Weekly Manhattan and Brooklyn Market Update: 12/1

Real Estate Howard Hanna NYC November 29, 2025

Real Estate Howard Hanna NYC November 29, 2025

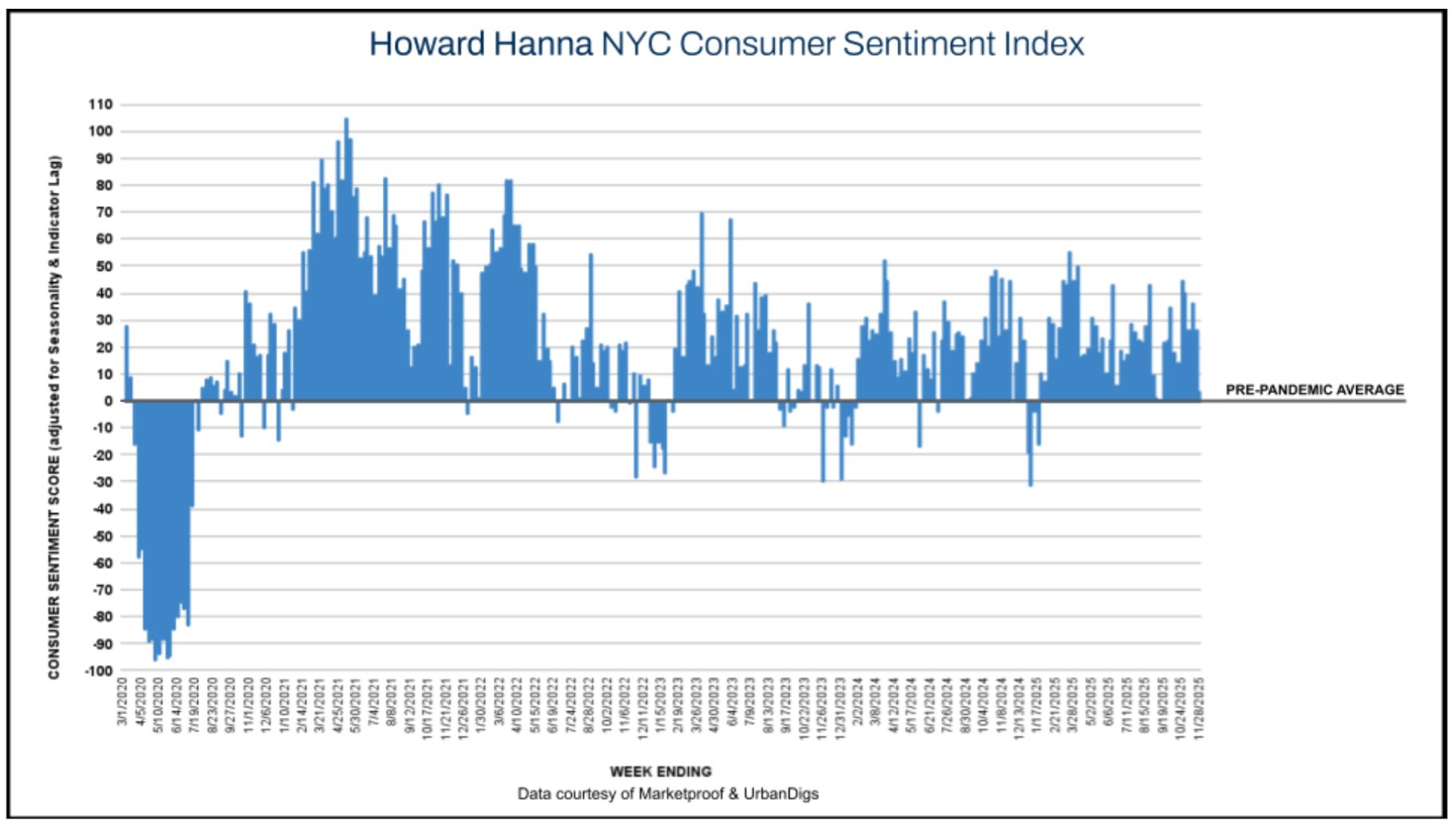

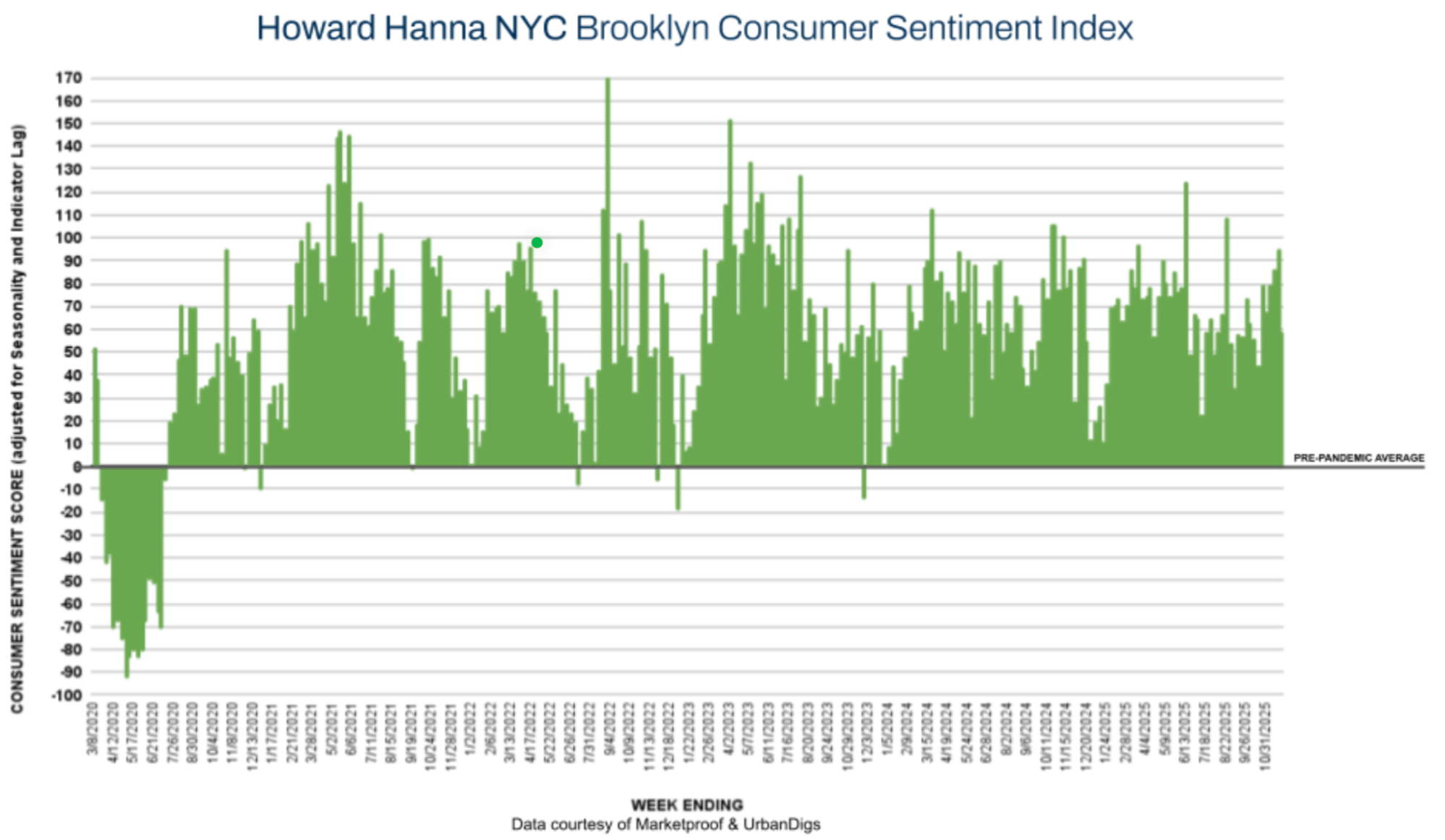

The final week of November delivered the expected post-holiday cooling, with both boroughs showing a marked pullback in new listings and contract activity. Manhattan continued its steady slide into the holiday lull, while Brooklyn remained more resilient year-over-year but still registered week-over-week contraction. Overall confidence retreated meaningfully — the Howard