Elegran Manhattan Market Update: October 2024

Elegran | Forbes Global Properties October 3, 2024

Elegran | Forbes Global Properties October 3, 2024

In September, the Federal Reserve cut interest rates by 50 basis points—the first reduction in four years and the largest since 2008. While mortgage rates had been declining in anticipation of the cut, they experienced a brief uptick in the week following the announcement. However, the psychological impact on buyers is profound; with the understanding that rates have peaked and expectations of further declines, buyers are stepping off the sidelines. Despite a seasonal rise in inventory and a month-over-month dip in contract activity, year-over-year demand is higher, and supply is lower, setting the stage for a more competitive market this fall. While the Elegran | Forbes Global Properties Manhattan Leverage Index indicated a market in equilibrium, it pointed to a slight advantage for buyers.

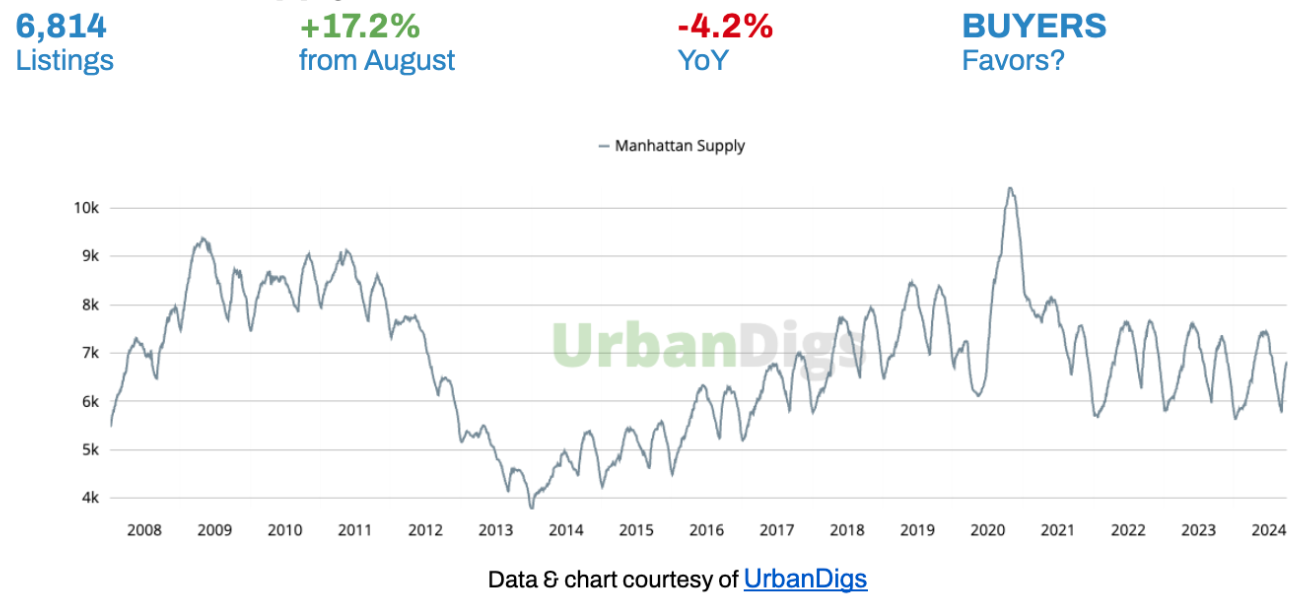

Manhattan’s housing inventory saw its usual seasonal rebound in September, with 6,814 units available—a 17.2% increase from August but, importantly, 4.2% lower year-over-year. This new supply aligns with increased buyer interest driven by lower mortgage rates, but inventory remains relatively tight compared to last year, helping to maintain market equilibrium. Buyers will find more options but should brace for increased competition, especially for well-priced properties. Sellers, meanwhile, must be strategic with pricing to capitalize on rising buyer activity and avoid extended market time.

