Weekly Manhattan and Brooklyn Market Update – 9/8 Insights

Elegran September 6, 2025

Elegran September 6, 2025

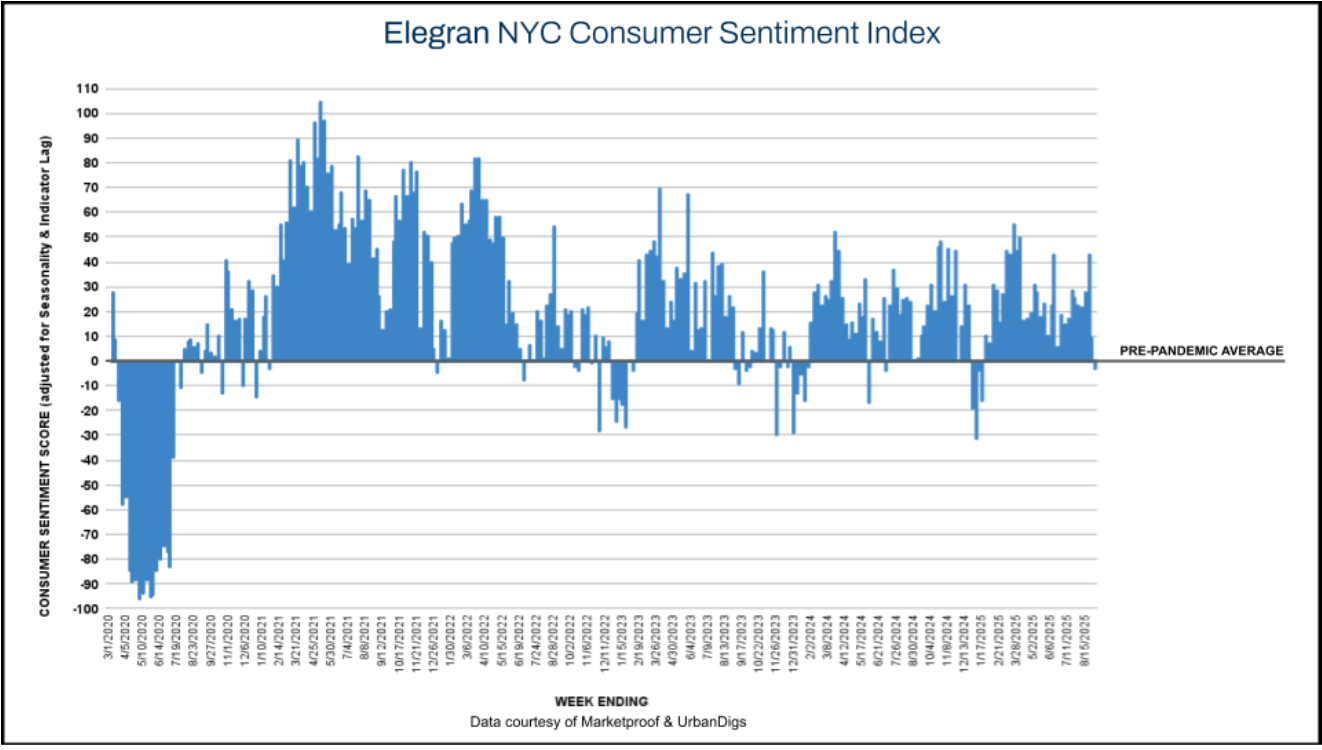

This week, Manhattan and Brooklyn saw a wave of new listings hit the market after Labor Day, finally reversing a three-month slide in inventory - most notably in Manhattan. Buyers, however, were slower to act, as contract signings fell from late-summer levels, pushing the Elegran NYC Consumer Sentiment Index into negative territory. Despite this temporary cooldown, year-over-year contract volumes remain in line with or above last year’s, suggesting that underlying demand is still resilient as the market moves into the fall season.

Key Takeaways

Cooling Sentiment: Elegran’s NYC Consumer Sentiment Index slipped from +9% to –3%. Manhattan sentiment fell to –15%, while Brooklyn remained positive at +34%, reflecting a normal early-September lull that should improve as buyers engage with fresh inventory.