Hanna NYC Consumer Sentiment Index fell from 26% to 4%, reflecting buyers pressing pause as the market transitions into December’s reduced activity window. The fundamentals remain stable, but momentum has definitively shifted into year-end mode.

December should remain quiet, with limited new supply and softer contract activity until the January reset. Seasonal contraction will dominate the coming weeks, though Brooklyn’s strong year-over-year demand signals deeper buyer engagement heading into 2026. Manhattan is likely to stabilize at lower activity levels, while Brooklyn continues to outperform its usual winter pattern.

Both boroughs enter December with predictable softening, but Brooklyn maintains a healthier trajectory. Pricing should hold steady, even as overall volume stays muted until activity ramps back up in January.

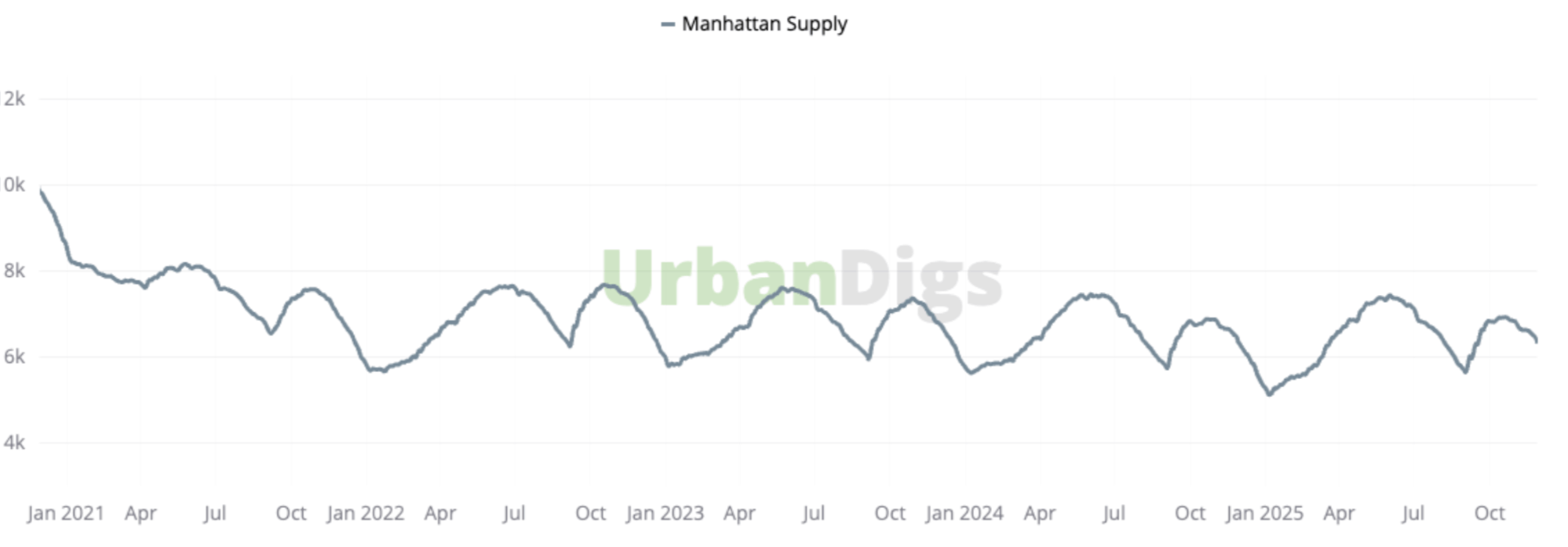

Manhattan’s active inventory edged lower for the second week to 6,331 homes (–1.9% WoW, –0.4% YoY). New listings dropped sharply to 109 units (–55% WoW, +20% YoY), as seller activity paused over Thanksgiving and the market entered its traditional holiday cool-down. Listing volume will likely remain muted until early January.

