Weekly Manhattan and Brooklyn Market Update: 10/20

Elegran October 20, 2025

Elegran October 20, 2025

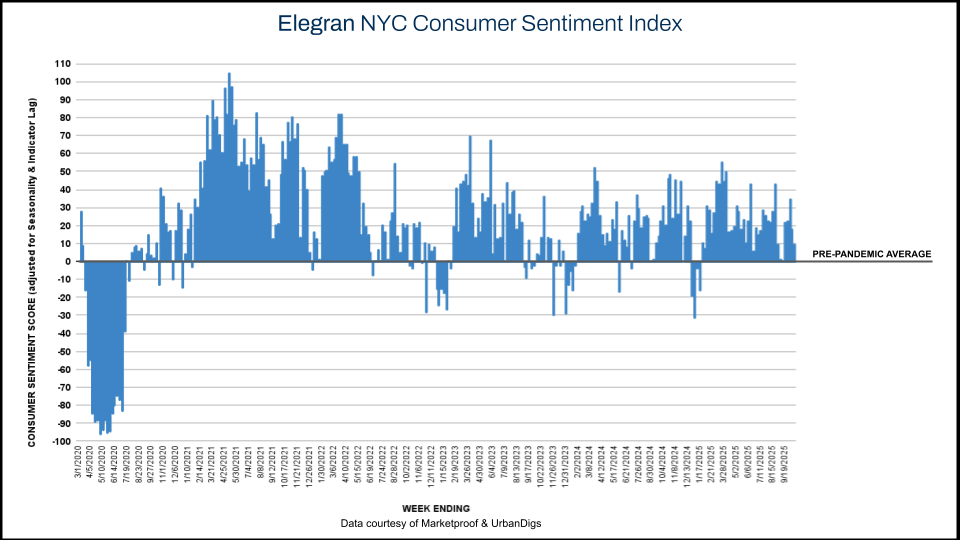

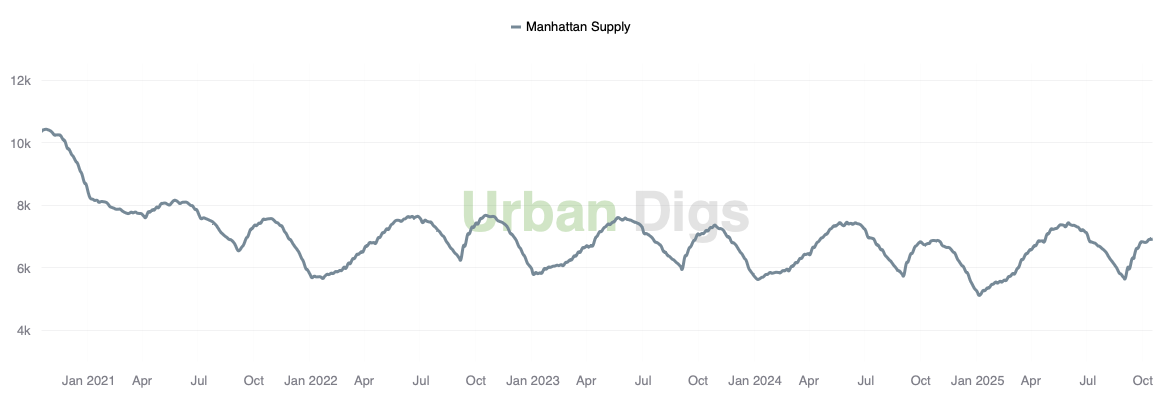

Mid-October brings a brief pause in momentum as the long weekend muted activity, yet both Manhattan and Brooklyn remain structurally sound. Manhattan’s supply growth continued for an eighth consecutive week, while pending sales advanced modestly across both boroughs. Brooklyn’s inventory edged higher, but new listings dipped, likely reflecting the impact of the holiday week. Overall, market sentiment eased slightly but remains comfortably positive, signaling a composed market rather than a contracting one. The overall Elegran NYC Consumer Sentiment Index decreased from +18% to +10%, reflecting measured confidence amid the fall transition.

Despite lighter activity, Manhattan and Brooklyn continue to display steady fundamentals. Supply is inching upward, buyers remain engaged, and sentiment - though lower - is still firmly positive. The next two weeks will determine whether the holiday lull gives way to renewed contract momentum before November’s seasonal slowdown.

Inventory climbed for the seventh consecutive week, reaching 6,933 homes (+0.4% WoW, +1.1% YoY). New listings declined to 302 units (–22% WoW) and sat 29% below last year, reflecting the first clear sign of seasonal tightening. The dip is likely tied to the Columbus Day and Indigenous Peoples’ Day holiday pause earlier in the week.