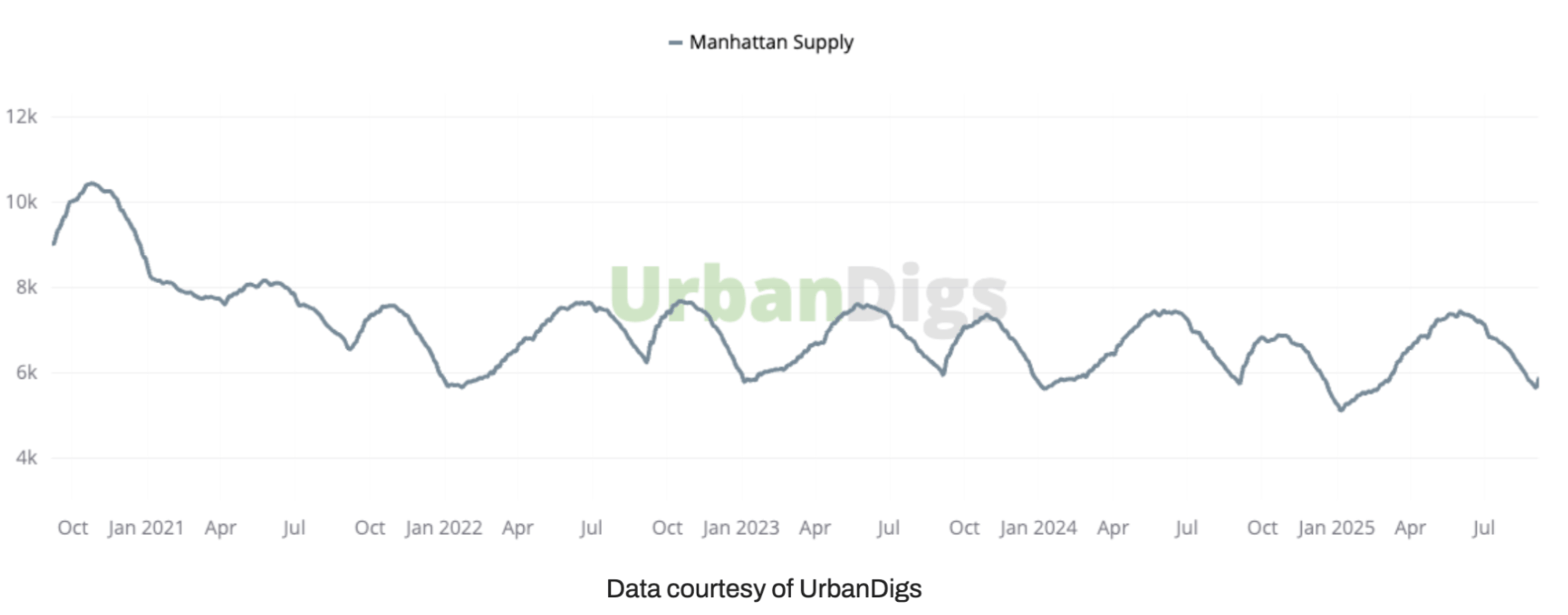

Manhattan’s inventory finally rebounded after thirteen consecutive weeks of decline, now standing at 5,908 available homes (+3.2% WoW). Sellers brought a flood of new listings to market – 512 units this week – which is a massive 279% increase from the low listing volume last week and even about 1% more than the same week last year. This significant post–Labor Day listing wave was an anticipated strategic move by sellers and has effectively narrowed the year-over-year inventory gap to less than 1% (Manhattan’s supply is just 0.7% below last September’s level).

