Weekly Manhattan & Brooklyn Market Update: 4/14

Elegran | Forbes Global Properties April 14, 2025

Elegran | Forbes Global Properties April 14, 2025

The crosswinds of economic volatility swept through New York City’s residential market. With interest rates spiking, stock markets swinging, and global trade tensions escalating, some buyers and sellers are taking a moment to pause. But the market isn’t standing still—especially not during the heart of the busiest season of the year.

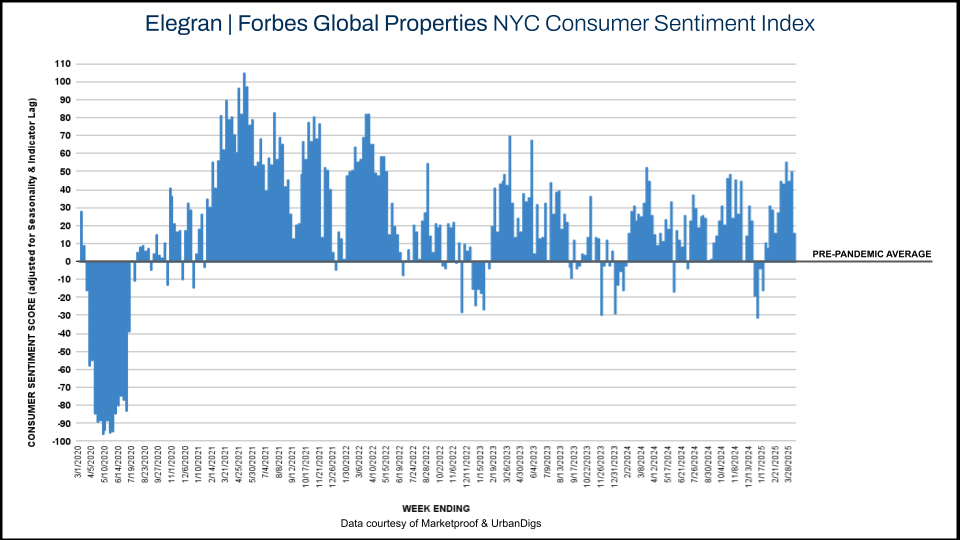

In Manhattan, contract activity pulled back—down 17% week-over-week to 233 signed contracts, a modest 3% decline from the same time last year. Meanwhile, Brooklyn saw 147 contracts signed, a 14% jump from the previous week and 17% ahead of last year. This shift is reflected in the Elegran | Forbes Global Properties NYC Consumer Sentiment Index, which dipped from +50 to +16.

This divergence highlights a larger truth: uncertainty breeds hesitation, especially around high-stakes decisions like buying or selling a home. But if history is any guide, moments of disruption are often when the best opportunities emerge.

Stocks swing. Yields spike. Headlines shift by the hour. Real estate doesn’t. It’s steady, tangible, and grounded in utility. Your home doesn’t flash a price every few seconds—and that quiet is powerful. In times like these, it’s that absence of volatility that makes real estate so compelling. Especially in New York, where value is built over time—not overnight—real estate offers something rare: stability you can live in.

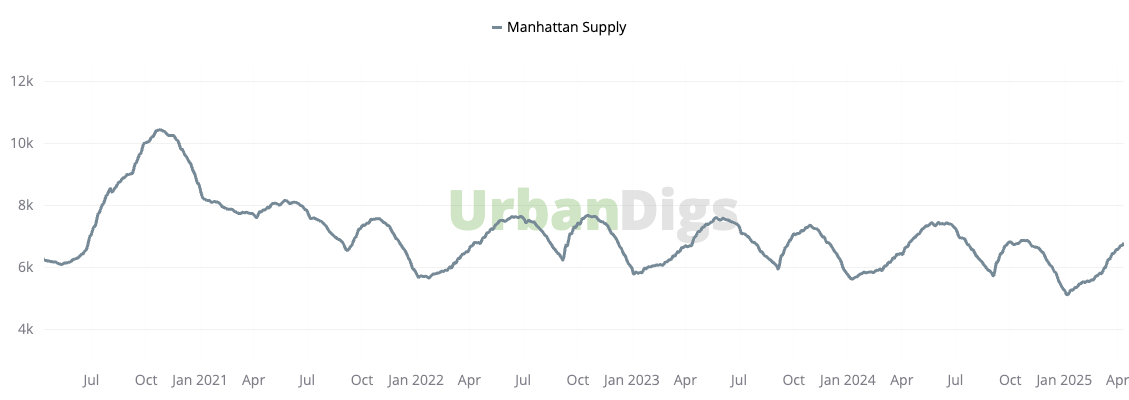

Manhattan’s residential inventory climbed again this week, hitting 6,812 active listings—a 2.17% increase. While the 493 new listings mark a dip from last week (down 6%), they still reflect strong momentum: new listings have averaged 13% higher over the past six weeks compared to the same time in 2024.

Despite the recent surge, overall inventory remains just under 1% above last year’s levels—suggesting that while supply is building, it’s doing so at a measured pace. The market remains active but not oversaturated with available inventory.

