Weekly Manhattan & Brooklyn Market Update: 7/7

Elegran July 7, 2025

Elegran July 7, 2025

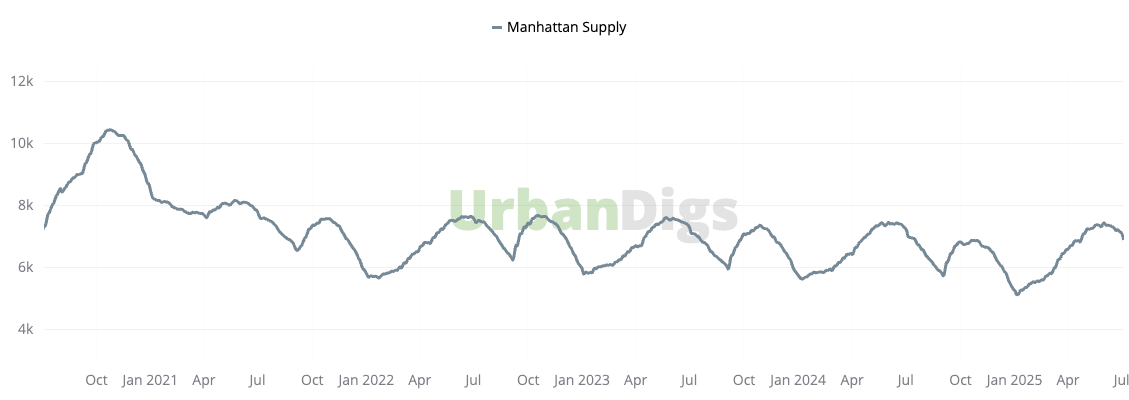

As we enter into the heart of summer, the NYC real estate market is following its typical seasonal slowdown with fewer new listings and a slightly calmer pace. Manhattan supply dropped for the fifth consecutive week, dipping below 7,000 homes for the first time since mid-April. Just 187 new listings came to market, a 29% decline from last week. While this drop is partly tied to the July 4th holiday, it reflects a broader seasonal trend: inventory is expected to continue trending downward until activity ramps back up after Labor Day.

Brooklyn followed a similar path, with active listings ticking down for the second week in a row to 3,427 homes. Only 128 new listings were added, representing a 24% weekly drop, although still slightly higher than at this time last year. As the borough eases into summer, the pace has become more relaxed, with fewer fresh options and buyers taking a breath after an active spring.

On the demand side, pending sales declined modestly in both boroughs. Manhattan’s pending sales dipped 1.3% to 3,456, the first weekly decrease since mid-February, while Brooklyn saw a slight 0.3% drop to 2,237. These small declines suggest that we have likely passed the peak of seasonal contract activity. That said, the market remains engaged: Manhattan recorded 234 contracts signed this week (up 2% week-over-week and 11% year-over-year), while Brooklyn logged 136 (down just 1% from last week but up 17% from this time in 2024).

Zooming out to the broader Q2 performance, the Manhattan market revealed a tale of two very different segments. The luxury tier was strong, powered by cash purchases. In fact, 69% of all Q2 sales were all-cash, the highest ever recorded. Recovering financial markets and a weakening U.S. dollar made NYC real estate especially attractive to international buyers, pushing the median luxury sale price to $6.5M (up 9% YoY) and cutting luxury inventory by 21%.

In contrast, the entry and mid-market segments are seeing a slower, more deliberate pace. Sales activity did tick up, but prices held steady and inventory grew slightly—signs that buyers in this range are taking their time. In fact, 80% of financed buyers included mortgage contingencies in their offers, which points to less bidding war pressure and more room for negotiation. It all adds up to a divided market, where cash buyers are moving more quickly and confidently, while financing buyers are proceeding with more caution.

Active listings have fallen for the fifth consecutive week, now totaling just 6,902 homes, the first time the supply has dipped below 7,000 since mid-April. This marks a 3.6% weekly drop, and we expect inventory to keep declining until the fall market kicks off after Labor Day.

Only 187 new listings hit the market this week, a 29% decrease from last week, but 32% higher than at the same time last year, largely due to the timing of the July 4th holiday.

Data courtesy of UrbanDigs

Active listings edged down for the second week in a row, now sitting at 3,427 homes. Only 128 new listings came online, a 24% decrease from last week, although still 2% higher than at this time last year.

As we head into the July 4th holiday weekend, the market is following its usual seasonal rhythm: fewer new options, a more relaxed pace, and a good time for buyers and sellers to take stock before activity picks up again in the fall.

Manhattan Pending Sales: Pending sales decreased by 1.3% to 3,456. This marks the first week-over-week decrease in this metric since mid-February, suggesting that the high-water mark for pending sales this season has likely been reached.

Brooklyn Pending Sales: Pending sales decreased by 0.3% to 2,237. This is the second consecutive week-over-week decrease in this metric since late February, suggesting that the high-water mark for pending sales this season has likely been reached.

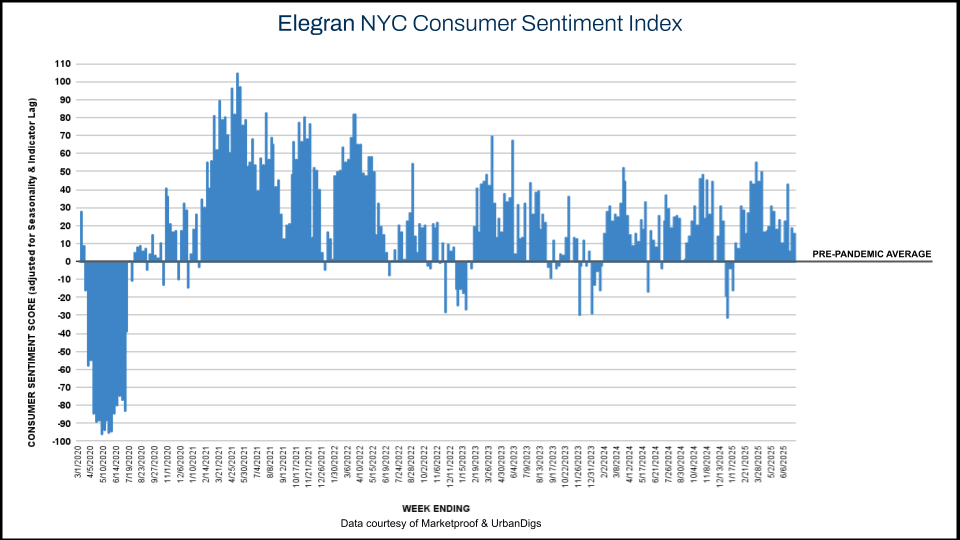

In Manhattan, 234 contracts were signed, a 2% increase from the prior week and 11% higher than the same time last year. The Elegran Manhattan Consumer Sentiment Index improved from -7 to -5.

Brooklyn recorded 136 signed contracts, down just 1% from the previous week and 17% above last year’s level. The Elegran Brooklyn Consumer Sentiment Index edged down slightly from +67 to +64, though overall sentiment remains strong.

Marketproof reported that 48 new development contracts were signed in 38 buildings this week. The following buildings were the top-selling new developments of the week:

The Greenwich by Rafael Vinoly (Financial District) signed 8 contracts

One Wall Street (Financial District), Sutton Tower (Sutton Place), and One Domino Square (Williamsburg) each signed 2 contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.