Weekly Manhattan and Brooklyn Market Update: 12/8

Real Estate Howard Hanna NYC December 6, 2025

Real Estate Howard Hanna NYC December 6, 2025

The first week of December brought a mild rebound in new listings as sellers re-entered the market after Thanksgiving, though overall activity continues its seasonal deceleration. Manhattan posted its third consecutive week of declining inventory but saw a sharp jump in new listings as sellers deliver a final push before the holiday freeze. Brooklyn followed a similar pattern, with supply easing but fresh listings bouncing back from last week’s holiday lull.

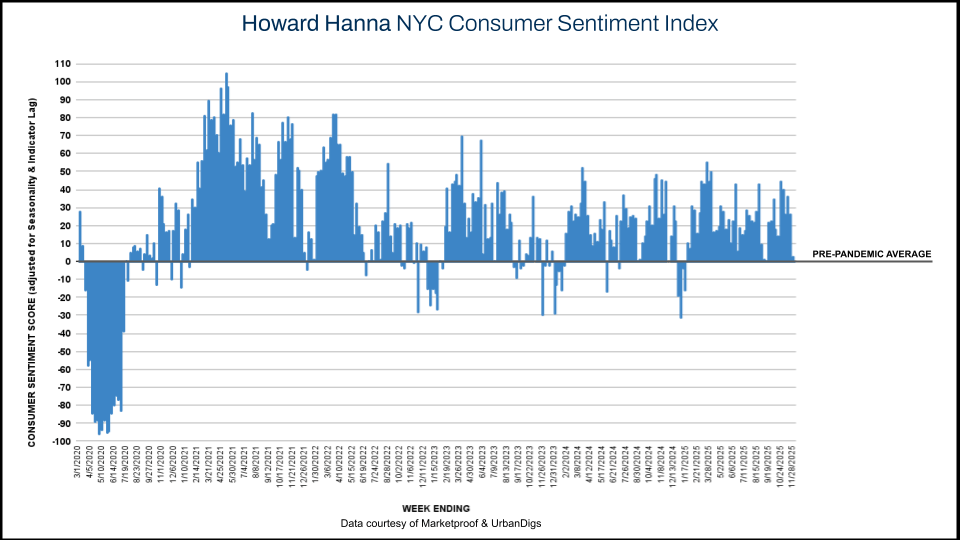

Buyer sentiment, however, remains soft — the Howard Hanna NYC Consumer Sentiment Index fell from 3 percent to -1 percent, reflecting the typical early-December cooldown as consumers shift into year-end mode. The market is settling into its quietest stretch of the calendar, with momentum likely remaining muted until January.

The early-December bounce in new listings is likely the final pulse of activity before the market enters its extended holiday freeze. Listing volume, contract activity, and buyer engagement will soften further over the next several weeks as both boroughs move into their lowest-velocity period of the year. January remains the next meaningful inflection point, with sellers expected to return more aggressively and buyers re-engaging once holiday travel and year-end distractions ease.

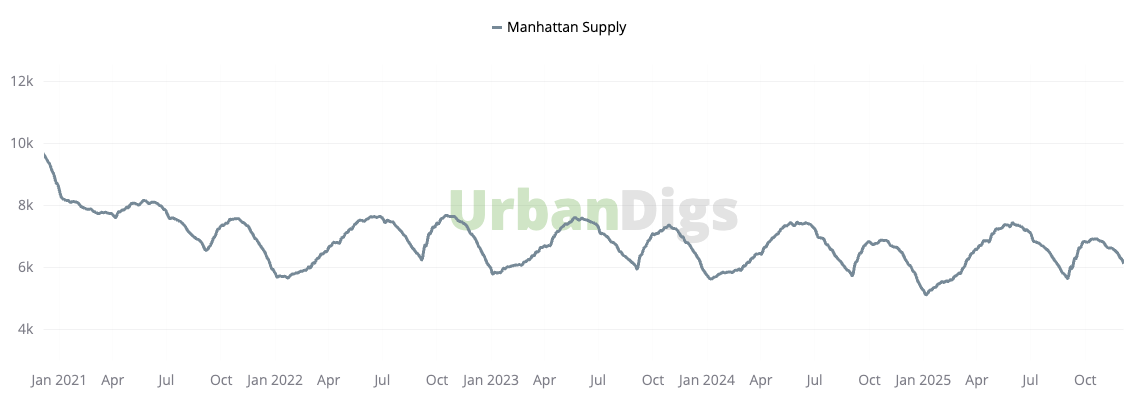

Manhattan’s active inventory slipped again to 6,136 homes (–3 percent WoW, 0 percent YoY), marking its third consecutive weekly decline .