Data courtesy of UrbanDigs

Brooklyn’s active listings increased to 3,313 this week—a 1.5% gain—while 218 new properties hit the market. That’s a notable 25% drop in new listings compared to last week’s spike, bringing fresh inventory back down to the lower end of the recent weekly range.

While overall supply is still growing, the pullback in new listings suggests a cooling pace of seller activity—something to watch closely in the weeks ahead.

Manhattan Pending Sales: Pending sales increased by nearly 2.5% to 3,173.

Brooklyn Pending Sales: Pending sales increased by 2.3% to 1,911.

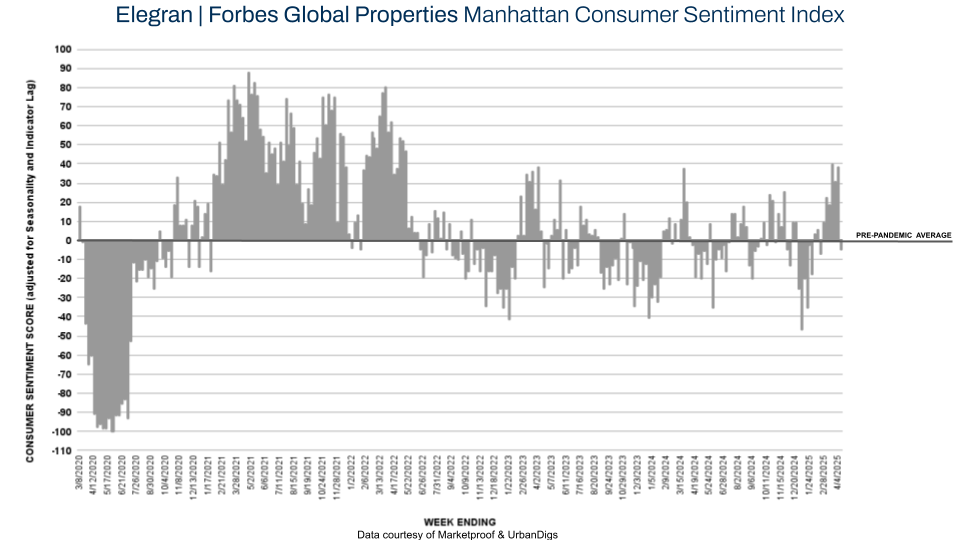

Contract activity in Manhattan slowed this week, with 233 contracts signed—down 17% from last week and 3% below the same period last year. This pullback has pushed the Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index from +39 to -5%, reflecting a negative shift in buyer confidence.

This hints at the first clear sign that recent economic volatility is starting to weigh on buyer confidence, even during peak season. While uncertainty may cause some to hesitate on major purchases, real estate continues to offer a unique sense of stability—a tangible, long-term asset that hedges against inflation and shields investors from the emotional swings of daily market noise.

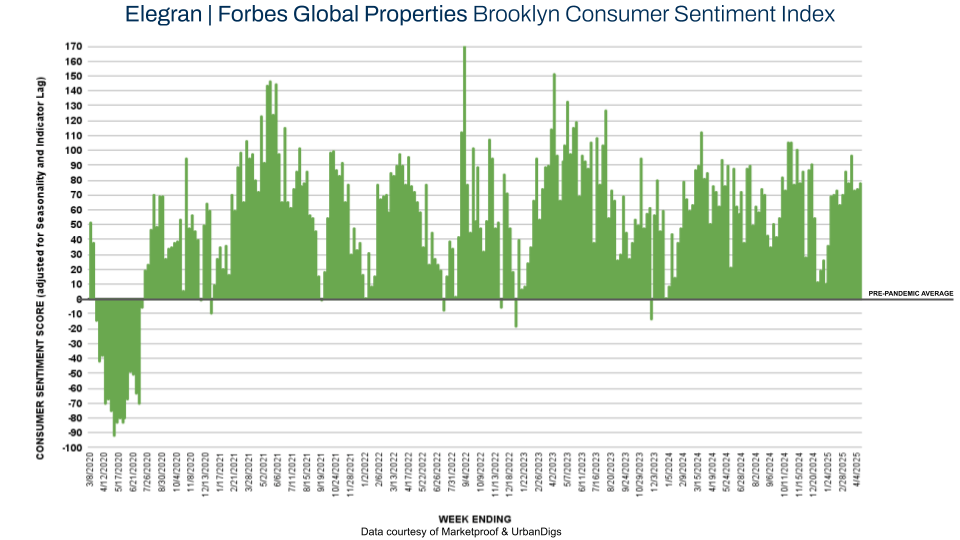

Brooklyn saw 147 contracts signed—a 14% increase from the week prior and 17% higher than the same period in 2024. This lifted the Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index from +74 to +78.

Transaction volume broke above Brooklyn’s typical 120–130 contract range, marking a standout start to April.

However, with rising mortgage rates and stock market volatility, the momentum could face headwinds in the coming weeks.

Marketproof reported that 36 new development contracts were signed in 34 buildings this week. The following buildings were the top-selling new developments of the week:

- The Ainsley (Park Slope) signed four contracts.

- The Broad Exchange Building (Financial Exchange) signed three contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.