Elegran Manhattan Market Update: November 2024

Elegran | Forbes Global Properties October 27, 2024

Elegran | Forbes Global Properties October 27, 2024

In October 2024, Manhattan’s real estate market showed signs of resurgence. The month marked a significant turning point, with contract activity soaring nearly 46% from September, as 999 contracts were signed. This represented a substantial 26% year-over-year increase compared to October 2023 and was the first month since May 2023 that contract activity surpassed the seasonal average and did so by nearly 11%. This growth underscored the strong demand for residential apartments in Manhattan and points to a healthy market outlook.

Adding to the appeal, Manhattan presents a compelling entry point for buyers. Since the start of the pandemic, the market has seen only a modest 3% price appreciation. In contrast, the national average was a 51% increase during the same period. Manhattan tends to move countercyclically to the national market, which, in conjunction with current data, suggests that prices are poised for upward pressure.

According to a recent UBS report, other markets, such as Miami—which experienced a staggering 83% appreciation since the start of the pandemic—are now in bubble-risk territory and are starting to see some downward pressure on prices. This positions Manhattan as a more stable and potentially lucrative option for buyers looking to invest in real estate.

The Elegran | Forbes Global Properties Manhattan Leverage Index indicates the market is in relative equilibrium, with a slight advantage for sellers in October. Inventory levels increased slightly during the month, reaching 6,846 units—a modest 0.1% increase from September but a 6.6% decrease compared to last year. This has put buyers in a more competitive environment, with demand far outpacing supply. Buyers are facing lower inventory levels than the previous year and increased competition that has reduced negotiability and triggered bidding wars for well-positioned properties. Conversely, sellers benefit from the heightened demand but must remain strategic with pricing and marketing to attract buyers quickly.

