Manhattan & Brooklyn Weekly Market Update – October 6

Elegran October 4, 2025

Elegran October 4, 2025

The first week of October brought a clear split between Manhattan and Brooklyn. Manhattan gained momentum with contracts surging and sentiment turning positive, while Brooklyn softened modestly after several weeks of strength.

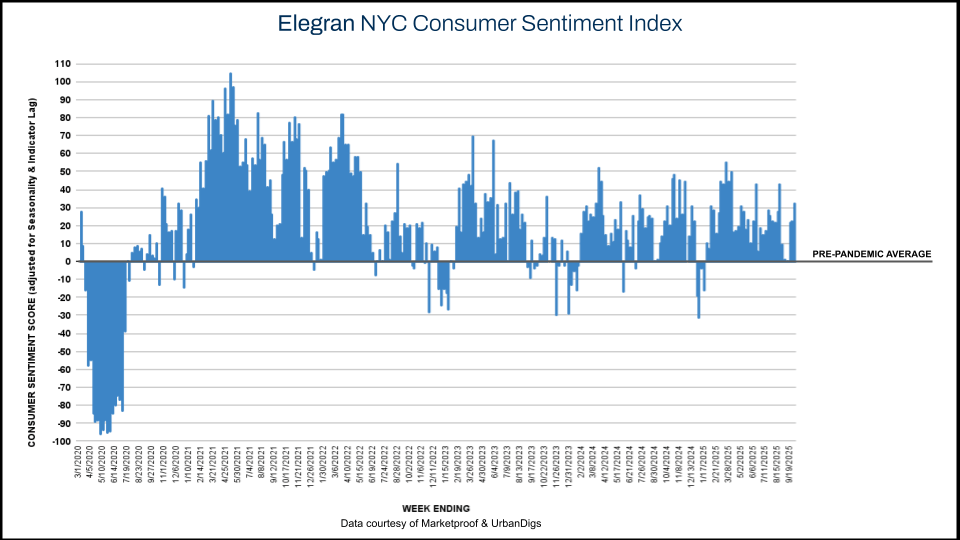

Overall, Elegran’s NYC Consumer Sentiment Index rose from 22% to +33%, signaling renewed Manhattan demand against Brooklyn’s pause. With supply elevated and financing conditions improving after the Fed’s recent rate cut, the fall market is showing both opportunity and divergence across boroughs.

October opened with Manhattan showing stronger contract growth while Brooklyn eased after a strong late-summer run. With supply holding above last year and conditions more favorable, buyers and sellers alike are finding new dynamics at play.

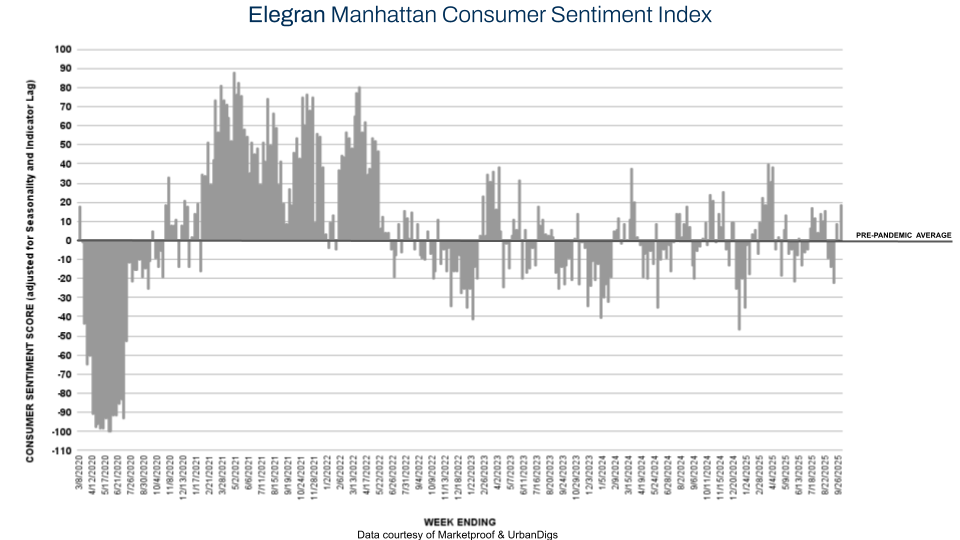

- Manhattan Bounce-Back: Contracts rose 21% week-over-week, lifting sentiment into positive territory.

