Weekly Manhattan & Brooklyn Market Update: 5/12

Elegran | Forbes Global Properties May 12, 2025

Elegran | Forbes Global Properties May 12, 2025

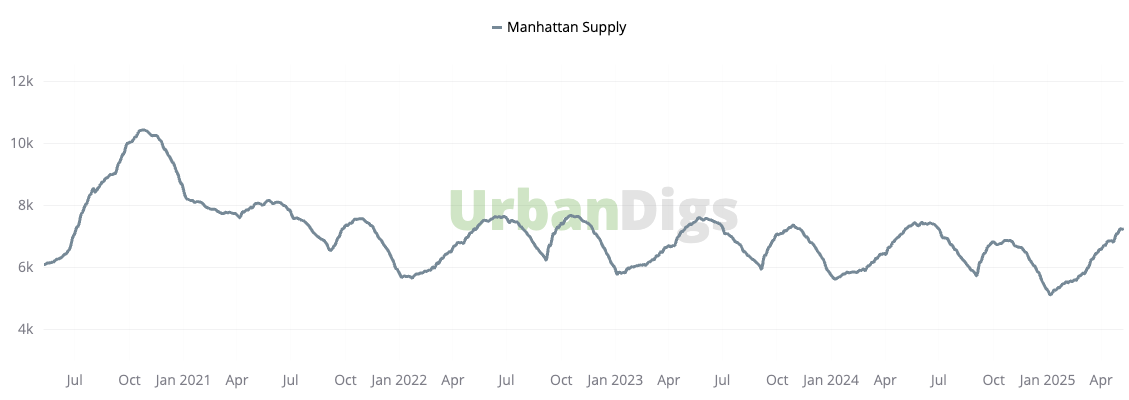

As Memorial Day approaches, the NYC real estate market is shifting into the final phase of the spring season. In Manhattan, the number of homes for sale increased slightly to 7,260, but fewer new listings are hitting the market, down 24% from last week and 11% below this time last year. That means buyers may have already seen the biggest wave of fresh options for the season, and the pace of new listings is likely to slow heading into summer.

Brooklyn is following a similar path, though its spring season typically lasts a bit longer. Inventory rose modestly to 3,498 homes, and while fewer new listings came on the market this week, there are still more options than this time last year. Overall, Brooklyn remains a steady and competitive market, though choices may start to thin in the coming weeks.

Buyers are still active. Manhattan had a strong week, with 271 homes going into contract, up nearly 7% from last week and 17% more than the same week last year. Brooklyn saw a small dip in deals, but pending sales actually ticked up, showing that demand is still there even if the pace varies week to week.

Mortgage rates stayed mostly flat after a few midweek swings. Rates have decreased slightly over the past few weeks, though they’re still higher than in March. Even so, buyers are clearly showing up, keeping the market moving steadily as we head into summer.

Manhattan’s active inventory inched up to 7,260 listings this week—just a 0.9% increase—signaling that the spring supply wave is nearing its crest. New listings dropped sharply, down 24% week-over-week and 11% below last year’s levels, falling short of typical seasonal averages. As Memorial Day approaches, the pace of fresh inventory is expected to taper further. For buyers, this may be the final moment to capitalize on peak spring supply before the summer slowdown, with respect to new inventory, sets in.

Data courtesy of UrbanDigs

Brooklyn’s active inventory ticked up 1.2% to 3,498 listings, with 252 new properties hitting the market—down 10% from last week, but 16% above the same period last year. Overall volume remains in line with the borough’s three-year seasonal norms, reinforcing a sense of market stability. While new supply is beginning to taper, Brooklyn’s spring listing season traditionally stretches longer than Manhattan’s, often carrying fresh inventory momentum into June. Buyers still have a window—but it’s beginning to narrow.