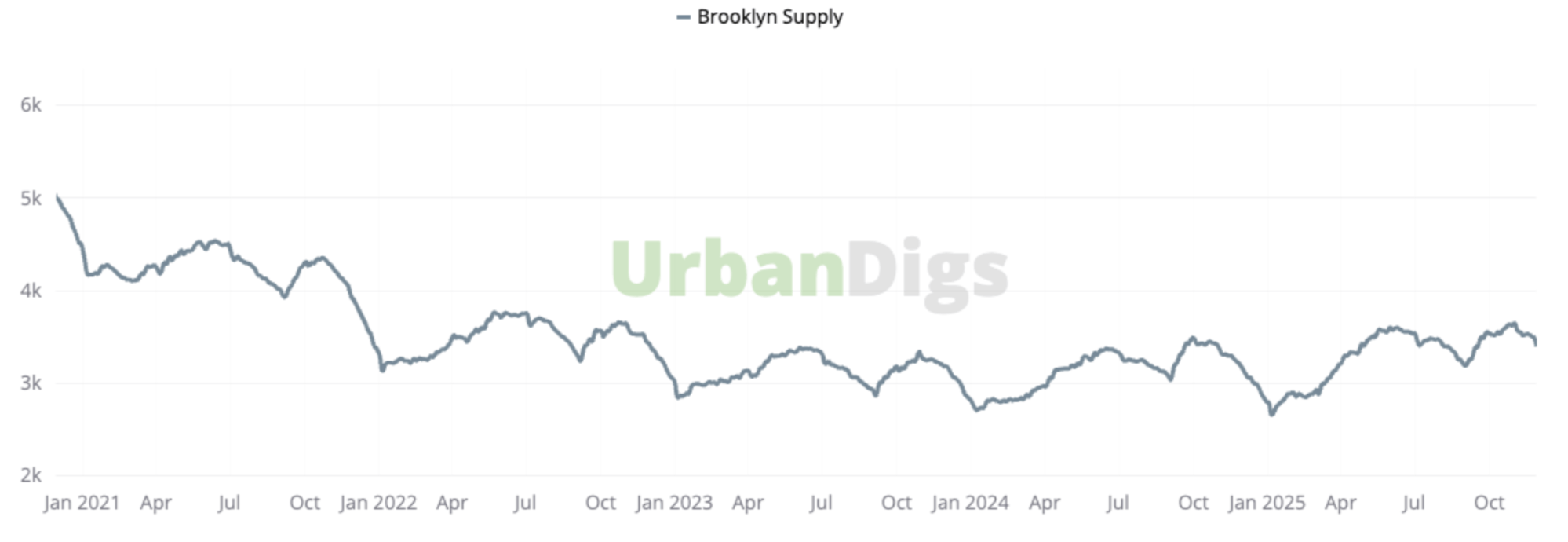

Brooklyn’s supply declined to 3,405 homes (–2.8% WoW, +6.6% YoY), continuing its steady YoY inventory growth even as late November suppressed weekly activity .

New listings fell to 75 units (–55% WoW, –9% YoY), mirroring Manhattan’s sharp holiday-driven pullback. The borough now enters December with relatively lean fresh supply.