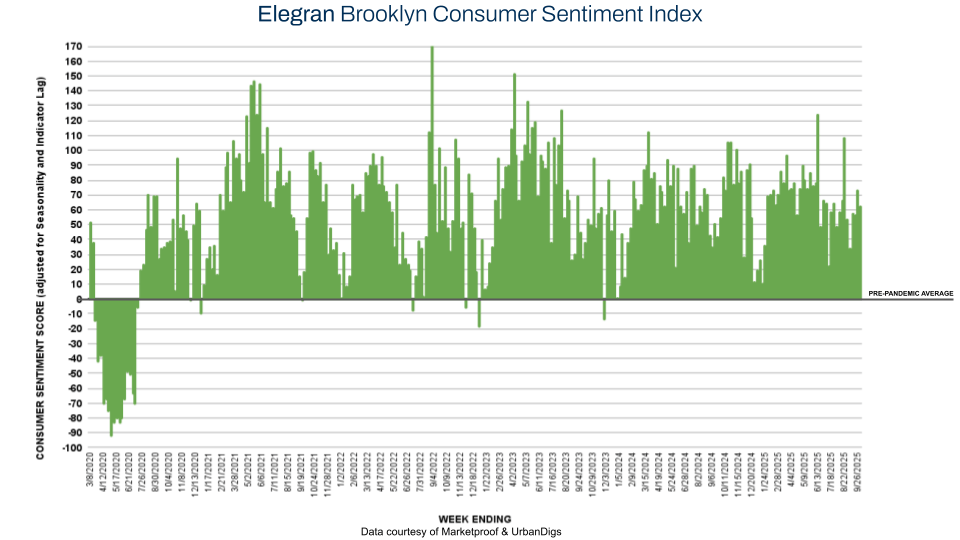

- Brooklyn Pause: Contracts slowed after weeks of gains, but confidence remains elevated compared to pre-summer levels.

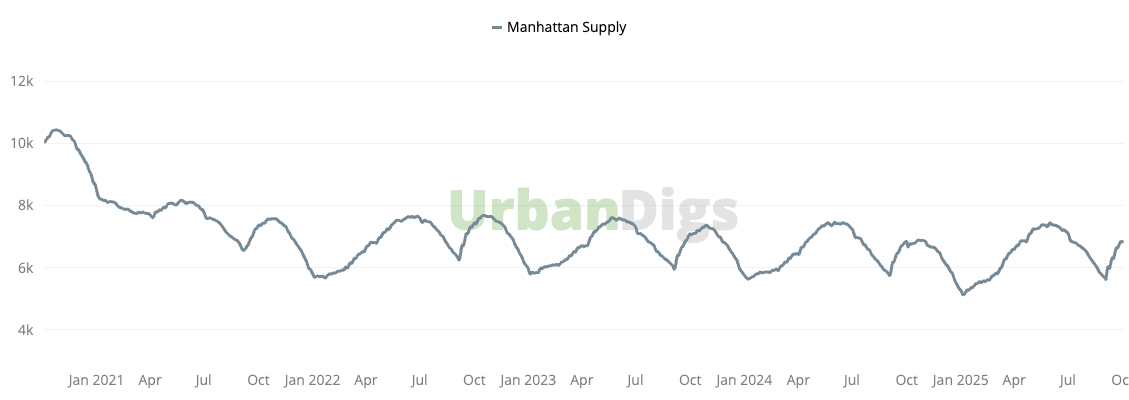

- Inventory Dynamics: Manhattan supply grew for the sixth straight week, while Brooklyn’s supply ticked down slightly after steady increases.

- Fall Market Outlook: With supply higher than a year ago and financing conditions easing, October could see buyers leverage more negotiating power - particularly in Manhattan. For buyers, elevated supply and improving financing conditions may present more negotiating power this fall. For sellers, especially in Manhattan, stronger contract activity suggests that well-priced listings are likely to capture renewed demand quickly.

Inventory rose for the sixth consecutive week, reaching 6,832 homes (+1% WoW, +2.4% YoY). New listings dropped to 328 units (–17.4% WoW), though still 11% higher than last year, reflecting ongoing seller engagement despite the weekly dip.

Brooklyn’s supply eased slightly to 3,488 homes (–0.2% WoW, +2% YoY) after five straight weeks of growth. New listings came in at 183 units (–14% WoW, +10% YoY), underscoring stronger seller activity than this time last year.

Contracts jumped to 216 signed, up 21% WoW and +10% YoY. Elegran’s Manhattan Consumer Sentiment Index rose from 0% to +19%, showing a meaningful rebound and setting up a stronger October.

Brooklyn recorded 118 signed contracts, down 6% WoW and –11% YoY. Elegran Brooklyn Consumer Sentiment Index declined from +73% to +63%, signaling contraction, though confidence remains solid relative to long-term averages.

Marketproof tracked 43 new development contracts across 34 buildings. Top performers included:

The West Residences Club (Clinton) signed 3 contracts

Monogram New York (Turtle Bay) signed 2 contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.