Weekly Manhattan and Brooklyn Market Update: 9/29

Elegran September 27, 2025

Elegran September 27, 2025

The final week of September highlighted a split dynamic between Manhattan and Brooklyn. Manhattan showed signs of cooling, with contract activity and sentiment easing, while Brooklyn continued to build momentum with stronger buyer confidence and a notable uptick in contracts.

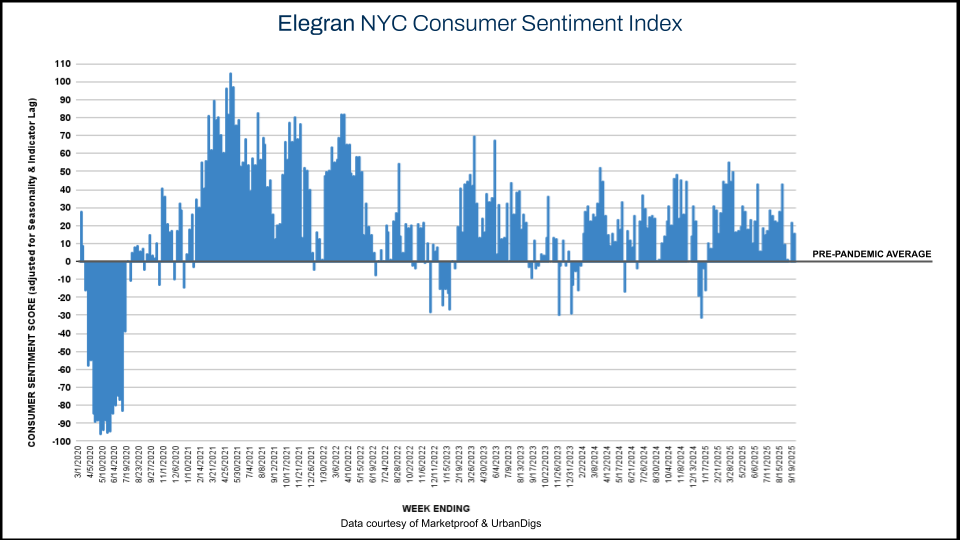

Overall, Elegran’s NYC Consumer Sentiment Index eased from 22% to 15%, reflecting a market still finding its footing as fall begins. With inventory continuing to expand across both boroughs and Brooklyn outperforming on buyer sentiment, October will be a key test for whether the fall rebound materializes fully.

Diverging Market Signals: Manhattan cooled with fewer contracts and softer sentiment, while Brooklyn strengthened with double-digit contract growth and surging buyer confidence.

Supply Keeps Building: Inventory rose for the fourth consecutive week in both boroughs, giving buyers more leverage heading into October.

Fall Outlook: With supply building and financing costs easing after the Fed’s recent rate cut, October is shaping up to be a pivotal month. The key question is whether Manhattan can reignite demand or if Brooklyn will continue to lead the city’s momentum. For buyers, the expanding inventory may open new opportunities; for sellers, competitive pricing and timing will be critical to capturing renewed fall demand.

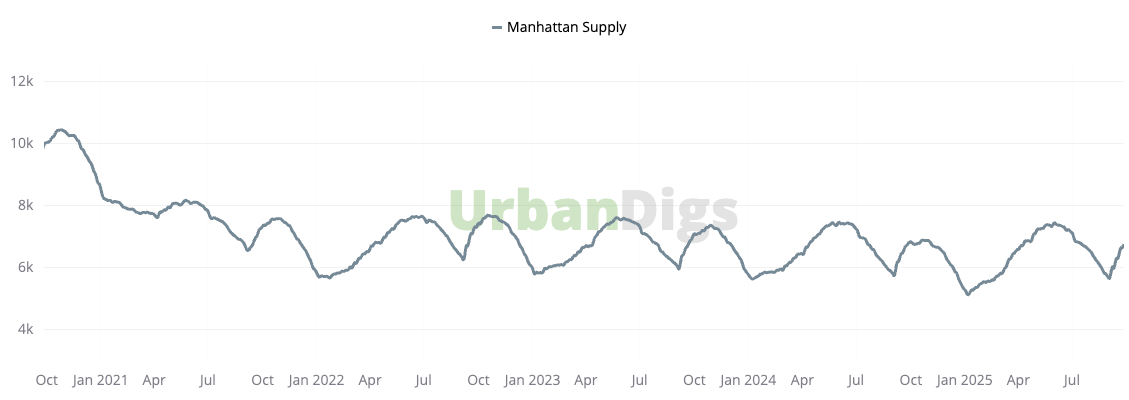

Manhattan’s inventory increased for the fourth consecutive week, reaching 6,762 homes (+3.3%). While overall supply is 0.4% lower than last year, the borough saw a sharp decline in new listings - 398 units this week (–23% WoW), though roughly on par with last year’s levels for the same period.