Data courtesy of UrbanDigs

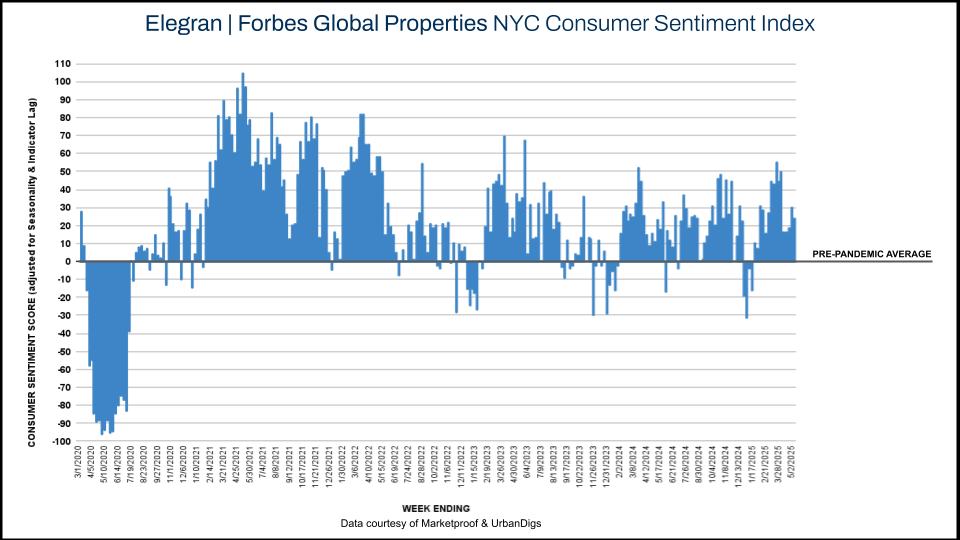

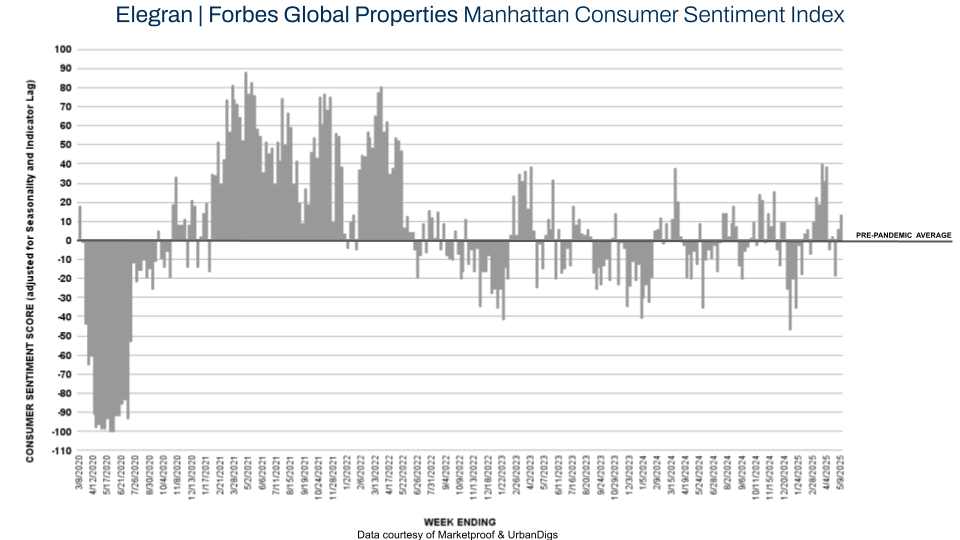

Manhattan saw 271 contracts signed this week—a 6.7% jump from last week and a strong 17% increase year-over-year—signaling sustained buyer engagement despite broader economic uncertainty. This momentum lifted the Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index from +5% to +13%, marking the second consecutive week in positive territory. The data points to a market regaining its footing, with confident buyers driving a return to normalized contract velocity this spring.

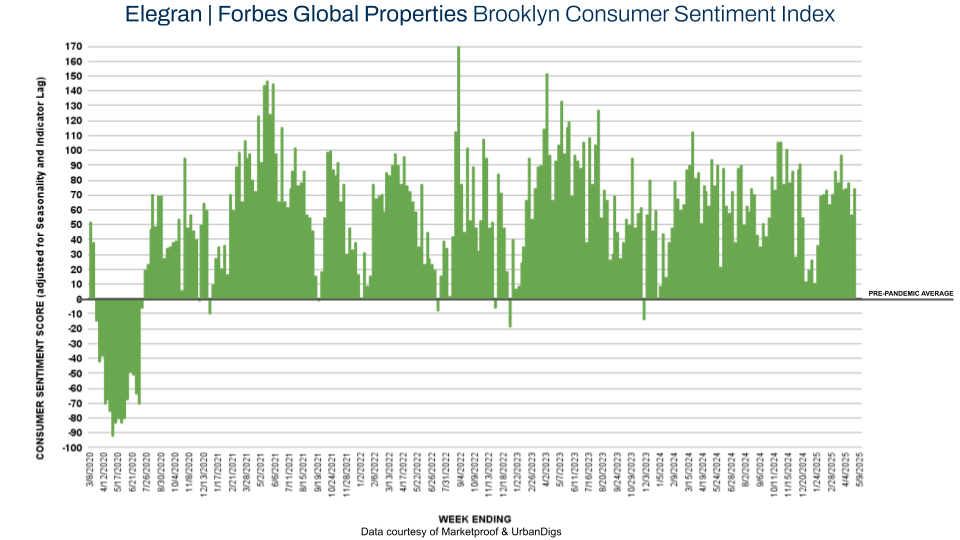

Brooklyn logged 148 contracts this week—a 5.1% dip from last week and 7% below the same period last year. While activity softened slightly, the Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index held firm at +80%, down from +90% but still comparatively strong. After several weeks in the 120–130 range earlier this spring, Brooklyn continues to attract steady buyer demand across price points, signaling deep market resilience even amid elevated rates and economic noise.

Marketproof reported that 38 new development contracts were signed in 35 buildings this week. The following buildings were the top-selling new developments of the week:

The Willow (Kips Bay) signed 3 contracts

The Solaire (Battery Park City) signed 2 contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.