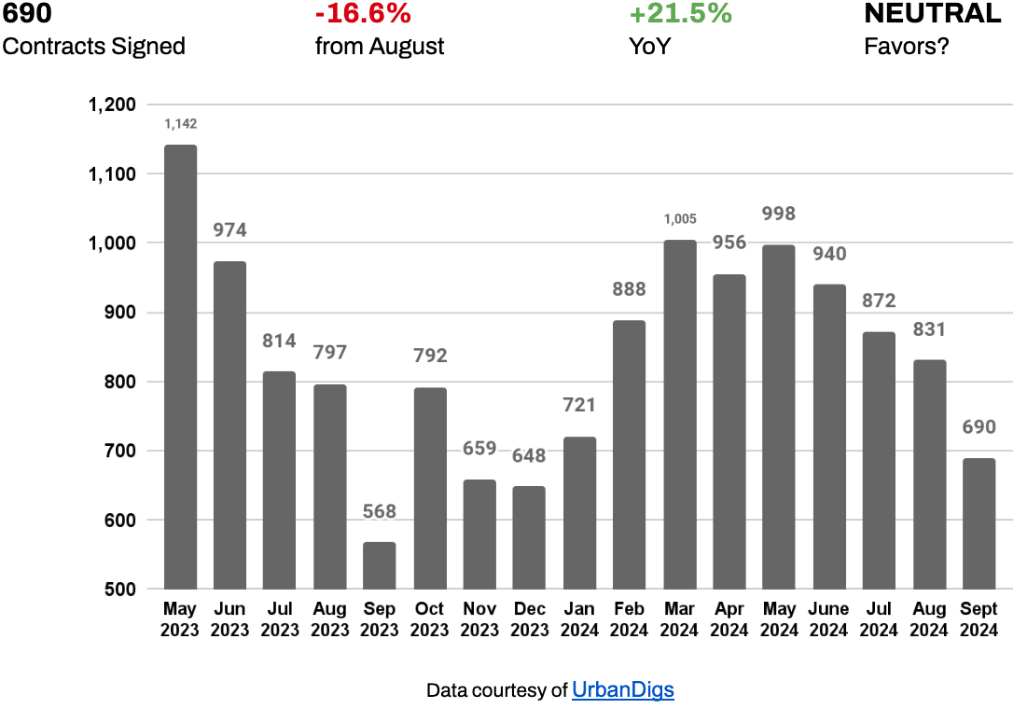

September also saw a typical seasonal dip in signed contracts, with 690 finalized—a 16.6% decrease from August. However, this figure marks a notable 21.5% year-over-year increase, signaling robust demand compared to 2023. As interest rates continue to fall, buyers should anticipate heightened competition, while sellers benefit from a fairly liquid market, provided they price their homes accurately.

With interest rates declining, the rent vs. buy equation is beginning to tilt in favor of buying. This dynamic may prompt more renters to transition into homebuyers, increasing demand in the sales market while alleviating pressure on the rental market, which has likely reached peak pricing as rents begin to soften.

– “Neutral” markets don’t exist because buyers and sellers are constantly playing tug-of-war for leverage

– Over the last 19 months, there has been no clear winner as buyers & sellers reach equilibrium. September demonstrated a market that favored buyers slightly²:

-Demand (measured by contracts signed) decreased by 16.6% MoM in the buyer's favor, and increased 21.5% YoY in the seller’s favor.

- Supply increased by 17.2% MoM in the seller’s favor.

- Median days on the market increased by 12.3% MoM to 82 days in the buyer's favor.

- Median PPSF (Price Per Square Foot) increased by +3.1% MoM in the buyer's favor.

– In August, the median rent decreased by 1.3% to $4,245 compared to the previous month, and by -3.5% compared to the same period last year. ³

– New lease signings for existing apartments rose annually at three times the rate of new development.

The Elegran | Forbes Global Properties Manhattan Leverage Index is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

- An increasing trend from left to right indicates a seller’s market

- A decreasing trend from left to right indicates a buyer’s market

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

- A gentle slope indicates a weak advantage by one party over the other

- A sharp slope indicates a strong advantage

It’s not the exact numbers that matter most—it’s the direction and slope of the trend. For the past year and a half, buyers and sellers have been in a stalemate in a relatively balanced market. This summer saw a slight shift in favor of sellers, but by September, buyers gained a modest advantage. However, this edge will likely be temporary as the Fed’s recent interest rate cuts and decline in mortgage rates have started drawing buyers off the sidelines.

As is typical for the season, Manhattan’s housing inventory rebounded in September, rising to 6,814 units. This marks a 17.2% increase from August, but a 4.2% decline compared to last year. The influx of new listings is timely, as the recent Fed rate cut and recent decline in mortgage rates have spurred increased buyer activity. However, inventory remains somewhat constrained year-over-year, helping to maintain market equilibrium.

What this means for:

- BUYERS: More options are available, but with the rise in buyer activity, competition is likely to intensify. As demand is up, it’s crucial to act quickly on well-priced properties.

- SELLERS: While competition is growing as more listings hit the market, the lower overall supply and increased buyer interest balance work in the seller’s favor. Accurate pricing remains key to avoiding prolonged time on the market or potential price reductions.

The peak of new inventory for the fall season occurred in September. While additional listings will continue to come on the market in October, much of the seasonal inventory has already come online. As a result, buyers will face fewer choices in the coming weeks. The best-positioned, most attractive properties listed in September have likely already found buyers, while others may linger. Buyers should be prepared for heightened competition and shouldn’t expect another significant influx of inventory until the spring.