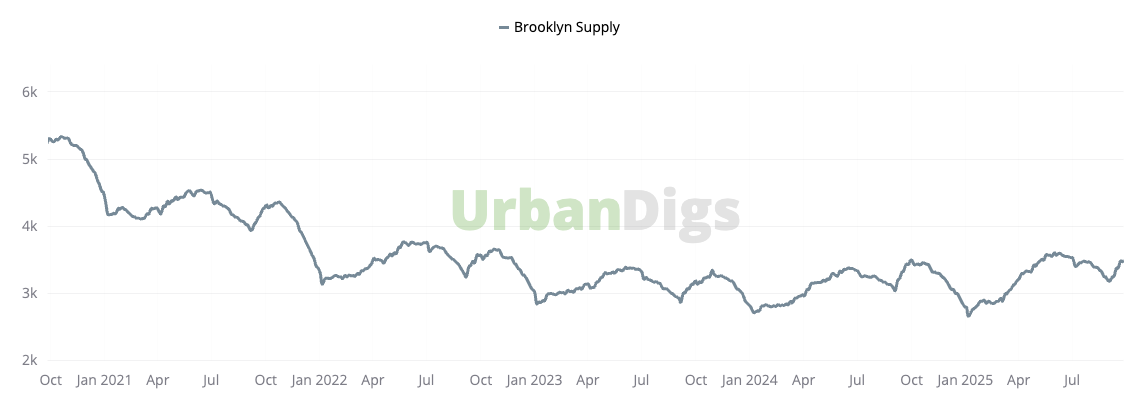

Brooklyn’s inventory climbed slightly to 3,496 homes (+0.7% WoW, +1.5% YoY). New listings came in at 211 units, a weekly decline of 14.6%, yet 9% higher YoY, suggesting more sellers are stepping into the market than at this time last year.

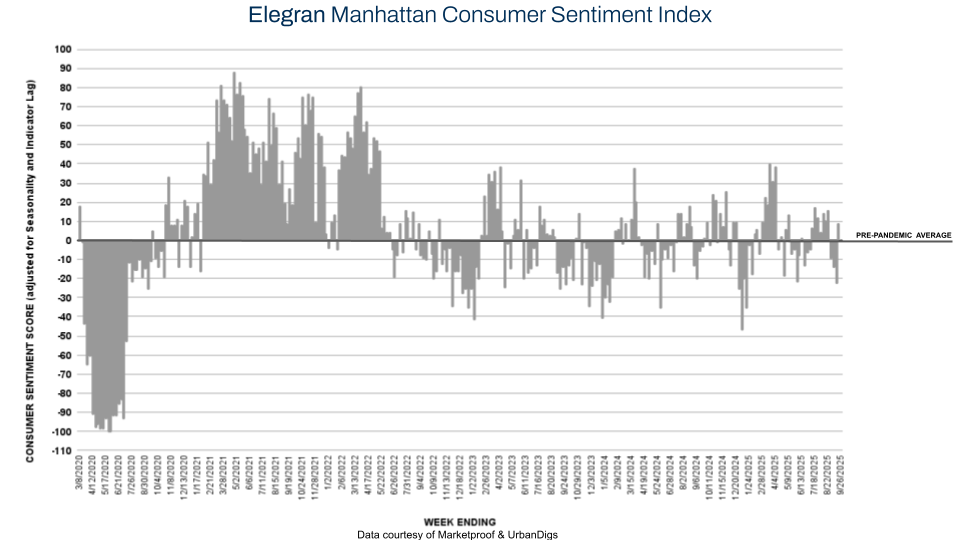

Contracts fell to 178 signed this week, a 9% WoW decrease and 5% below last year’s pace. Elegran’s Manhattan Consumer Sentiment Index dropped from +9% to 0%, holding flat rather than turning negative. The slowdown raises the question of whether Manhattan’s rebound can reassert itself in early October.

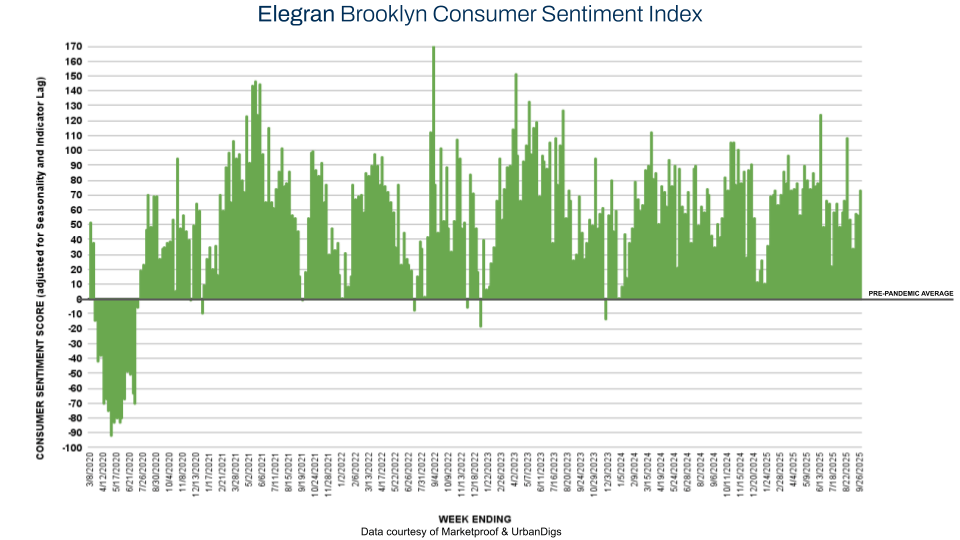

In contrast, Brooklyn strengthened with 126 contracts signed, a double-digit weekly increase (+11.5%) and +13% YoY growth. The Elegran’s Brooklyn Consumer Sentiment Index surged from +56% to +73%, signaling strong buyer confidence as the market transitions into October.

Marketproof tracked 21 new development contracts across 16 buildings. Top performers included:

The Village West (Greenwich Village) signed 3 contracts

Front and York - York Tower (Dumbo) and Linea (West Chelsea) each signed 2 contracts.

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.