Weekly Manhattan & Brooklyn Market Update: 9/9

Elegran | Forbes Global Properties September 7, 2024

Elegran | Forbes Global Properties September 7, 2024

As anticipated, the fall market kicked off with a surge in new inventory following Labor Day. Manhattan experienced a significant uptick, with 506 new listings, a 278% increase compared to the previous week. Brooklyn also saw a notable rise, with 249 new listings, reflecting a 118% increase. This influx of new inventory caused overall supply to grow by nearly 4% in Manhattan and 2.4% in Brooklyn.

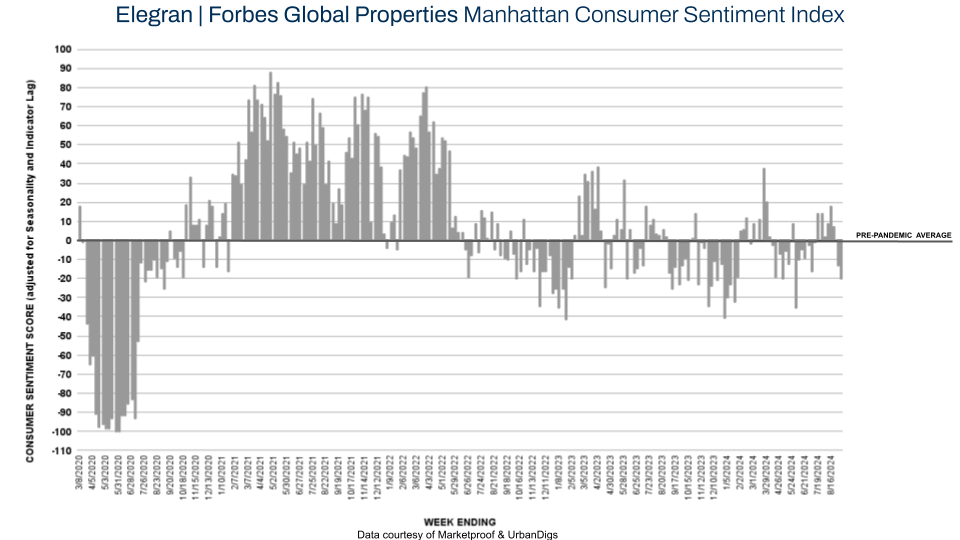

Contract activity, however, was subdued due to the shortened holiday week. In Manhattan, 137 contracts were signed, marking a 9% decrease from the previous week, while Brooklyn saw a similar trend with 97 contracts signed, down almost 6%. As a result, the Elegran | Forbes Global Properties Consumer Sentiment Index fell slightly from 0 to -1 this week.

Looking ahead, contract activity is expected to increase later in September as buyers begin to engage with the fresh inventory. New listings will likely continue coming to market in the coming weeks, although at a more measured pace than this week’s surge.

As anticipated, the week following Labor Day saw a significant influx of new listings, with 506 properties hitting the market—a 278% increase from the previous week. While this surge is substantial, it is still 2% below the same week last year and 13% below the same week in 2019. The total number of available units rose nearly 4% to 6,058, reversing the downward trend seen throughout August. Despite this boost, overall supply remains 5% lower compared to the same period last year.

Data courtesy of UrbanDigs

Similar to Manhattan, Brooklyn experienced a surge in new listings, with 249 properties hitting the market—an increase of 118% compared to the previous week. This week’s influx was 12% higher than the same week last year but still 6% below the same week in 2019. The total number of available units climbed by 2.4% to 3,157, reversing the downward trend in August. Unlike Manhattan, Brooklyn’s total supply is now 2% higher than it was at this time last year.

Data courtesy of UrbanDigs

As expected following Labor Day and the shortened week, Manhattan’s residential real estate contract activity continued its downward trend, with a 9% drop, totaling 137 signed contracts. Despite this decline, the volume remains 11% higher than the same period last year and 5% above the same week in 2019, highlighting the market’s ongoing resilience. The Elegran | Forbes Global Properties Manhattan Consumer Sentiment Index fell from -14 to -20 over the past week. With buyers still exploring the influx of new listings, contract activity will likely stay relatively subdued in the short term, with a potential rebound anticipated later in September.

Brooklyn’s residential real estate market mirrored Manhattan’s trend this week, with contract activity dipping 6% compared to the previous week, as 97 contracts were signed. However, this week’s contract volume remains 3% higher than the same period last year and 20% above the same week in 2019, signaling sustained demand in the market. The Elegran | Forbes Global Properties Brooklyn Consumer Sentiment Index dropped from +43 to +35 over the past week. As buyers continue to assess the influx of new listings, contract activity is expected to remain subdued in the near term, with a potential rebound anticipated later in September.

Marketproof reported that 51 new development contracts were signed in 38 buildings this week. The following building was the top-selling new development of the week:

One Wall Street (Financial District) signed 4 contracts

Her experience, expertise, and engaging personality make Sonal the perfect combination of advisor, advocate, and strategist. She is the proud owner of several NYC properties and a skilled negotiator with a deep understanding of people and sharp instincts about market trends.