New listings jumped to 209 units (+92 percent WoW, +9 percent YoY) as sellers who held back during Thanksgiving returned to market. This represents the final listing push before the typical December and early January slowdown.

Brooklyn supply decreased to 3,307 homes (–2.9 percent WoW, +6.8 percent YoY), continuing a multiweek contraction even as annual levels remain elevated.

New listings increased to 106 units (+39 percent WoW, –15 percent YoY), mirroring Manhattan’s post-holiday resurgence. This is likely the borough’s last measurable increase before the Christmas and New Year holiday pause.

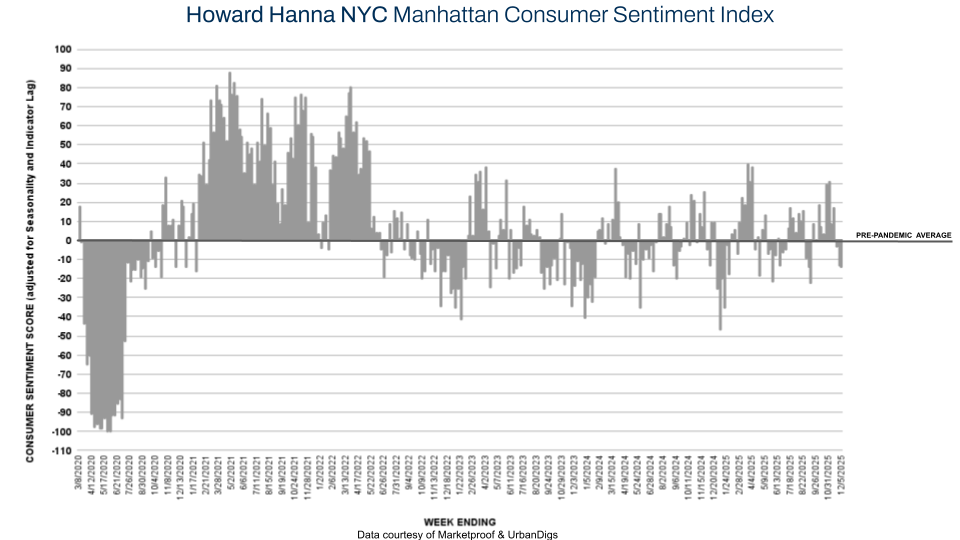

Contracts signed fell slightly to 165 (–1 percent WoW, –1 percent YoY), pushing the Manhattan Consumer Sentiment Index from –13 percent to –14 percent .

This aligns with typical post-Thanksgiving patterns and suggests December will remain subdued across most price segments.

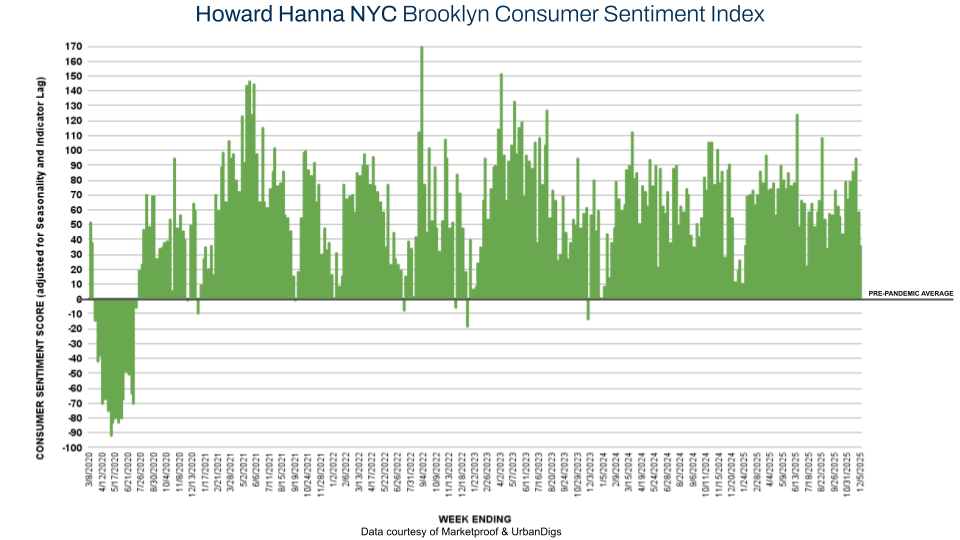

Brooklyn recorded 105 signed contracts (–14 percent WoW, –27 percent YoY), bringing the Sentiment Index from +58 percent to +36 percent .

The decline reflects both the holiday cooldown and the early-December transition but remains consistent with Brooklyn’s stronger long-term buyer base.

Marketproof tracked 34 new development contracts across 27 buildings. Top performers included:

The Willow (Kips Bay) and The Cortland (West Chelsea) signed 2 deals.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.