Weekly Manhattan & Brooklyn Market Update: 4/28

Elegran | Forbes Global Properties April 27, 2025

Elegran | Forbes Global Properties April 27, 2025

New York City’s residential real estate market showcases sharp contrasts this week, with Brooklyn gaining momentum while Manhattan takes a momentary step back.

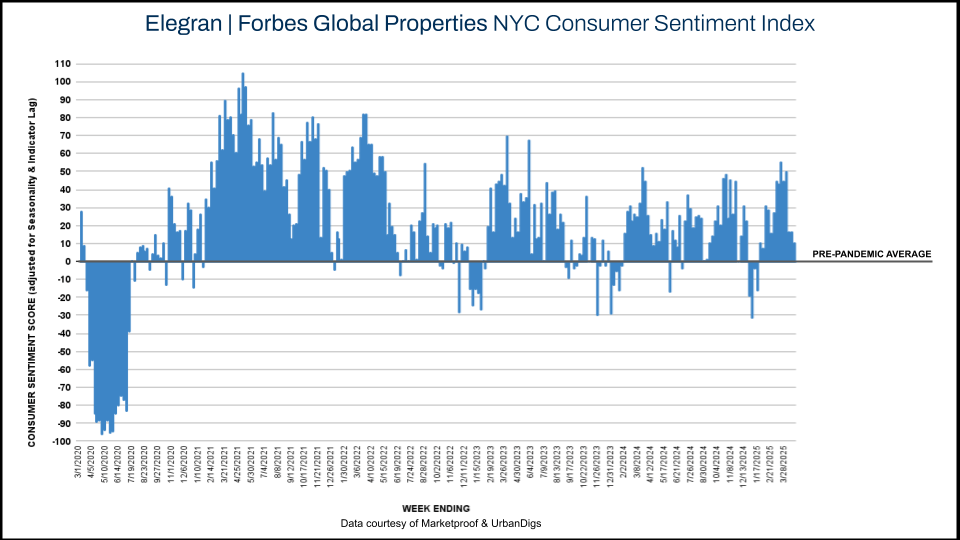

In Manhattan, contract activity fell 17% week-over-week, pushing the Elegran | Forbes Global Properties NYC Consumer Sentiment Index down from +17% to +10%. Yet this pullback coincides with a 28% surge in new listings, suggesting a market replenishing its supply rather than retreating. With inventory—particularly in the luxury segment—on the rise, buyers are gaining more negotiating power across select submarkets.

Brooklyn, by contrast, is accelerating. Contracts signed rose 11% week-over-week, topping the borough’s typical spring range, while new listings jumped 71% compared to last week—marking the fourth-highest weekly influx in the past three years. The surge in inventory is expanding buyer options without slowing demand, especially in the competitive sub-$1.5M segment where multiple-offer scenarios remain common.

Despite these divergent trajectories, both boroughs are seeing steady growth in pending sales, pointing to healthy transaction pipelines. New development activity also remains robust, with 54 contracts signed across 39 projects—the strongest showing in several weeks.

This week’s movements highlight a key truth: NYC’s real estate market remains hyperlocal, dynamic, and increasingly segmented. Navigating today’s environment requires a sharp understanding of these shifting neighborhood-specific dynamics.

