Weekly Manhattan & Brooklyn Market Update: 10/21

Elegran | Forbes Global Properties October 19, 2024

Elegran | Forbes Global Properties October 19, 2024

This week brought an unexpected uptick in new supply and contract signings across Manhattan and Brooklyn. In Manhattan, 428 new listings hit the market—a 59% jump from last week, though slightly below the post-Labor Day surge seen in prior weeks. Brooklyn also saw a nearly 10% increase in new listings, with 196 properties entering the market, higher than recent weeks but still below the peak following Labor Day.

This increase in listings may be driven by sellers responding to heightened buyer activity, spurred by the Federal Reserve’s recent decision to lower the federal funds rate by 50 basis points earlier this fall. That decision seems to have shifted buyer sentiment, creating a sense of urgency despite a subsequent rise in mortgage rates by nearly 50 basis points in the last few weeks. Some buyers are looking to take advantage of current market conditions, hoping to secure favorable deals in a less competitive environment ahead of a potentially busier spring market while holding the option to refinance as rates are expected to trend lower.

Although the recent rise in interest rates has caused some buyers to pause, the impact hasn’t yet been reflected in contract signings. This week, Manhattan saw a surprising 29% jump in contracts signed, with 242 deals—the highest weekly number since May. Brooklyn followed suit, with contracts signed up by 19%, reaching 158—also the highest since May. This surge in buyer activity resulted in the Elegran | Forbes Global Properties Consumer Sentiment Index rising significantly from +20 to +44.

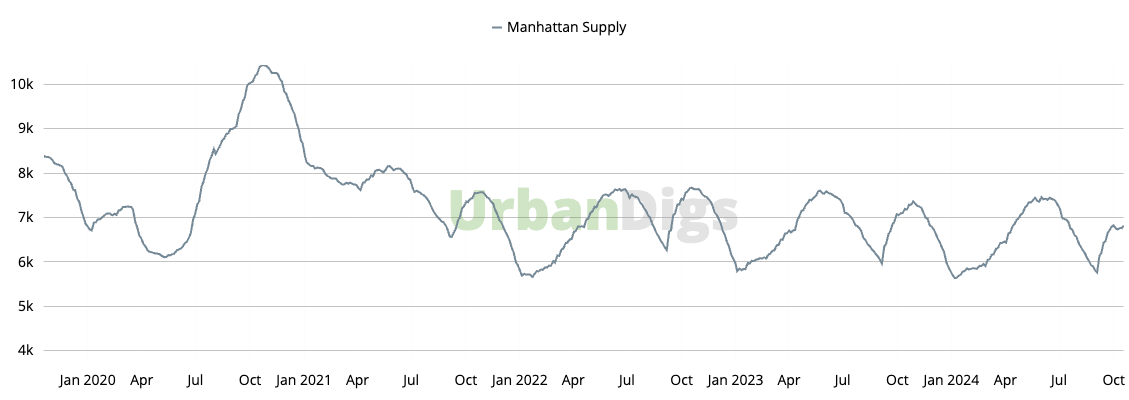

Continuing its upward trend, inventory increased by 1% this week, reaching 6,825 units for sale. A total of 428 new properties came onto the market, marking a significant 59% jump from last week and a 9% year-over-year rise for the same period.

Data courtesy of UrbanDigs

Brooklyn’s housing inventory held steady at 3,430 units this week. Although 196 new listings hit the market—representing a 19% increase from the previous week—the rise in contracts signed and properties removed from the market kept the overall supply unchanged.

Data courtesy of UrbanDigs

The number of signed Manhattan residential contracts increased by 30% both week-over-week and year-over-year, reaching 242. This rise significantly increased the Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index, which rose from -3 to +24.

Brooklyn's residential real estate market showed resilience this week, with a nearly 19% increase in contract signings totaling 158. This marks a substantial 35% increase compared to last year's period. Reflecting this positive trend, the Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index rose from +73 to +105, indicating increasing buyer interest in the market.

Marketproof reported that 54 new development contracts were signed in 37 buildings this week. The following buildings were the top-selling new developments of the week:

- Bergen Brooklyn (Boerum Hill) signed 6 contracts

- The Cortland (West Chelsea) signed 3 contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.