Elegran Manhattan Market Update: September 2024

Elegran | Forbes Global Properties September 10, 2024

Elegran | Forbes Global Properties September 10, 2024

Contract Activity: In August 2024, Manhattan witnessed the fourth-highest number of signed contracts in an August in the past ten years, showcasing the market's enduring strength and appeal. The dip in interest rates has prompted some buyers to act ahead of the traditionally busier fall season, underscoring the market’s resilience.

Interest Rates: Beginning the month at their lowest point in a year, interest rates are expected to decline further as the Federal Reserve is widely expected to cut rates in September. This downward trend draws buyers off the sidelines and can begin to shift the rent-versus-buy equation in favor of buying, adding further momentum to the market.

Supply Trends: Supply decreased by 10% compared to July, which aligns with seasonal expectations, yet it remains 5% below last year’s levels. This reduced inventory, and a 4% year-over-year increase in demand are heightening competition. However, the competitive landscape is not universal: prime properties move quickly with minimal price negotiations, while less desirable listings may see extended market time and require price adjustments to attract interest.

Market Dynamics: The Elegran | Forbes Global Properties Manhattan Leverage Index remained nearly balanced between buyers and sellers in August, reflecting a stable market environment. However, with decreasing supply and interest rates, the balance could gradually tilt in favor of sellers, especially in sought-after neighborhoods, during the fall.

– “Neutral” markets don’t exist because buyers and sellers are constantly playing tug-of-war for leverage

– Over the last 18 months, there has been no clear winner as buyers & sellers reach equilibrium. August showed to be a completely balanced market between buyers and sellers.²