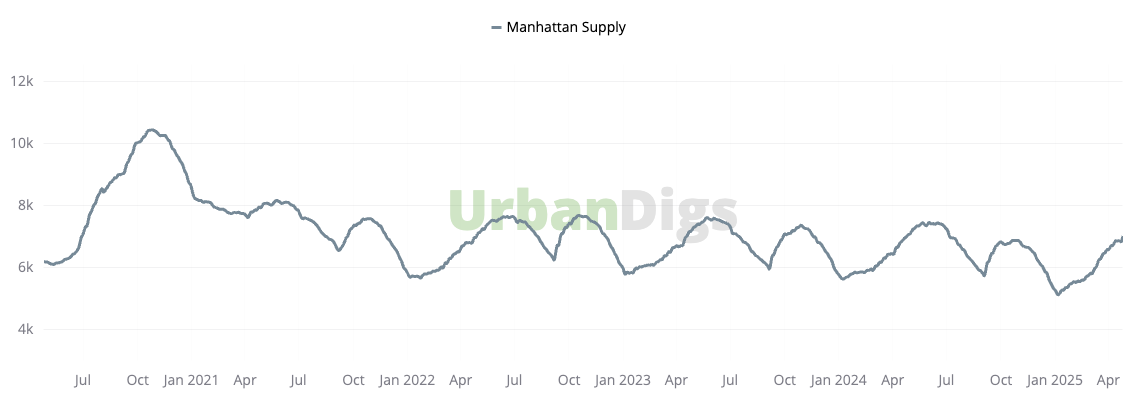

Manhattan’s residential inventory climbed to 7,025 active listings this week—a 2.6% jump and one of the most substantial weekly gains of the spring. New listings jumped 28% from last week’s dip and were 9% higher than a year ago, highlighting sustained seller momentum this season.

This acceleration, especially pronounced in the luxury segment, is giving buyers more negotiating power in select pockets of the market. While overall supply remains below historical norms, the pace of growth is worth watching.

Data courtesy of UrbanDigs

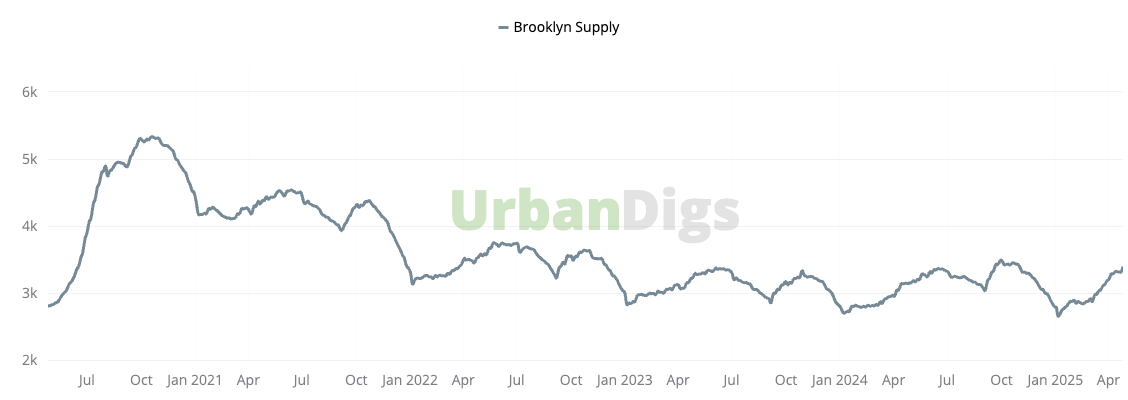

Brooklyn’s inventory rose 2.7% this week to 3,406 active listings—but the real story is the rise in new-to-market supply. New listings jumped 71% week-over-week, with 277 properties hitting the market—the fourth-highest weekly total in the past three years. This wave of inventory is meaningfully expanding buyer choice and could begin to reshape the dynamics of Brooklyn’s traditionally tight market if the trend persists.