Brooklyn’s overall supply rose to 3,565 homes (+1.1% WoW, +3.8% YoY), marking its second consecutive week of gains. However, new listings slipped to 185 units (–5.6% WoW, –6% YoY) - a mild retreat likely influenced by the shortened work week.

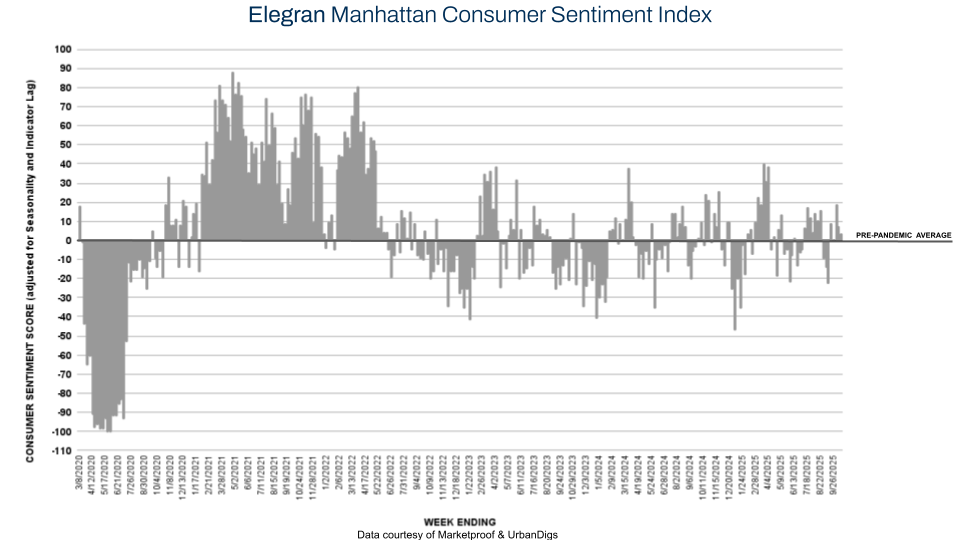

Contracts signed dipped to 201 (–2.9% WoW, –6% YoY), while the Elegran Manhattan Consumer Sentiment Index eased from +7% to +3%. The slight contraction appears holiday-related rather than indicative of broader softening. Activity is expected to regain momentum heading into late October.

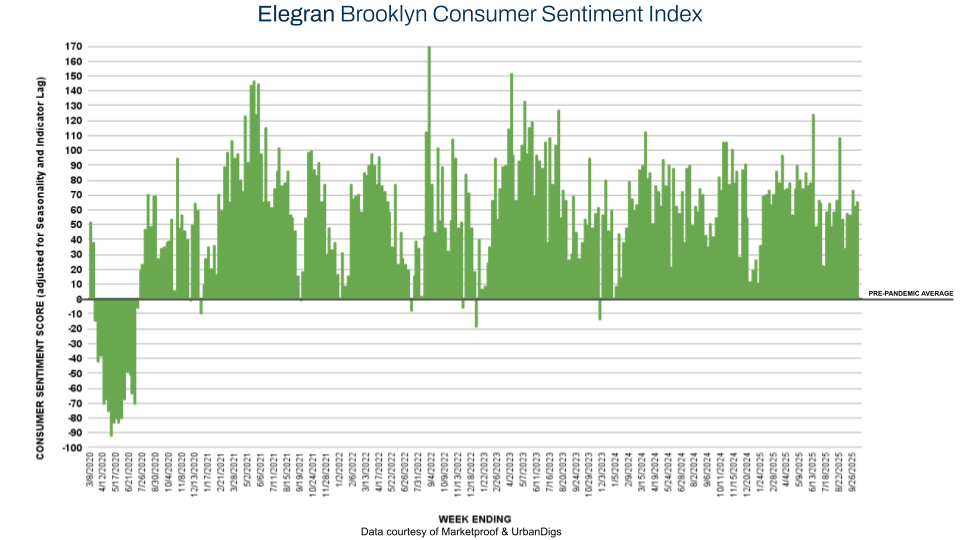

Brooklyn recorded 111 signed contracts (–5.9% WoW, –30% YoY). The Brooklyn Consumer Sentiment Index decreased from +56% to +44%, showing a temporary cooling likely caused by the shortened week. Upcoming data will clarify whether this is a momentary pause or a continuing moderation.

Marketproof tracked 30 new development contracts across 27 buildings. Top performers included:

The Greenwich By Rafael Vinoly (Financial District) signed 3 contracts

The Village West (Greenwich Village), Bergen 17 (Cobble Hill) and One Domino Square (Williamsburg) each signed 2 contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.