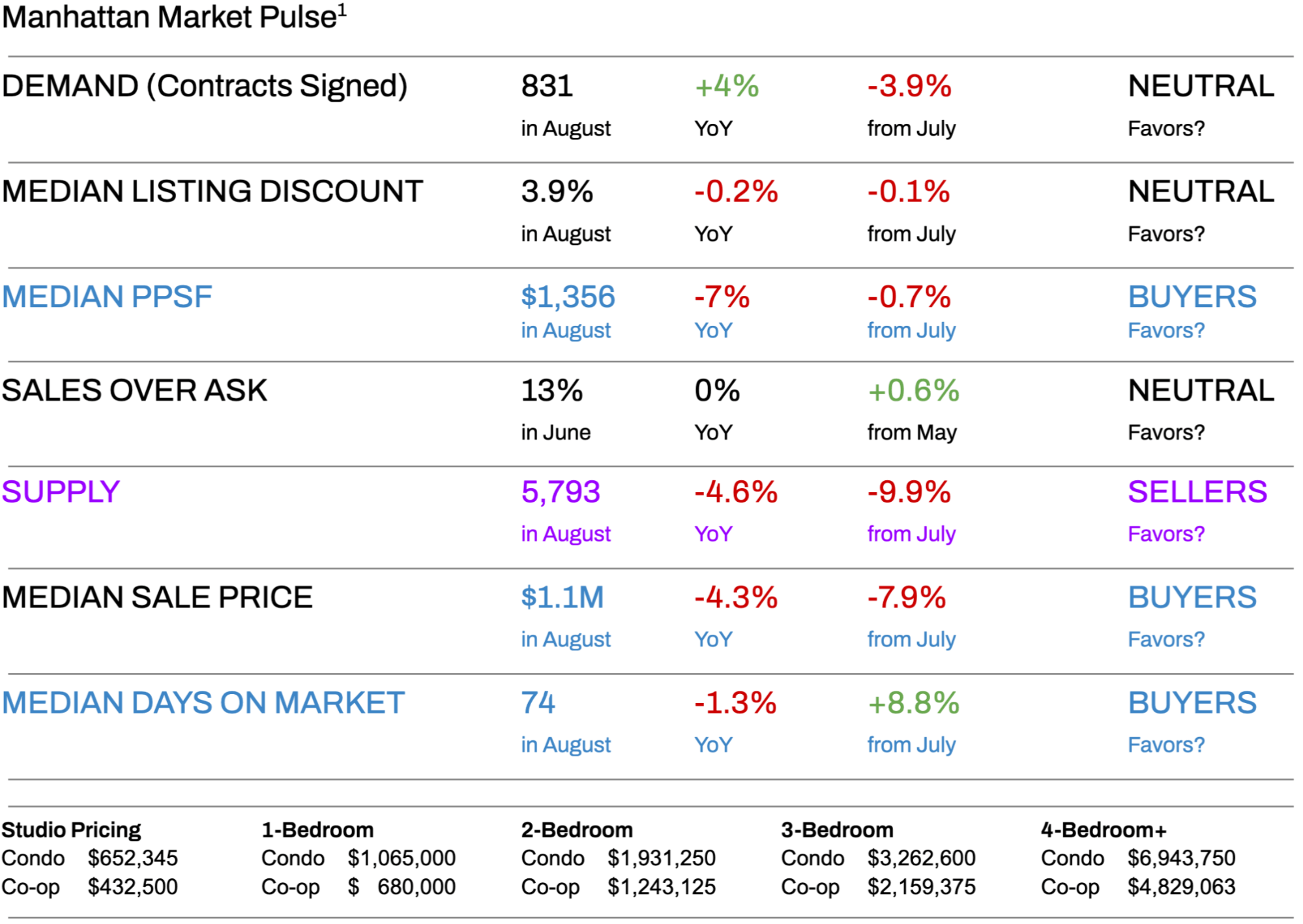

- Demand (measured by contracts signed) decreased by 3.9% MoM in the buyer's favor, and increased 4% YoY in the seller’s favor.

- Supply decreased by 10% MoM in the seller’s favor.

- Median days on market increased by 9% MoM to 74 days in the buyer's favor.

- Median PPSF (Price Per Square Foot) decreased by 0.7% MoM in the buyer's favor.

– In July, the median rent remained unchanged at $4,300 from the prior month but declined by 2.3% compared to last year.³

– New lease signings rose to its highest level on record for July as listing inventory rose to its third-highest for July.

The Elegran | Forbes Global Properties Manhattan Leverage Index is powered by four indicators: supply, demand, median price per square foot (PPSF), and median listing discount.

It informs us whether the current is a buyer’s or a seller’s market, i.e., which party possesses transactional leverage. Looking at the graph below, this is indicated by the direction of the curve, where:

Our indicator also informs us regarding the relative strength of that leverage, indicated by the slope of the curve, where:

It’s not the exact numbers that matter most—it’s the direction and slope of the trend. Buyers and sellers have been locked in a stalemate within a relatively balanced market for over a year. Earlier this summer, there was a slight shift in leverage toward sellers, but by August, the market returned to equilibrium, as reflected in the flatness of the trend line over the past month.

The supply of homes for sale in Manhattan continued to tighten in August 2024, with total inventory dropping to 5,793 units. This represents a 10% decrease from July and a 4.6% decline year-over-year. While there was a slight decrease in signed contracts in August compared to July, the more significant drop in supply has kept certain market segments feeling competitive, as supply has diminished more sharply than demand.

What this means for:

- BUYERS: The window of opportunity for buyers narrowed sooner than anticipated as supply decreased more than expected over the summer months, which kept the market relatively competitive. However, an increase in inventory is expected in September, as a wave of new listings typically hits the market post-Labor Day. Buyers should stay alert for new opportunities but be prepared to act quickly if they find a property that fits their needs.

- SELLERS: The reduction in inventory has been advantageous for sellers, but the landscape is about to shift with new competition arriving as post-Labor Day inventory enters the market. Sellers should closely monitor comparable properties and adjust their pricing strategically, avoiding overly ambitious pricing if they aim to sell quickly and close to their asking price.

As new inventory enters the market in early September and buyers return to the city from their summer breaks, the fall offers a compressed period of high activity, typically lasting only a few months and tapering off after Thanksgiving. The ideal pricing strategy should capitalize on the first 30 days a listing is on the market. Prices should be adjusted accordingly if offers aren’t received within that timeframe. Buyers waiting for fresh inventory should use September to explore new options but not hesitate to make an offer on a property they find appealing.