While September is typically a busy month for new listings and buyer activity, it tends to be slower for signed contracts. In September 2024, Manhattan saw a 16.6% decline in signed residential contracts compared to the previous month, with 690 contracts finalized. However, this represents a significant 21.5% increase year-over-year from September 2023, reflecting a strong upward trend despite the month-over-month dip.

What this means for:

- BUYERS: Although contract activity dipped month-over-month, the decline was smaller than last year’s, and recent interest rate cuts are already pulling more buyers into the market. Expect increased competition as rates drop further and buyer demand picks up.

- SELLERS: The year-over-year increase in contract activity signals a healthy, relatively liquid market, which is a positive sign for sellers. Accurate pricing remains critical to take advantage of this momentum.

The recent interest rate reductions are just beginning to influence the local market. Early indicators show rising buyer interest, which is expected to boost contract activity in the coming months.

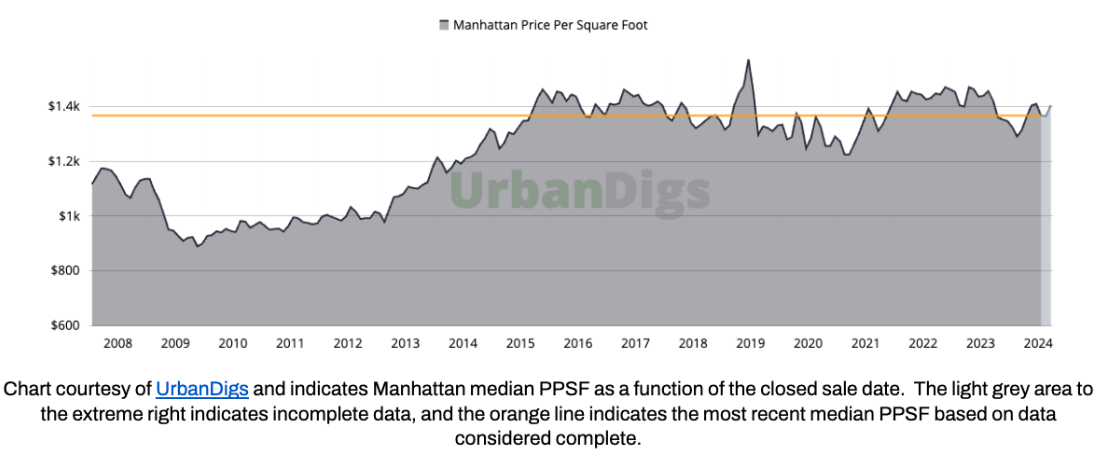

In September 2024, the median price per square foot (PPSF) for residential apartments in Manhattan rose to $1,409, reflecting a 3.1% increase from the previous month. Though this figure is down 1% year-over-year, the recent decline in mortgage interest rates is likely to drive increased demand and exert upward pressure on prices in the coming year.

What this means for:

- BUYERS: As the median PPSF increases, buyers can expect to pay more per square foot for their desired apartment.

- SELLERS: An increase in median PPSF means sellers can potentially command higher prices for their properties.

Overall, the upward trend in PPSF signals a strong market with growing demand for residential real estate in Manhattan. After nearly eight years of little to no significant price appreciation, Manhattan appears poised for a breakout as declining interest rates continue to draw more buyers into the market.

In September 2024, the median listing discount for Manhattan homes increased to 4.4%, compared to 4% in August. This slight increase is primarily due to seasonal factors, as a larger proportion of homes sold had been on the market longer, leading to deeper discounts. However, the year-over-year change was minimal, with just a 0.1% decline.

What this means for:

- BUYERS: A higher listing discount suggests that sellers may be more open to price negotiations, giving buyers a better chance to secure a deal below the original asking price.

- SELLERS: A higher listing discount can make selling a property at a premium price more challenging.

The slight increase in the median listing discount reflects past market conditions and a seasonal anomaly. With interest rates declining and buyer activity rising, this discount trend is expected to continue its downward trend through the fall.

In August, the median rent decreased by 1.3% to $4,245 compared to the previous month and dropped 3.5% year-over-year, signaling that rental rates may have peaked. New lease signings for existing apartments increased at three times the rate of new developments, as existing apartments typically offer more affordable rental rates. With interest rates declining, the rent vs. buy equation is beginning to tilt in favor of buying. As a result, more renters may transition into buyers, increasing demand in the sales market while easing pressure on the rental market.

Concerning mortgage rates, the 30-Year Fixed Rate JUMBO Mortgage Index is trending lower at 6.49%⁴, and the average JUMBO APR is 6.05%⁵.

The total return is driven by net rental income and capital appreciation. For all-cash investors, Manhattan cap rates are currently 2.7 - 3.2%. Unfortunately, there is no net income potential for those investors using a large percentage of leverage, with the average JUMBO mortgage APR at 6.2%. Timing and a strong USD may afford foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

1. Data courtesy of UrbanDigs

2. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.