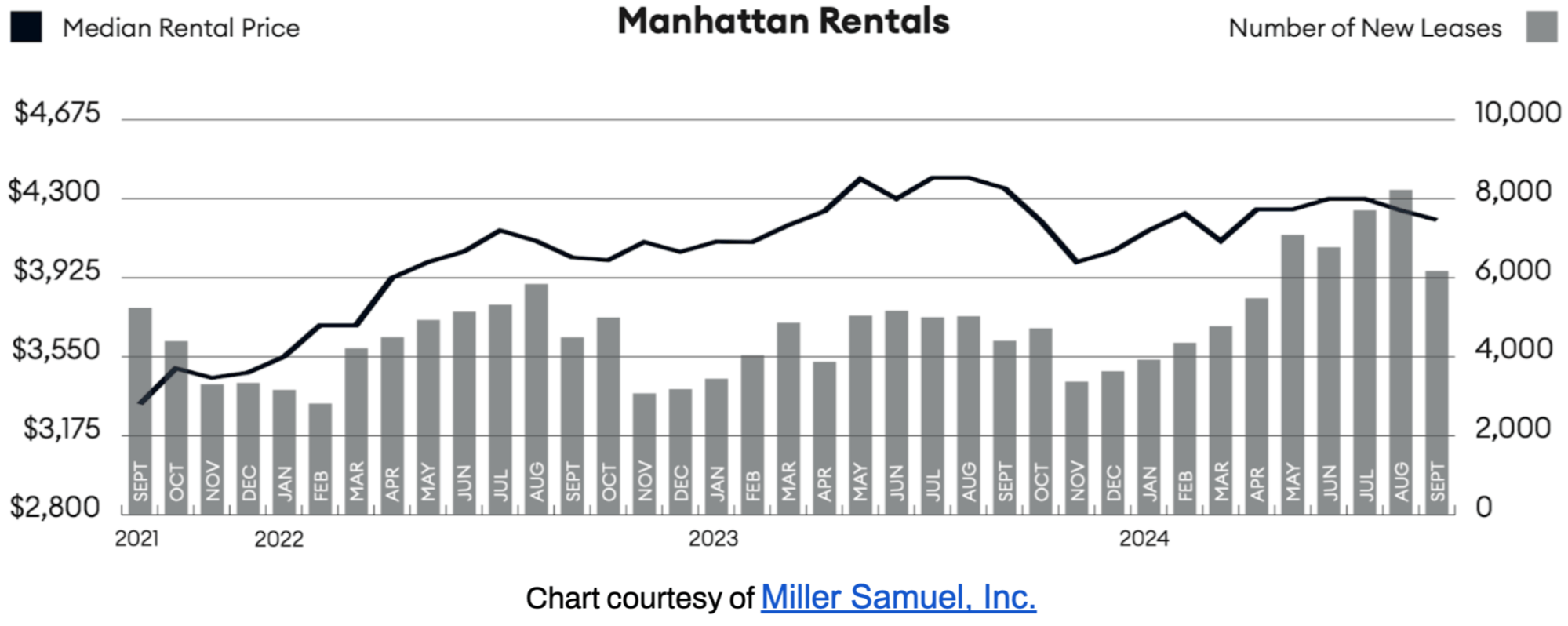

The rental market also experienced shifts, with the median rent declining by 1.1% to $4,200 and a 3.4% year-over-year drop, marking the second consecutive month of reductions. The rent-versus-buy equation began to tilt in favor of purchasing, prompting more renters to transition into buyers. This shift is expected to intensify competition in the sales market while easing pressure on rentals.

The Elegran | Forbes Global Properties Manhattan Leverage Index² is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

It’s not the exact numbers that matter most—it’s the direction and slope of the trend. Buyers and sellers have been in a stalemate within a balanced market for over eighteen months. This summer saw a minor shift favoring sellers, but buyers regained a slight advantage by September. In October, the pendulum has swung back again, leaning subtly toward sellers.

As is typical for this time of year, Manhattan’s housing inventory increased slightly in October, reaching 6,846 units. This marks a slight 0.1% rise from September but reflects a 6.6% drop compared to last year. The increase in new listings coincides with the recent Fed rate cut, sparking renewed buyer interest. Although inventory remains tighter year-over-year, this balanced market dynamic will likely continue in the near term.

- BUYERS: Growing buyer demand has swiftly absorbed the seasonal inventory increase. This fall, inventory levels are lower than they were last year. With limited supply and more competition among buyers, the market feels more intense, leading to reduced negotiability and more frequent bidding wars for well-priced, well-positioned properties. However, incorrectly priced or poorly positioned properties may linger on the market and could present more room for negotiation.

- SELLERS: Despite the competitive market, the rise in inventory means sellers should be strategic with pricing and marketing to attract buyers efficiently. With more options available, buyers may feel emboldened to submit lower offers, especially for properties that have been listed for an extended period.

Overall, Manhattan’s housing market still leans in favor of sellers. Buyer demand is expected to build through the winter and into next spring, offering sellers the chance to plan their market timing. Supply will likely remain tight over the holidays, as fewer sellers typically list their homes, with a gradual increase as spring approaches.

October 2024 saw a notable surge in Manhattan’s residential real estate market, with contract activity skyrocketing nearly 46% from September as 999 contracts were signed, which marks an impressive 26% year-over-year increase compared to October 2023. For the first time since May 2023, monthly contract activity exceeded the seasonal average, a sign that the local market is rebounding from the extended low-volume period of the past year and a half. Over the past three months, this upward trend has gained momentum, fueled by the Fed’s rate cut and a collective buyer sentiment shift, recognizing that interest rates have likely peaked for this cycle. Contract volume this month surpassed the seasonal average by almost 11%, underscoring robust demand and a positive market outlook.

- BUYERS: The surge in contracts highlights growing buyer interest, suggesting more competition and the potential for bidding wars and price increases. Buyers need to be decisive and prepared to act quickly to secure desirable properties.

- SELLERS: The uptick in contract activity is welcome news for sellers, signaling strong demand and increasing liquidity in the market. With competition for limited inventory, sellers may see multiple offers and higher prices for their properties.