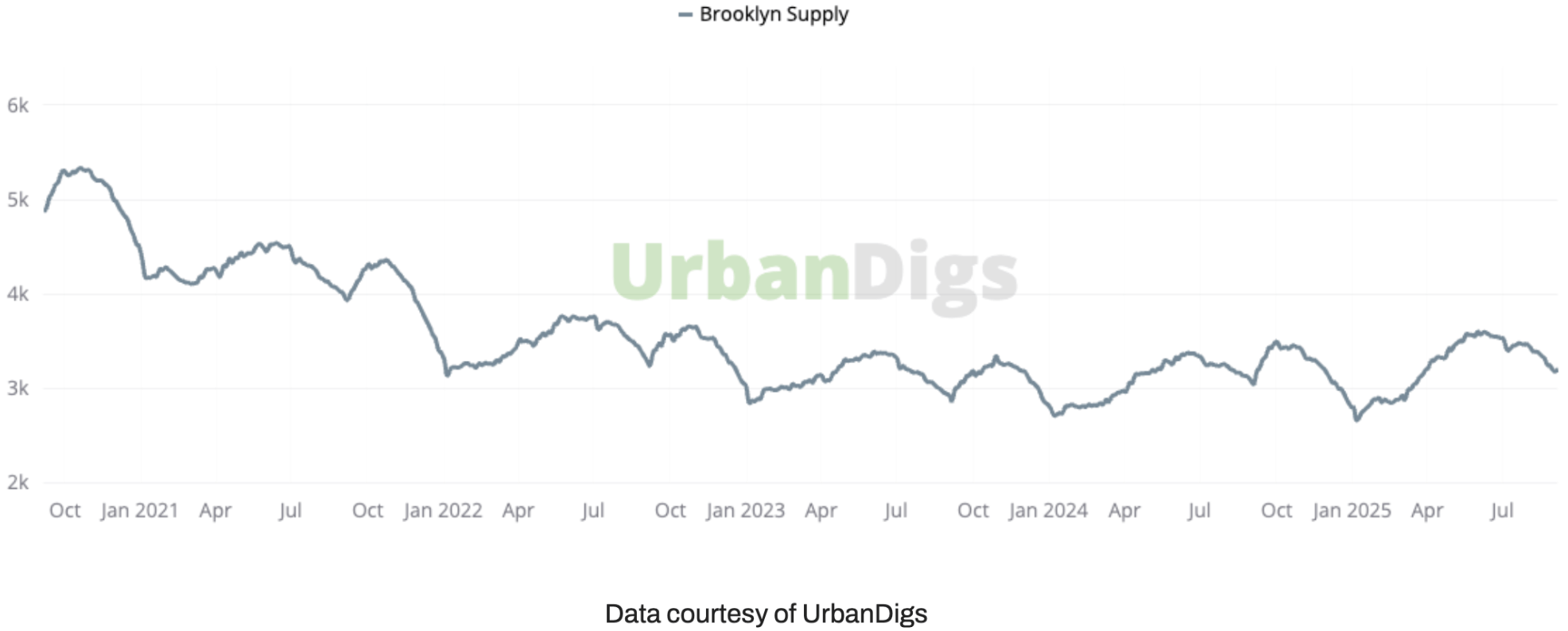

Brooklyn’s inventory bounced back as well, increasing slightly by 0.4% from last week to reach 3,213 homes (+0.4% WoW) on the market. New listings spiked to 238 units (+112% WoW, though about 4% lower YoY) – a significant jump after the holiday lull. Overall supply in Brooklyn is now 2.7% higher than a year ago, providing buyers with more options than they had last fall. This uptick in inventory should create more opportunities for buyers to find the right home and potentially ease some of the competitive pressure.

