trend. In today’s neutral market, success depends less on perfect timing and more on strategic execution. Emotion is no longer driving outcomes—fundamentals are. Expertise is being rewarded. Preparation is outperforming impulse. And those who lead with data, discipline, and long-term perspective are the ones gaining the edge.

Data & charts courtesy of UrbanDigs

Manhattan’s real estate market is entering a sweet spot. With just over 7,400 homes on the market, there’s enough inventory to give buyers real options, without tipping into oversupply that could drag down prices.

Compared to last year, listings are up 3.8%, a sign that sellers feel confident putting their homes on the market. And because inventory dipped slightly from last month (down 0.4%), it’s clear that quality homes are selling, not sitting on the market.

What This Means for You:

BUYERS: This is a prime moment to explore your options. Many listings that have been on the market for 45+ days could present negotiation opportunities, as sellers aim to secure deals before summer slows things down. If you’ve been waiting for the right time to make a move, this could be it.

SELLERS: Today’s market rewards preparation. With thousands of active listings, standing out is essential. The homes that are getting traction are priced thoughtfully, marketed well, and bring something unique to the table. Simply listing and hoping for momentum is no longer enough—strategy is everything.

Looking Ahead:

Data courtesy of UrbanDigs

In Manhattan, the reason people are buying homes is changing—and it’s making the market healthier. In May, 1,036 buyers signed contracts. That’s not just a solid number—it reflects a smarter, more intentional approach to real estate.

Yes, that’s a slight dip from April (down 4.7%), but it’s exactly what we expect this time of year after two busy months. Even better? It’s a 3.4% increase from the same time last year—proof that demand is still strong, just more thoughtful.

What This Means for You:

BUYERS: Today’s buyers aren’t rushing to chase the market. They’re making moves based on life changes—like growing families, job shifts, or long-term plans—not just interest rates. If you’re one of them, you’re in good company. This measured pace creates a more stable market and rewards those buyers who are well-prepared.

SELLERS: The market is rewarding homes that are priced right, staged well, and clearly stand out. We’re seeing top-tier properties attract strong offers quickly, while more average listings take longer to find the right buyer. Sellers who know their home’s strengths and market them effectively are coming out ahead.

Looking Ahead:

While summer is usually a slower season, this year may be different. With serious buyers still active and ready to act, we could see the market stay steady through the warmer months. If you’re thinking about listing, you may not need to wait until fall to make your move.

Data & chart courtesy of UrbanDigs

Manhattan Median Price Per Square Foot: Breaking Through the Ceiling

Manhattan just hit a major milestone: the median price per square foot reached $1,449—a level we haven’t seen in a few years. This isn’t just a number on a chart. It signals a shift in buyer mindset: people aren’t just accepting current prices—they’re willing to pay more, but only for homes that check all the right boxes.

With steady growth of 1.9% both month-over-month and year-over-year, this rise feels different from the rollercoaster swings of recent years. It’s a sign of real, sustained confidence in the market that’s starting to build.

What This Means for You:

BUYERS: The price increases we’re seeing aren’t driven by hype—they’re backed by real demand. Even with higher mortgage rates, buyers are stepping up for the right homes, especially in prime locations where options are limited. If you’re waiting for a price drop, you may be waiting a while. The smarter play? Focus on finding a great property at today’s fair market value.

SELLERS: Today’s buyers are savvy and selective. Homes with strong locations, standout design, or unique features command top dollar. But listings that feel generic or overpriced are sitting longer. If your property offers something special, now is a great time to capitalize. Just remember: strategy and presentation matter more than ever.

Looking Ahead:

This steady upward trend suggests that the market has turned a corner. For buyers, it’s less about trying to time the dip and more about making a smart, well-informed move. For sellers, it’s an opportunity to succeed in a market where appreciation is back—but only for homes that earn it.

Data courtesy of UrbanDigs

In today’s Manhattan real estate market, the gap between asking price and final sale price is getting smaller. The average listing discount—how much sellers typically come down from their original price—is now 4.6%, a slight dip from last month. That means sellers are sticking closer to their asking prices, and buyers have fewer opportunities for deep discounts.

Compared to a year ago, discounts have tightened by nearly 1%. Why? Because buyers and sellers are getting more in sync. Homes are being priced more accurately from the start, which makes the whole process smoother and more predictable.

What This Means for You:

BUYERS: There’s still room to negotiate, but the best deals go to buyers who are thoughtful and strategic. Instead of expecting a broad discount, look for properties with signs of flexibility: homes that have been sitting for a while, need some work, or have motivated sellers. That’s where you’re more likely to score savings.

SELLERS: The message is clear: Pricing your home right from day one pays off. Properties that are aligned with market value tend to sell within a narrow discount range. But if you start too high, you may face a longer time on the market and be forced to negotiate more later.

Looking Ahead:

This trend toward tighter pricing shows that Manhattan’s market is becoming more efficient—and that’s a good thing. It means fewer surprises, smoother negotiations, and a more transparent process for everyone involved.

Chart courtesy of Miller Samuel, Inc.

Rental Market: Still Red-Hot Heading Into Summer

Manhattan’s rental market isn’t cooling down anytime soon. In April, the median rent hit $4,500—the second record high in just three months. While the month-over-month change was small (+0.1%), rents are up nearly 6% compared to last year, showing just how strong the demand has been throughout 2025.³

What This Means for You:

RENTERS: This is a fast-moving market. The best listings—especially those in prime locations or with standout amenities—are going fast, often with multiple applications in just days. To compete, renters need to act quickly and come prepared: have your paperwork ready, know what you’re looking for, and be ready to commit when you find the right place.