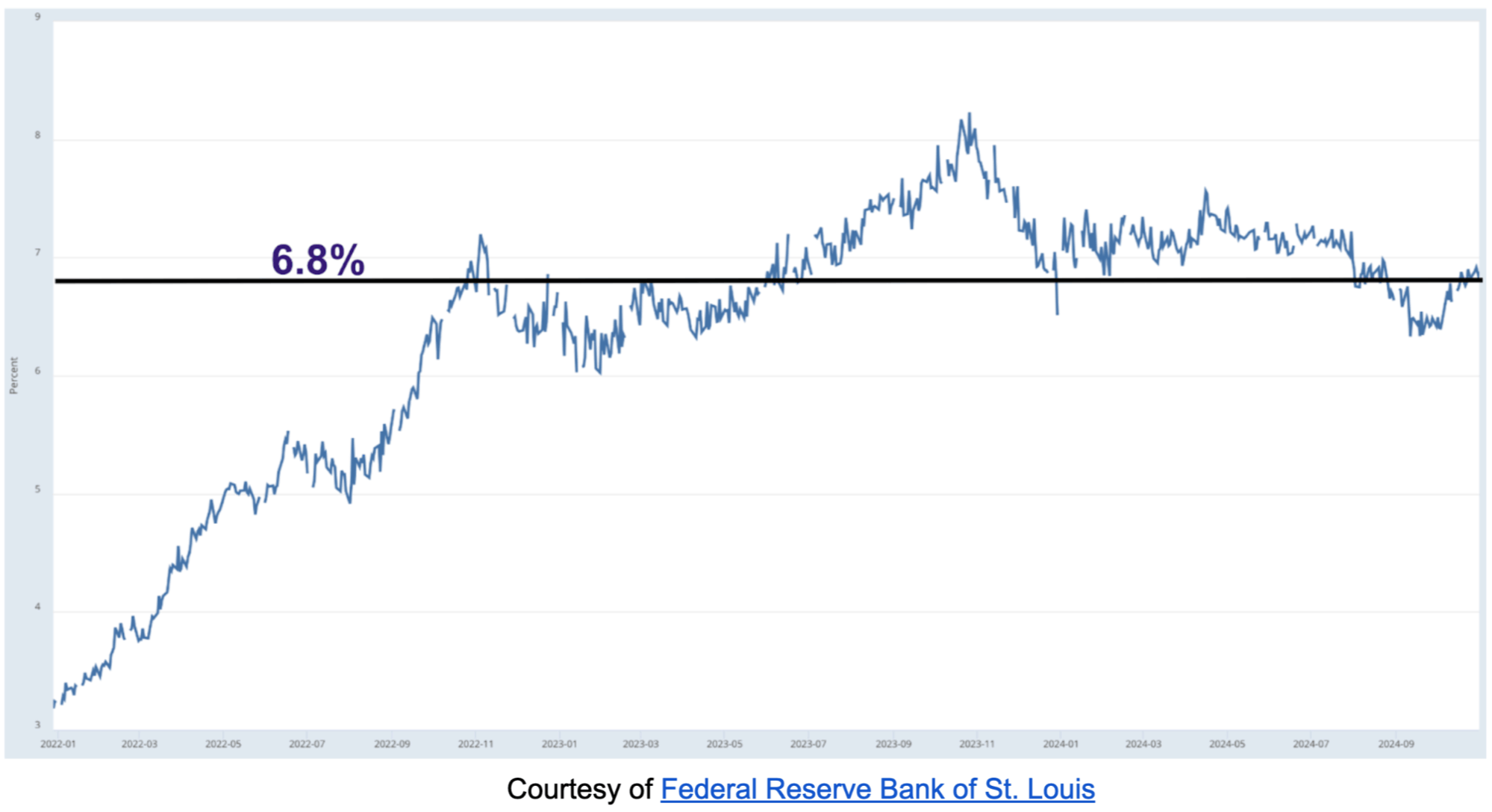

Overall, the sharp rise in contracts reflects a strong Manhattan real estate market, currently tilting in favor of sellers. Buyers should brace for a competitive landscape and be ready to move swiftly. However, it remains to be seen if contract volumes will continue to beat seasonal averages through November and December, especially given the 80-basis-point increase in average mortgage rates since mid-September and the uncertainty surrounding the election. Once election-related concerns subside and interest rates resume their gradual decline, buyer activity is expected to pick up even more substantially.