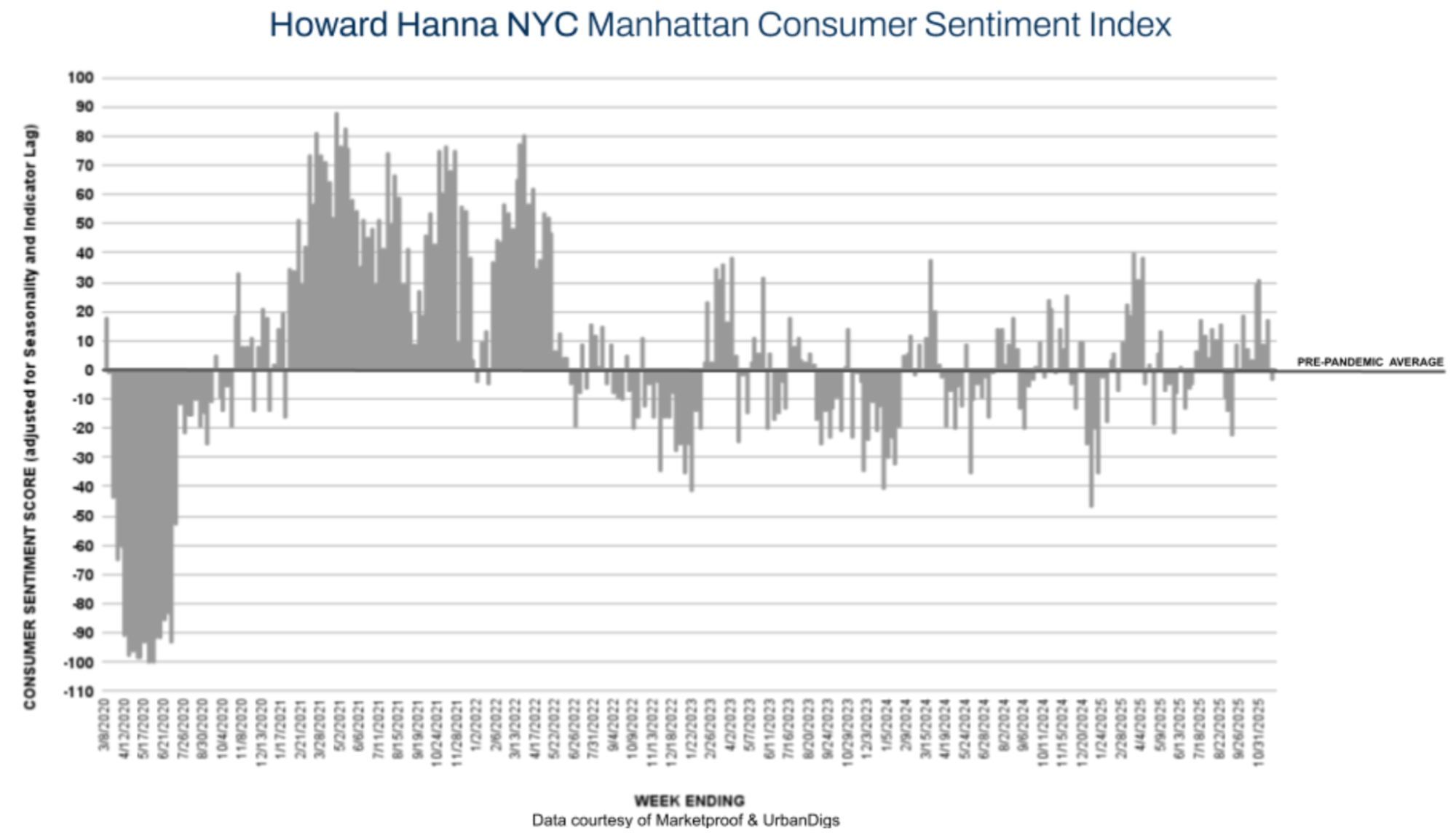

Contracts signed fell to 167 (–10% WoW, –9% YoY), pushing the Manhattan Consumer Sentiment Index from –3% to –13%. This is directly in line with the Thanksgiving slowdown and likely foreshadows continued contraction into December as holiday schedules dominate buyer behavior.

Brooklyn recorded 122 signed contracts (–18% WoW, +23% YoY), bringing the Sentiment Index down from +95% to +58%. The week-over-week retreat was expected after Thanksgiving, yet the year-over-year strength highlights stable demand heading into winter.

Marketproof tracked 35 new development contracts across 25 buildings. Top performers included:

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.