Weekly Manhattan and Brooklyn Market Update: 10/13

Elegran October 11, 2025

Elegran October 11, 2025

Seasonal shifts are settling in, yet both Manhattan and Brooklyn show firm market footing. Manhattan inventory continues its steady climb - now seven weeks in a row - while contract activity remains resilient despite lighter new listings. Brooklyn, meanwhile, regained ground in supply and held buyer confidence, hinting at a market that’s balancing renewed demand with realistic pricing. Early October data signals a composed, steady fall season ahead - neither overheated nor cooling too sharply.

Executive Highlights:

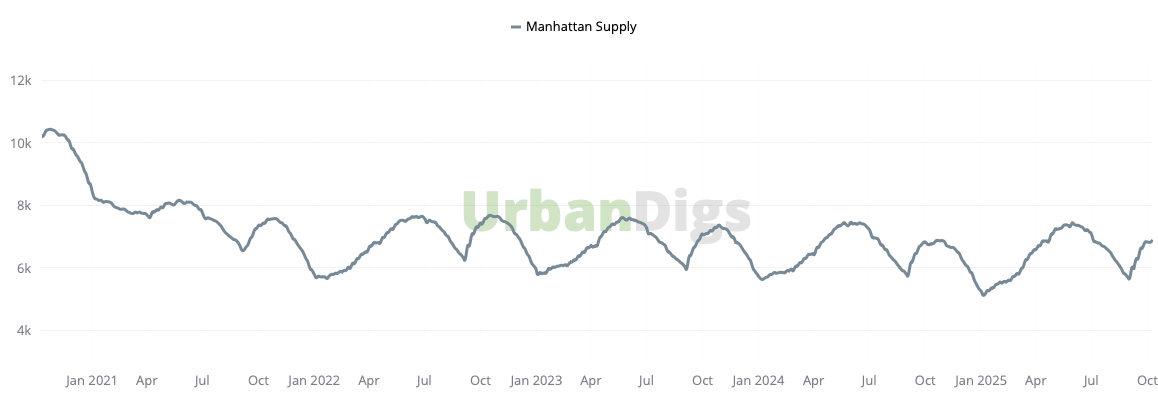

Manhattan inventory rose for the 7th straight week to 6,903 units (+1% WoW, +1.8% YoY)

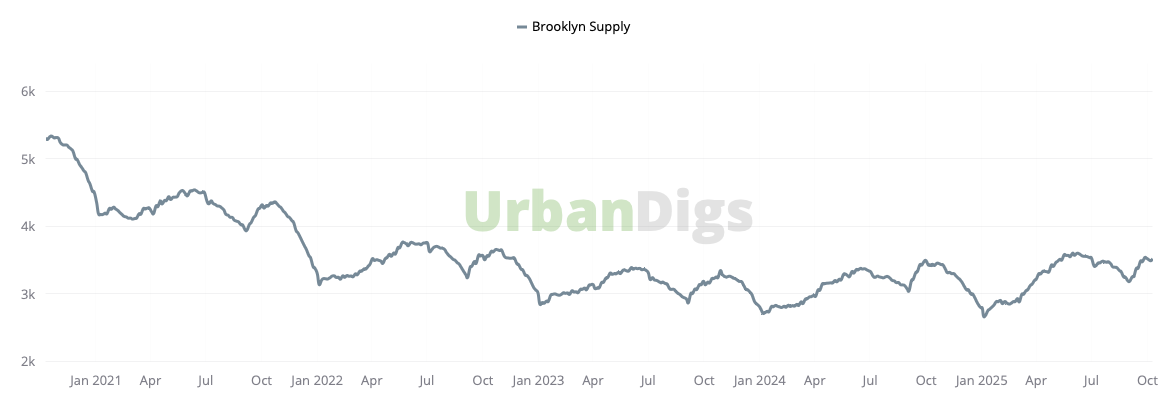

Brooklyn supply rebounded to 3,526 homes (+1.09% WoW, +2.9% YoY)

Contracts signed: Manhattan 209 (–2.8% WoW, +12% YoY) and Brooklyn 120 (+1.7% WoW, –10% YoY)