In October 2024, the median price per square foot (PPSF) for residential apartments in Manhattan dipped slightly to $1,398, marking a 0.6% decrease from the previous month. While this figure is 2.6% higher year-over-year, Manhattan is poised to break out above the current price ceiling. On average, prices in Manhattan are only 3% higher than at the start of 2017—compared to a staggering 74% increase in the national average over the same timeframe.

- BUYERS: The slight decrease in median PPSF is largely a lagging indicator based on contracts signed during the summer before the Fed’s interest rate cut. Current demand for Manhattan real estate suggests that prices are under upward pressure. Manhattan presents a rare opportunity to purchase assets that have remained virtually unchanged in value since 2017. No other metro area in the country has seen so little appreciation. Additionally, Manhattan tends to move countercyclically compared to national trends and is not at bubble risk, creating a compelling entry point for buyers.

- SELLERS: The recent price decline is primarily due to contracts signed earlier this year, and the coming months should begin to reflect upward movement. While strong demand is expected to support property values, accurate pricing is crucial to attract buyers in a competitive market. Buyers are savvy, and overpricing may deter potential interest.

Overall, the Manhattan residential market remains strong, and both buyers and sellers should carefully consider the current market conditions to make informed decisions. With buyer demand intensifying and prices poised for growth, now is an opportune time for strategic action on both sides of the market.

In October 2024, the median listing discount for Manhattan homes rose to 4.5%, up from 4.3% in September. This modest increase is primarily attributed to seasonal factors. It reflects contracts signed during the summer months, which typically involve a higher percentage of homes on the market longer and are, therefore, more negotiable. However, on a year-over-year basis, the change was negligible—a mere 0.5% decline—pointing to a firming of the price floor and setting the stage for price increases in the mid-term.

- BUYERS: May find opportunities to secure better deals, especially on homes that have been on the market for extended periods.

- SELLERS: To avoid deeper discounts, sellers should aim to properly position their homes for sale in terms of price and appearance. Well-staged homes can attract buyers and potentially command higher offers.

Overall, while the slight increase in the median listing discount may offer some advantages for buyers, sellers should still be able to achieve favorable outcomes with proper market knowledge and strategic pricing. Discounts are expected to decline moving through the winter and into the spring as competition further intensifies.

In September, the median rent declined by 1.1% to $4,200 compared to the previous month and fell 3.4% year-over-year, marking the second consecutive month of reductions. Nearly one-fifth of all rentals experienced bidding wars.³ With interest rates declining, the rent-versus-buy equation is beginning to tilt in favor of buying. As a result, more renters may transition into buyers, increasing demand in the sales market while easing pressure on the rental market. The rental market has peaked, and that peak is not expected to be surpassed next year. Rather, renters may experience some relief next spring and summer as long-time renters, previously deterred by high interest rates, leave the rental market to purchase homes. This shift from renting to buying can intensify competition in the sales market while reducing competition in what has been a red-hot rental market for the last two years.

Regarding mortgage rates, the 30-Year Fixed Rate JUMBO Mortgage Index is trending at 6.8%⁴, and the average JUMBO APR is 6.7%⁵. While this rate trended lower in late August and into mid-September, it has increased by 80 basis points since hitting a low in mid-September. As uncertainty subsides, rates should resume their gradual decline near the end of 2024, hopefully providing relief for buyers into the spring.

The total return is driven by net rental income and capital appreciation. For all-cash investors, Manhattan cap rates are currently 3 - 3.4%. Unfortunately, there is no net income potential for those investors using a large percentage of leverage, with the average JUMBO mortgage APR at 6.7%. Current demand for Manhattan real estate suggests that prices are under upward pressure. Importantly, though, Manhattan presents a rare opportunity to purchase assets that have remained virtually unchanged in value since 2017 (as indicated in the chart below).

No other metro area in the country has seen so little appreciation. Additionally, Manhattan tends to move countercyclically compared to national trends and is not at bubble risk, creating a compelling entry point for buyers. Timing and a strong USD may afford foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

1. Data courtesy of UrbanDigs

2. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.