Data courtesy of UrbanDigs

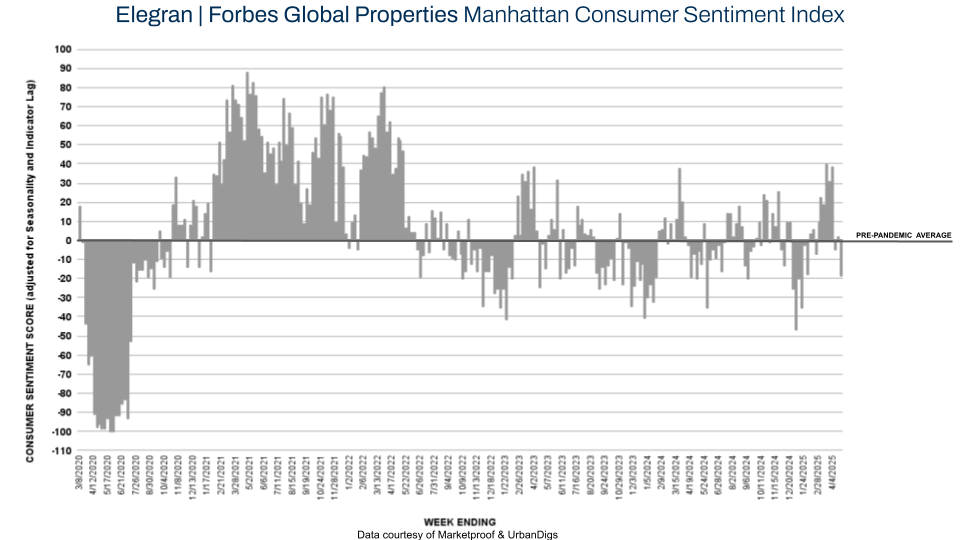

Manhattan contract activity slowed this week, with 206 contracts signed—a 17% drop from last week and 10% below the same period last year. This pullback pushed the Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index down from +2% to -19%, marking the lowest weekly contract volume in nine weeks and signaling a, hopefully only temporary, shift in market momentum.

Heightened macroeconomic volatility and a spike in mortgage rates appear to be giving buyers a temporary pause. Still, the underlying fundamentals of Manhattan’s market remain strong: prices are breaking through the previous cycle’s ceiling, and for savvy buyers, today’s momentary hesitation could create tomorrow’s opportunity.

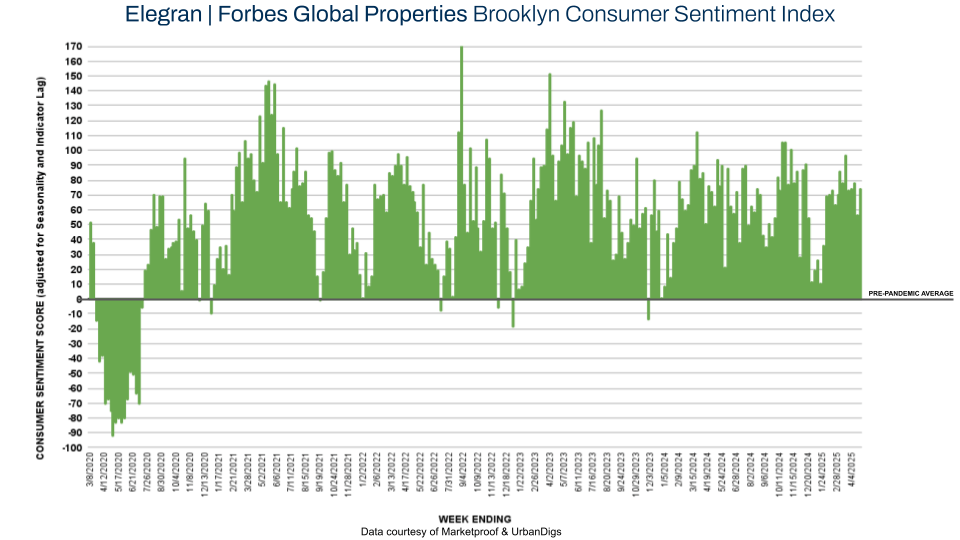

In contrast to Manhattan, there were 144 contracts signed in Brooklyn this week—an 11% jump from last week and 1% higher than the same time last year. This lifted the Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index from +56 to +75.

Contract activity remains well above Brooklyn’s typical weekly range of 120–130, highlighting the borough’s resilient demand. Even as inventory expands, sustained buyer enthusiasm underscores Brooklyn’s enduring appeal across a wide range of price points. Well-priced properties—especially under $1.5 million—continue to draw multiple offers in top neighborhoods.

Marketproof reported that 54 new development contracts were signed in 39 buildings this week. The following buildings were the top-selling new developments of the week:

Vesta (Hunter’s Point) signed seven contracts.

One11 Residences (Midtown) and The Broad Exchange Building (Financial District) each signed three contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.