In August 2024, Manhattan recorded 831 signed contracts for residential real estate, representing a 3.9% decline from July 2024 but a 4% increase compared to August 2023. The market showed resilience despite interest rates and ongoing economic, political, and geopolitical uncertainties, tempering some discretionary demand. August’s contract activity was relatively stable compared to the past decade, even slightly surpassing the figures from August 2022 and 2023, indicating sustained demand for Manhattan real estate. While August typically experiences lower contract activity than July, recent declines in mortgage interest rates have started to bring some buyers off the sidelines, with expected future rate drops likely to motivate them further.

What this means for:

- BUYERS: The summer months offered some opportunities, but the absence of desperate sellers and a shrinking inventory have narrowed the window for buyer leverage.

- SELLERS: As mortgage rates have declined, some buyers have reentered the market. Sellers should anticipate increased demand heading into the typically busier fall season, supported by further expected drops in interest rates. It’s crucial for sellers to carefully consider comparable properties and price their listings competitively to attract serious buyers.

August, typically a quieter month for contract activity in NYC, performed slightly better than the previous two Augusts and matched the historical average. Given the backdrop of economic, geopolitical, and political uncertainty and persistently high interest rates, performing at this level is a positive sign for what’s to come as these uncertainties ease and rates continue to decline.

In August 2024, the median price per square foot (PPSF) for residential apartments in Manhattan was $1,356, reflecting a 0.7% decrease from July and a 7% decline year-over-year. However, with mortgage interest rates continuing to fall, which should lead to a rise in demand, there is potential for price appreciation in the coming year.

What this means for:

- BUYERS: The recent month-over-month decrease in median PPSF and lower mortgage rates present a favorable buying opportunity. Now may be an ideal time to enter the market before priceDes rise again.

- SELLERS: Constrained supply has helped prevent further price declines. Sellers should closely monitor supply and demand dynamics this fall. Those aiming to achieve higher prices may consider waiting until spring, when market conditions are expected to be more favorable.

While ongoing uncertainty and mortgage interest rates have weighed on the market, the outlook is improving. Interest rates are expected to continue declining through the fall. As some uncertainties are resolved, the stage could be set for a stronger market in the spring, potentially leading to price appreciation in Manhattan’s residential market.

In August 2024, the median listing discount for Manhattan homes held steady at 3.9%, reflecting only a slight decrease from July. This represents a 0.1% month-over-month decline and a modest 0.2% drop year-over-year. The narrowing discount indicates growing market confidence, with sellers becoming more assured in holding firm on their asking prices while still allowing for some negotiation.

What this means for:

- BUYERS: The shrinking median listing discount suggests that sellers are increasingly confident in their pricing and may be less inclined to negotiate significantly. Buyers should be prepared to pay closer to the asking price, especially for desirable properties.

- SELLERS: The reduced discount indicates a more favorable market for sellers, as buyers appear more willing to meet asking prices.

These trends suggest that the Manhattan residential real estate market is becoming more competitive, with sellers gaining leverage in negotiations.

In July median rent remained unchanged at $4,300 from the prior month but slid 2.3% from the same period last year. New lease signings rose to their highest level on record for July as listing inventory rose to its third-highest for July. The 30-Year Fixed Rate JUMBO Mortgage Index is trending lower at 6.7%⁴, and the average JUMBO APR is 6.2%⁵. So, it’s a “catch-22” for renters, as the rent versus buy scale may feel equally punitive on both sides. Rents have likely hit their upper limits for this busy season.

The total return is driven by net rental income and capital appreciation. For all-cash investors, Manhattan cap rates are currently 2.7 - 3.2%. Unfortunately, there is no net income potential for those investors using a large percentage of leverage, with the average JUMBO mortgage APR at 6.2%. Timing and a strong USD may afford foreign investors, depending on their native currency, the opportunity to realize significant capital gains upon selling their assets.

1. Data courtesy of UrbanDigs

2. According to the Elegran | Forbes Global Properties Brooklyn Leverage Index

3. Data courtesy of Miller Samuel, Inc.

4. Data courtesy of Federal Reserve Bank of St. Louis

5. JUMBO mortgage rate APR data courtesy of Bank of America, Chase, and Wells Fargo

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.