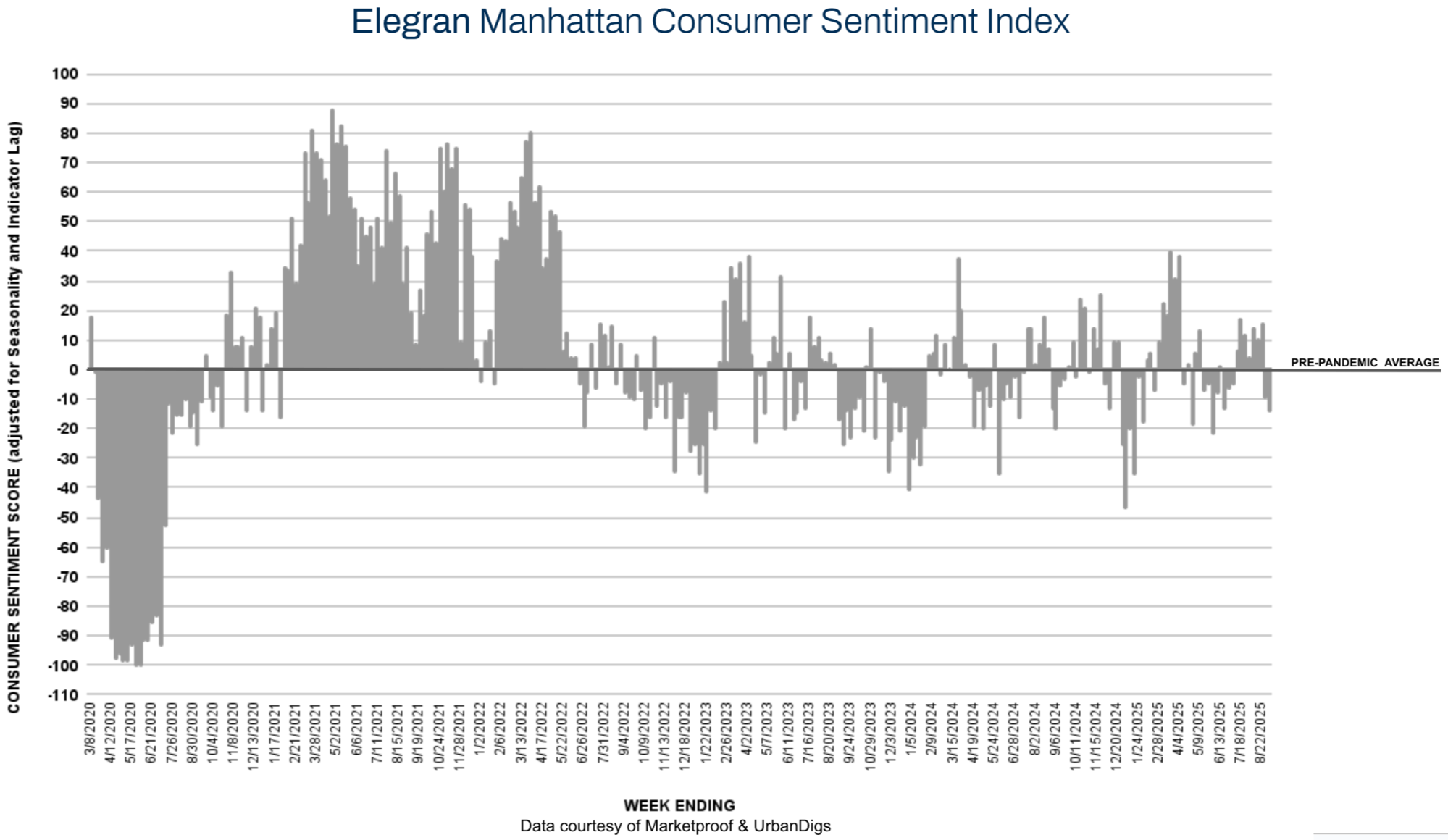

Contract signings in Manhattan continued to slow down coming out of Labor Day. Only 148 contracts were signed this week (–6% WoW), a decrease from the prior week’s volume. Despite this pullback, Manhattan’s deal volume remains about 8% higher than the same week last year, showing that activity is still above last year’s pace. The Elegran Manhattan Consumer Sentiment Index dropped from –10% to –15%, sliding further into negative territory. This index movement aligns with a typical early-September lull. Buyers are momentarily cautious as they absorb new inventory, but sentiment should improve if contract activity picks up again later in the month.