LANDLORDS: Landlords hold the advantage right now. With demand far outpacing supply, nearly any well-maintained rental is finding a tenant—and quickly. The current market gives landlords significant pricing power, allowing for premium rents with minimal concessions. While presentation still matters, strong fundamentals and scarcity are doing most of the heavy lifting.

Looking Ahead:

With the summer leasing season approaching, rental demand is expected to stay high. With quick inventory turnover and steady job growth, we’ll likely see continued pressure on prices and competition for quality apartments well into the second half of 2025.

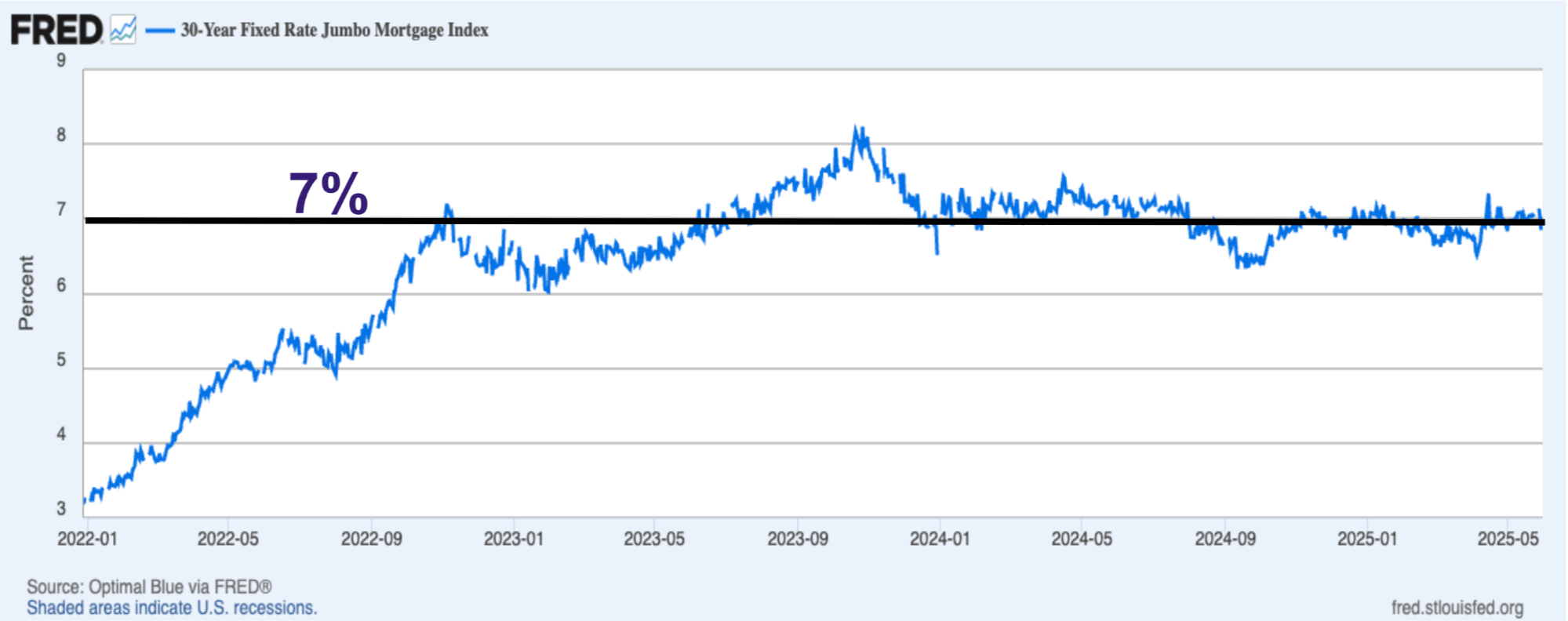

Courtesy of Federal Reserve Bank of St. Louis

Jumbo mortgage rates are holding steady, with the 30-year fixed now around 7%⁴, and the average APR landing at 6.7%⁵. While these numbers may feel high compared to a few years ago, the reality is: this is the new normal.

Experts don’t expect rates to drop meaningfully anytime soon, and most forecasts see them hovering in this range through 2026. But here’s the good news: buyers and sellers are adjusting. Instead of waiting for the perfect rate, people are making moves based on their own goals, timelines, and life events.

In other words, the market is moving forward—and so can you.

For real estate investors, returns come from two places: rental income and property value growth. Right now, all-cash buyers in Manhattan are seeing cap rates between 3% and 3.4%, which can offer steady income in a stable market.

However, for investors relying heavily on financing, today’s 6.7% average jumbo mortgage rate makes it tough to turn a profit on rent alone. That said, timing matters—and for international investors, a strong U.S. dollar could translate to major gains when it’s time to sell, depending on exchange rates.

Bottom line: the investment case in Manhattan remains strong, especially for those playing the long game or coming in with strategic currency advantages.

Chart courtesy of UrbanDigs and indicates Manhattan median PPSF as a function of the closed sale date. The light grey area to the extreme right indicates incomplete data, and the orange line indicates the most recent median PPSF based on data considered complete.

1. Data courtesy of UrbanDigs

2. According to the Elegran Manhattan Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.