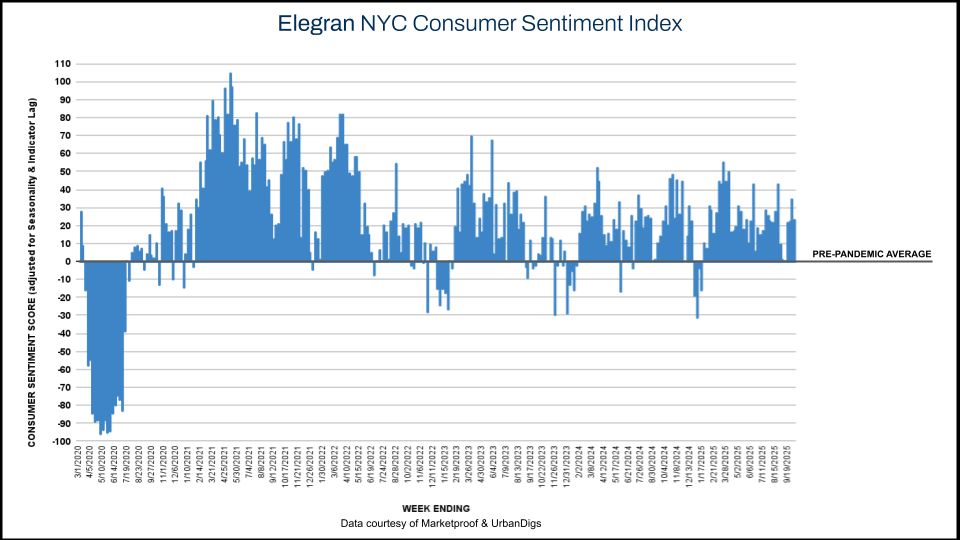

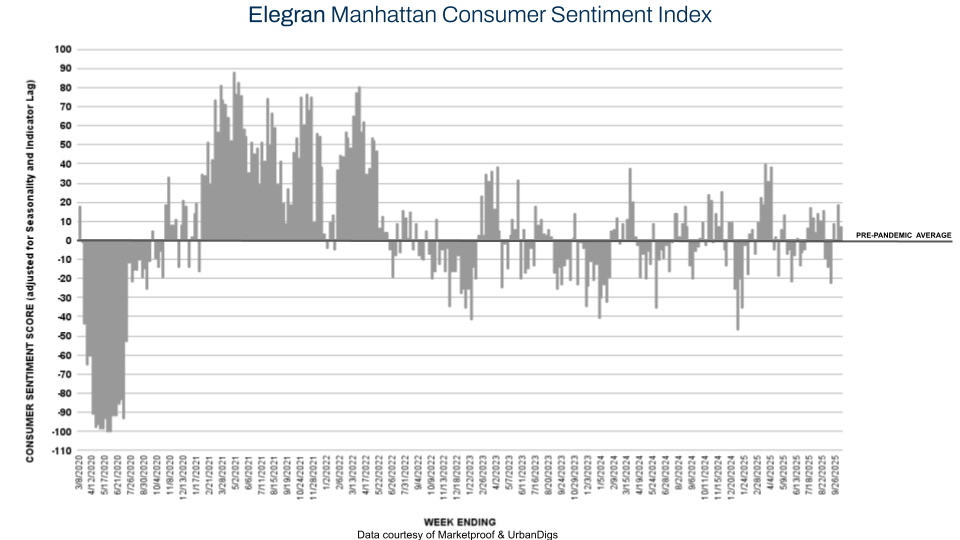

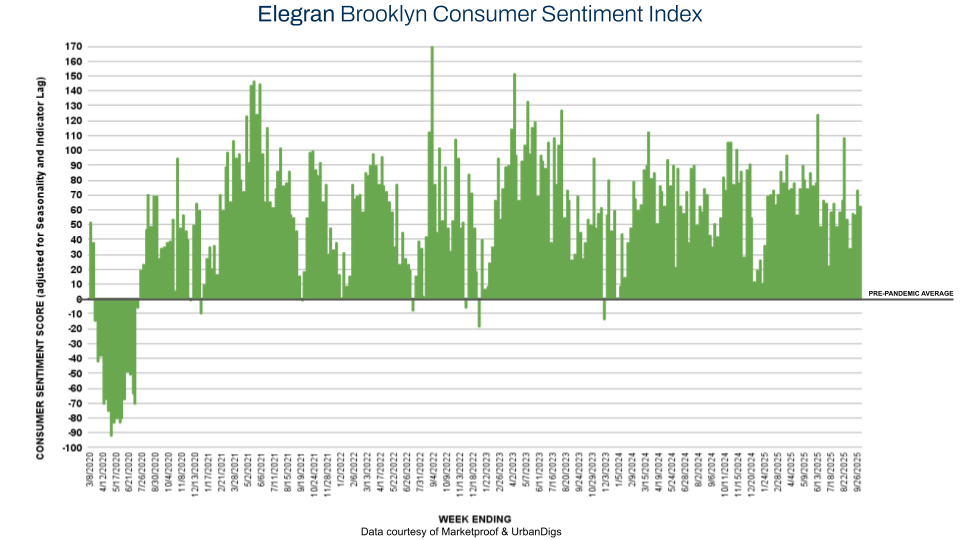

Consumer Sentiment Index: Manhattan +7% | Brooklyn +65% - confidence remains steady in both boroughs

Also, the overall Elegran NYC Consumer Sentiment Index decreased from 35% to 23%, reflecting a more measured but still optimistic outlook across boroughs.

Inventory climbed for the seventh consecutive week, reaching 6,903 homes (+1% WoW, +1.8% YoY). While new listings dipped to 388 units (–18.7% WoW), supply remains 44% above last year, showing sellers remain engaged even as the pace cools slightly.

Brooklyn’s supply rose to 3,526 homes (+1.09% WoW, +2.9% YoY) after a brief pullback. New listings reached 193 units (+4.9% WoW, +8% YoY), underscoring the borough’s solid seller participation and market balance heading into mid-October.

Contracts reached 209 signed (–2.8% WoW, +12% YoY), while Elegran’s Manhattan Consumer Sentiment Index moderated from +19% to +7%. The fall market is taking shape as post-summer contracts normalize, signaling a composed - rather than contracting - market.

Brooklyn recorded 120 signed contracts (+1.7% WoW, –10% YoY). The Brooklyn Consumer Sentiment Index climbed from +63% to +65%, reinforcing sustained optimism and measured stability among active buyers.

Marketproof tracked 30 new development contracts across 27 buildings. Top performers included:

Brooklyn Point (Downtown Brooklyn) and One Domino Square (Williamsburg) each signed 2 contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.