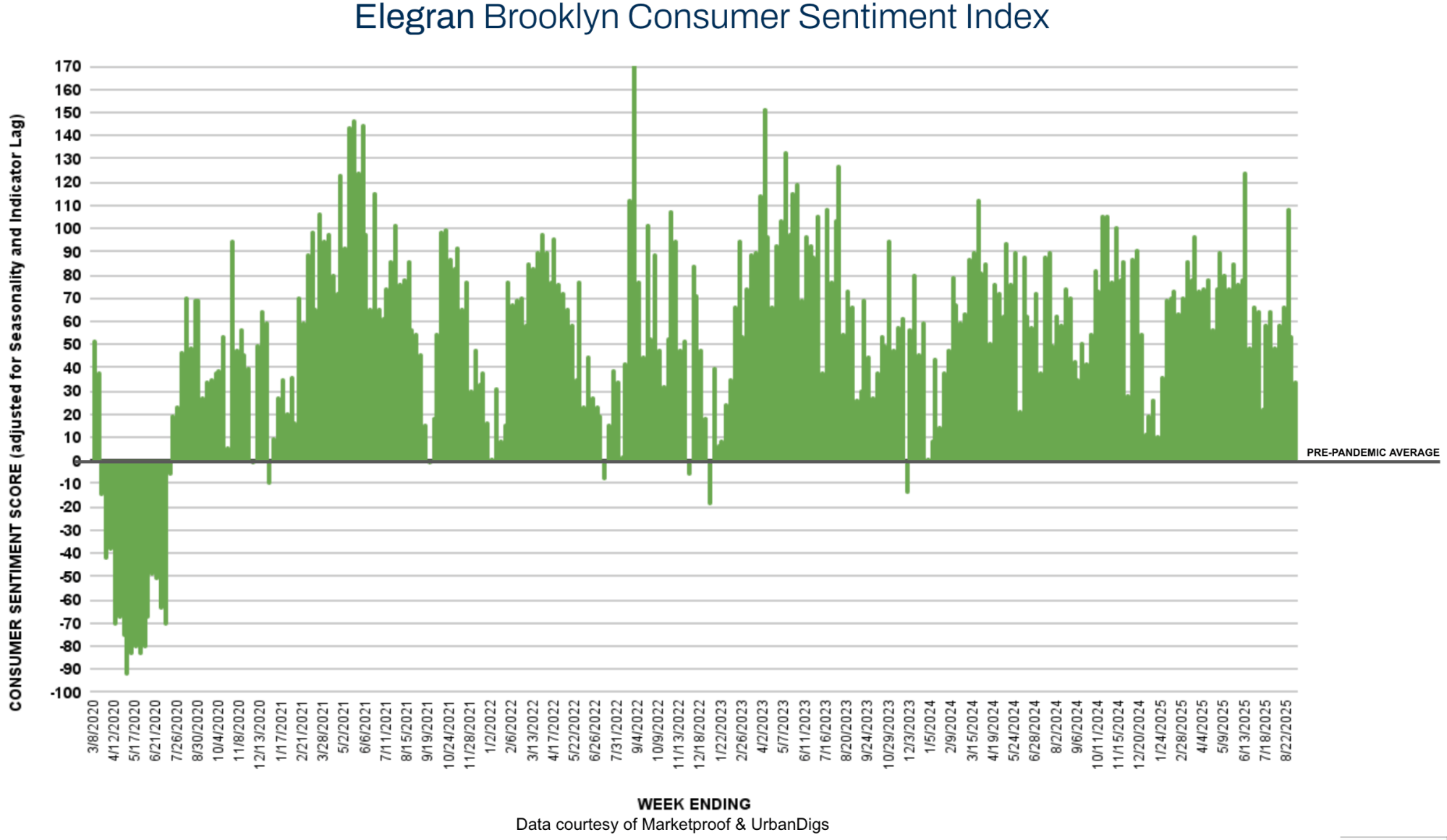

Brooklyn’s contract activity underperformed coming out of the holiday, with 96 contracts signed (–12.7% WoW). That total is only about 1% lower than the number of deals signed in the same week last year, indicating Brooklyn is essentially keeping pace with last year’s market. The Elegran Brooklyn Consumer Sentiment Index fell from +54% to +34%. While this is a sizable week-over-week drop, it isn’t out of the ordinary for the first week after Labor Day, given seasonal trends. Brooklyn’s sentiment index remains in positive territory, reflecting that buyers are still active and generally upbeat. With a significant increase in new listings now on the market, we anticipate that Brooklyn’s buyer engagement and sentiment could strengthen again as we move further into the fall selling season.

Marketproof reported that 33 new development contracts were signed in 28 buildings this week. The following buildings were the top-selling new developments of the week:

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.